Gold (XAU/USD) Struggling to Push Higher, US Jobs Report Next

Gold (XAU/USD) Analysis, Prices, and Charts

- US Treasury yields stem recent sell-off.

- US NFPs are the next potential driver of price action.

Recommended by Nick Cawley

Get Your Free Gold Forecast

DailyFX Economic Calendar

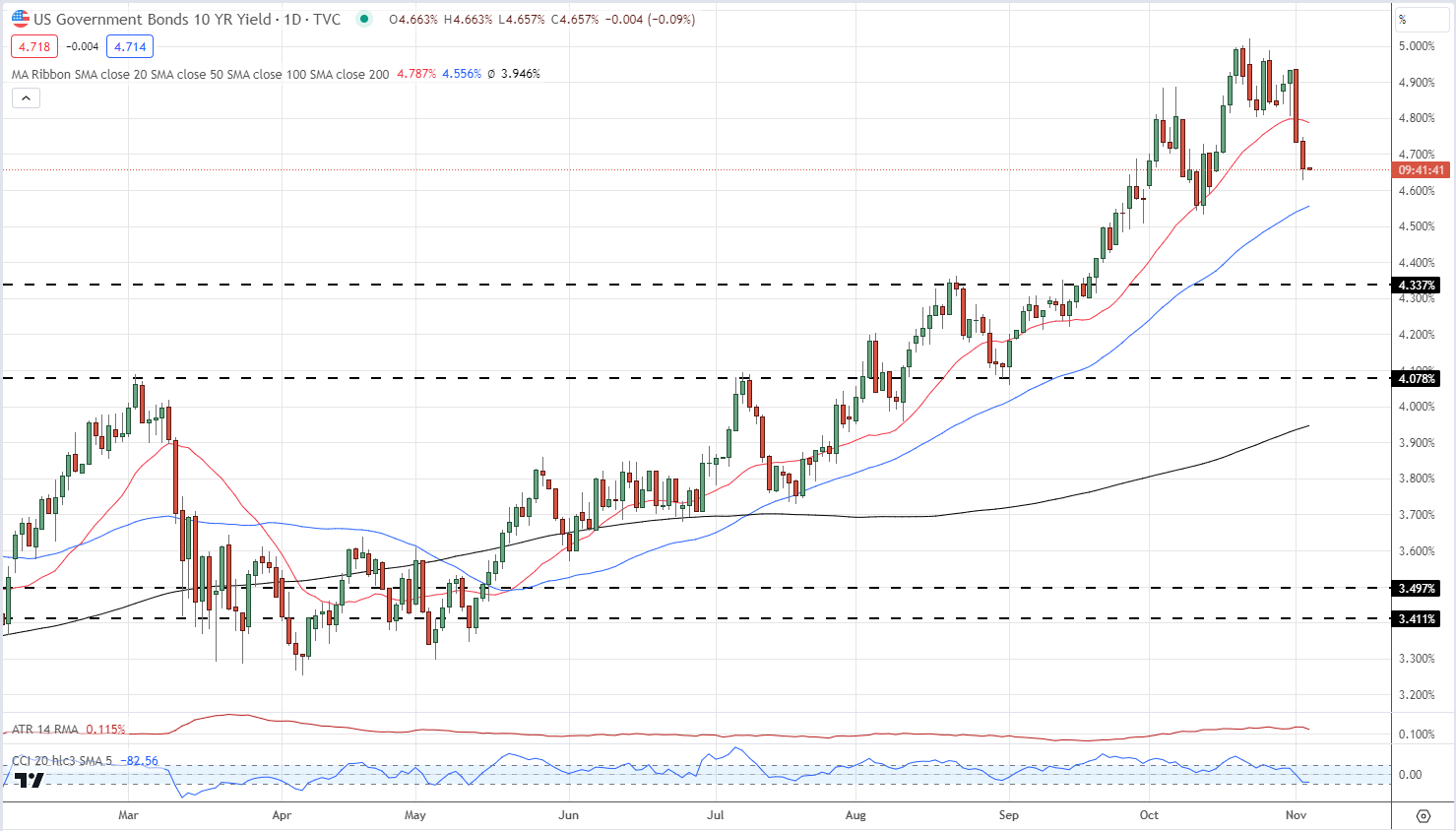

Gold is struggling to regain its recent highs despite US Treasury yields turning sharply lower this week. There is a growing market sentiment that global bond yields have peaked, especially in the longer-end, and with recession fears growing, the market is continuing to price in peak rates. After trading above 5% less than two weeks ago, the yield on the US 10-year benchmark is currently at 4.66%, while the 30-year long bond is now offered at 4.82% compared to a peak of 5.18% on October 23rd. The 5.02% print on the US 10-year was a new 16-year high.

