Gold Relinquishes Key $2,000 Floor, GBP/USD Held Captive by Critical Trendlines

GOLD PRICES AND GBP/USD FORECAST:

- Gold prices slump, dragged lower by rising U.S. yields

- GBP/USD loses altitude after failing to clear overhead resistance at 1.2680

- This article looks at GBP/USD and XAU/USD’s key tech levels to watch in the near term

Most Read: Gold Prices Veer Off Bullish Path as US Dollar Firms but Outlook Still Upbeat

Recommended by Diego Colman

Get Your Free Gold Forecast

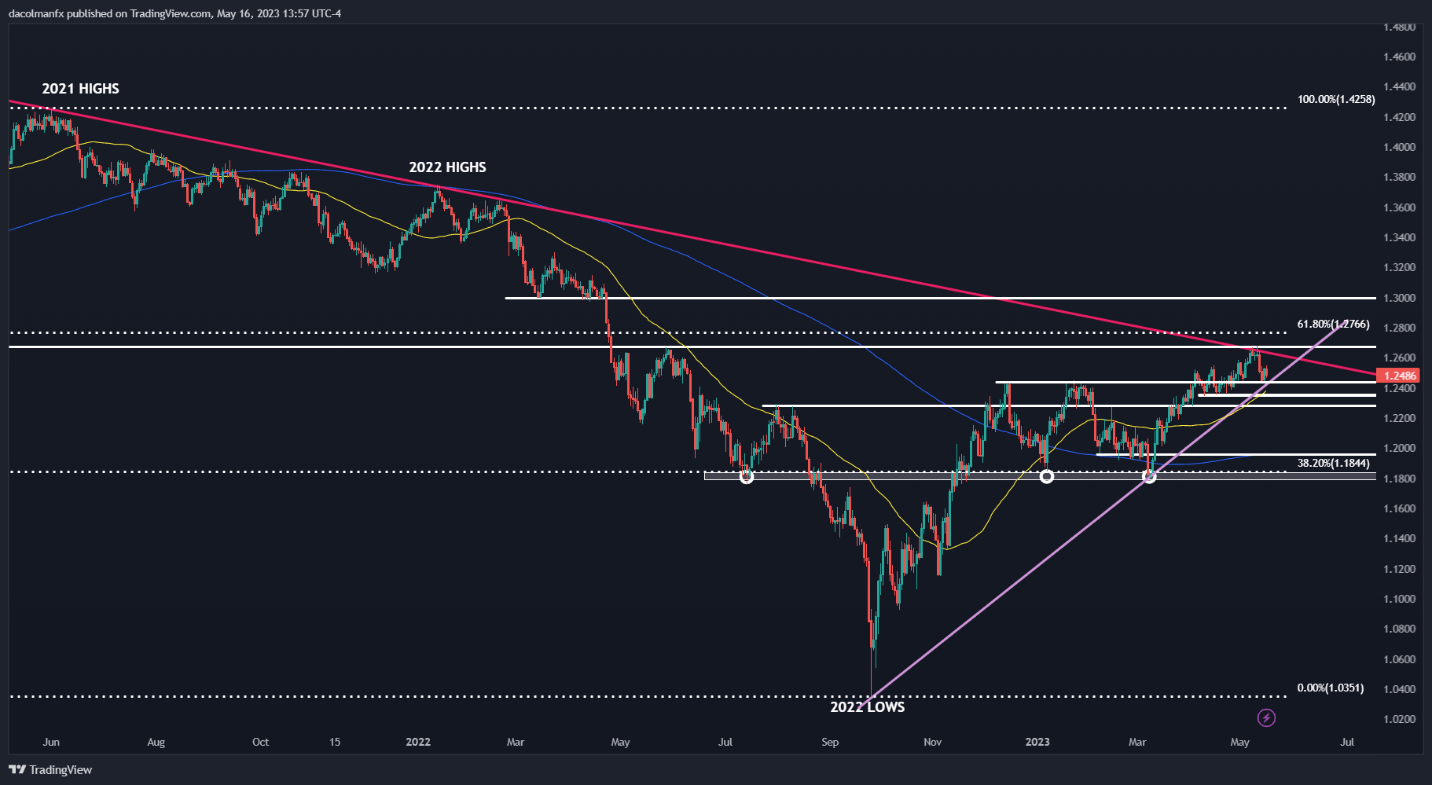

GOLD PRICES TECHNICAL ANALYSIS

Gold prices plummeted on Tuesday, dragged lower by rising U.S. Treasury yields following better-than-expected U.S. economic data and hawkish Fedspeak. In this context, XAU/USD sank more than 1.3% to settle near $1,988 per ounce in late afternoon trading, hitting its lowest level since early May.

In terms of technical analysis, gold relinquished the $2,000 level after Tuesday’s sell-off, a sign bulls may be jumping ship. If XAU/USD fails to recapture this threshold soon, sentiment could turn more negative, setting the stage for a move toward $1,975. On further weakness, the focus shifts to $1,920.

Conversely, in buyers regain control of the market and manage to drive prices decisively above the $2000 mark, the metal could regain its composure, creating a more conducive environment for an initial rally toward $2,050, followed by $2,070, the final frontier before fresh all-time highs.