US Treasury 10-Year Yield

Coming up shortly is the closely watched US Jobs Report (NFP), a known market mover. The US jobs market remains robust and the Fed would like to see the labor market weaken as the US central bank continues to battle with above-target inflation. Around 180k new jobs are expected to have been created in October and any miss of this forecast or a meaningful revision lower of last month’s blockbuster 336k could see bond yields, and the US dollar, move lower.

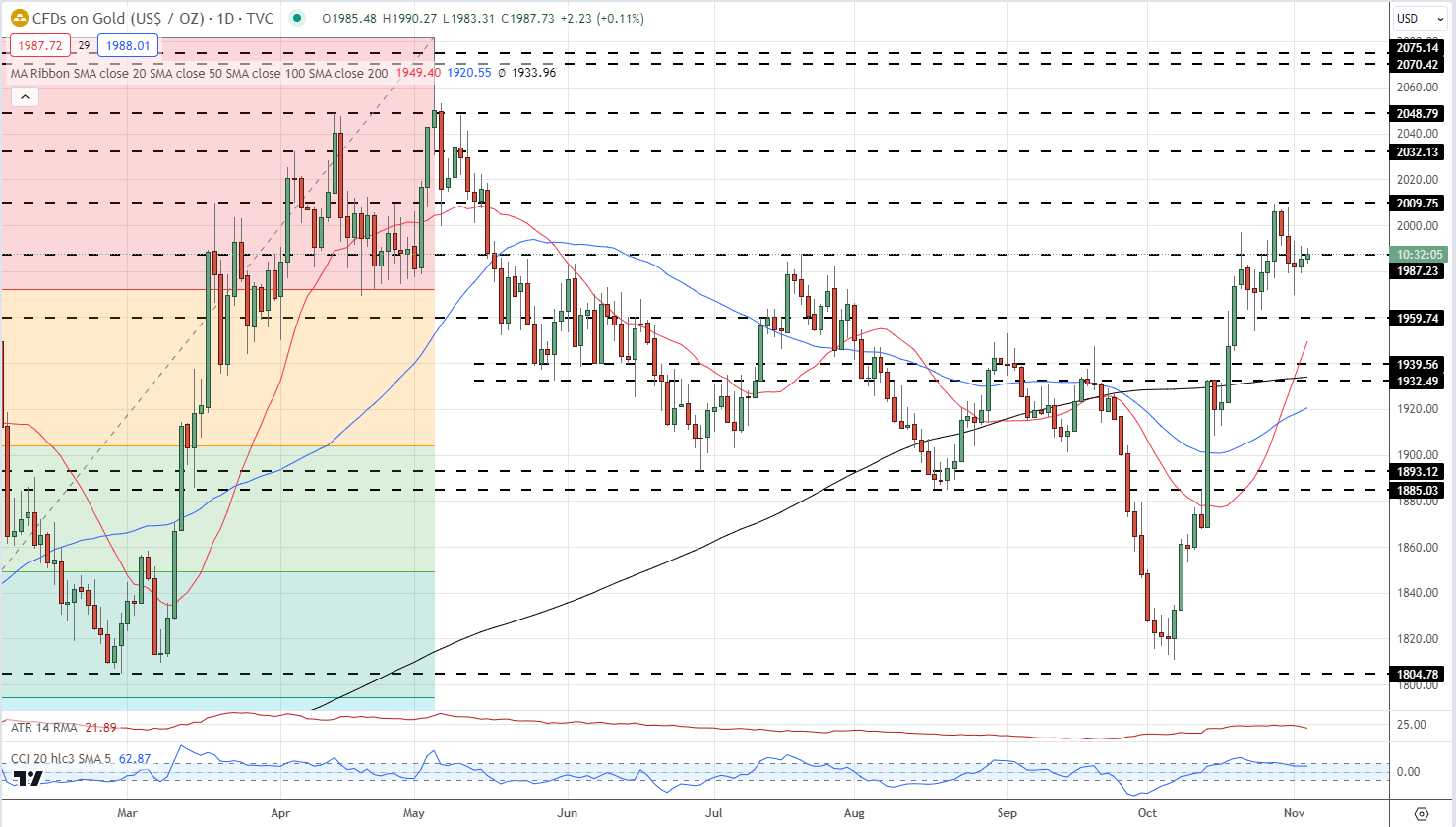

Gold is in a holding pattern ahead of today’s jobs data and is unlikely to move ahead of the release. The precious metal tries to break resistance at $2,009/oz. on three occasions but has been unsuccessful so far. Support is seen at $1,973/oz. ahead of $1,960/oz.

Recommended by Nick Cawley

How to Trade Gold

Gold Daily Price Chart – November 3, 2023

Chart via TradingView

IG Retail Trader data shows 59.72% of traders are net-long with the ratio of traders long to short at 1.48 to 1.Download the full Gold Sentiment Report to see how daily and weekly changes affect price sentiment

| Change in | Longs | Shorts | OI |

| Daily | -3% | 2% | -1% |

| Weekly | -4% | 3% | -1% |

What is your view on Gold – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

Comments are closed.