GOLD PRICES TECHNICAL CHART

Gold Prices Chart Prepared Using TradingView

Recommended by Diego Colman

Get Your Free GBP Forecast

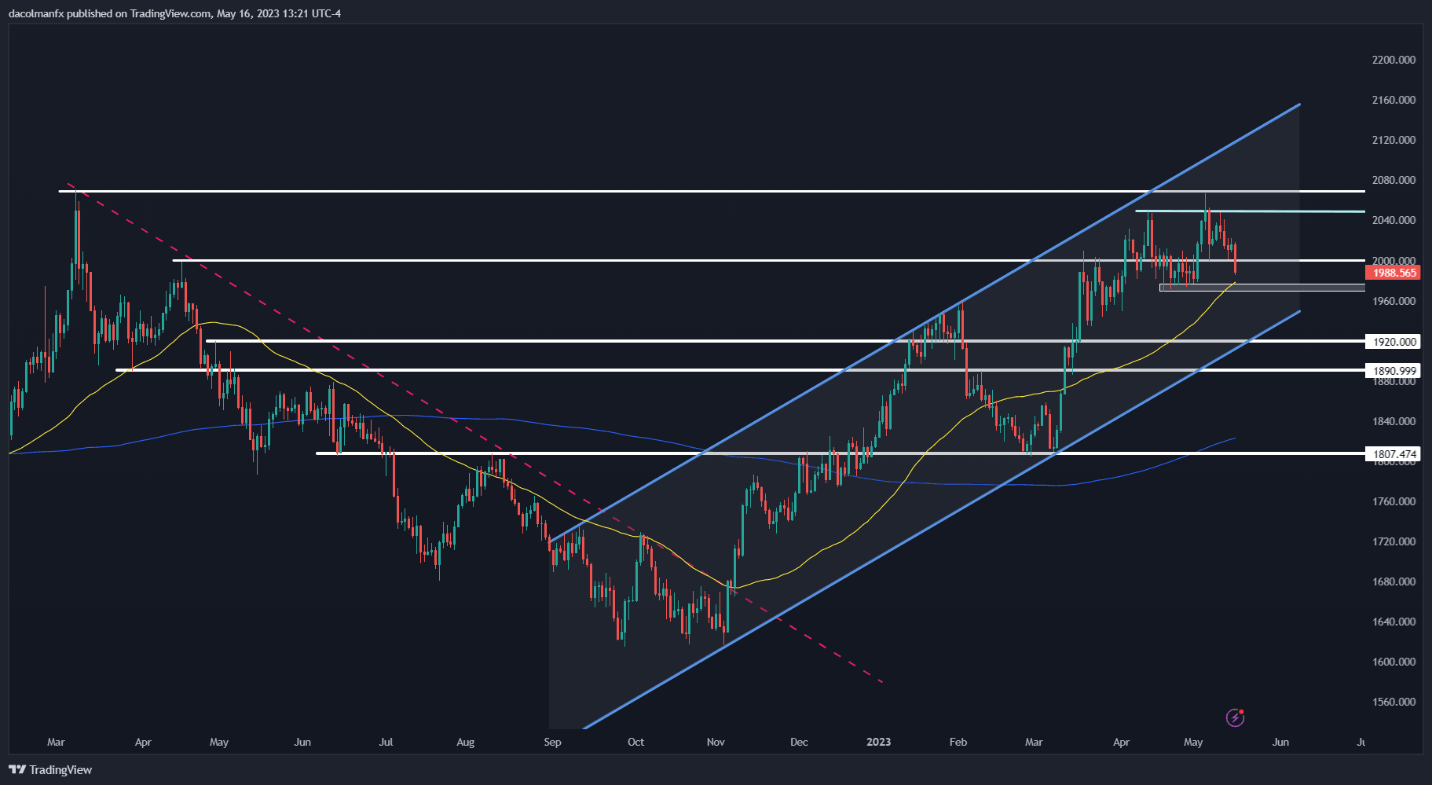

GBP/USD TECHNICAL ANALYSIS

GBP/USD has rallied aggressively since early March, but bullish momentum has begun to fade following an unsuccessful attempt to climb above overhead resistance at 1.2680, with the pair now in retreat after being repelled lower by a descending trendline extended off the 2021 highs.

While cable’s broader technical outlook remains constructive, the situation could change if bulls fail to defend cluster support at 1.2440, an area where a medium-term rising trendline aligns with several swing highs from last year and early 2023. If this floor is breached, sellers could launch an attack on 1.2355, followed by 1.2285. On further weakness, a larger pullback toward 1.1975 cannot be ruled out.

In the event of a bullish turnaround, dynamic resistance sits at 1.2620. A sustained move above this ceiling is required to have a standing chance of recapturing 1.2680. If both barriers are taken out, bulls may become emboldened to challenge 1.2765, the 61.8% Fib retracement of the 2021/2022 selloff.

GBP/USD TECHNICAL CHART

GBP/USD Chart Prepared Using TradingView

Comments are closed.