Gold Prices Rise as Markets Focus on Fed Rate Cut Bets and Regional Bank Woes

Gold, XAU/USD, Fed, Rate Cuts, Regional Bank Woes – Briefing:

- Gold prices aim slightly higher, though erase most gains

- Markets focused on Fed easing and regional bank woes

- XAU/USD faces negative RSI divergence, Shooting Star

Recommended by Daniel Dubrovsky

Get Your Free Gold Forecast

Risk Appetite Deteriorates After the Fed

Gold prices aimed cautiously higher over the past 24 hours in what was a relatively volatile intraday trading session. XAU/USD briefly touched its highest in over a year in the immediate aftermath of Wednesday’s Federal Reserve monetary policy announcement. But, since then, prices came down. Instead of capturing a gain of almost 2%, gold gained 0.35%.

After raising interest by 25 basis points, the central bank hinted at a pause in its tightening cycle. Then, Chair Jerome Powell tried to pour cold water on rate cut bets this year. But, his press conference ultimately fell on deaf ears. By the end of the day, the markets doubled down on near-term rate cut bets. As of Thursday, overnight index swaps are now pricing in about a 50% probability of a rate cut in July.

US regional bank woes remained a lingering source of financial instability. In the aftermath of First Republic being picked up by JP Morgan and the Fed monetary policy announcement, PacWest Bancorp announced that it was exploring a sale after being clobbered by shareholders. The stock is down over 93% since the most recent top in late 2021.

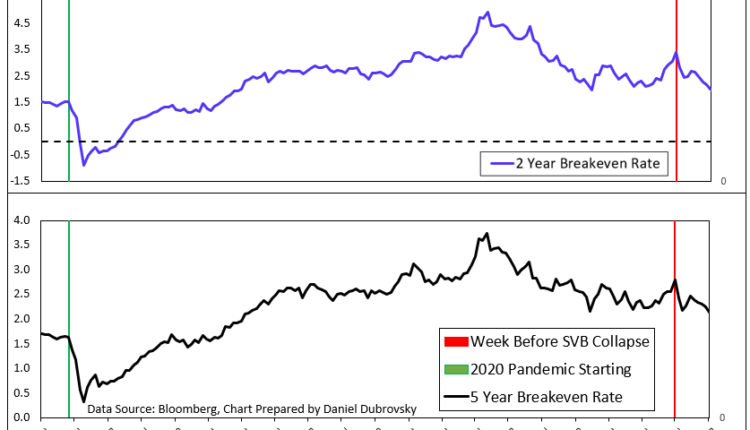

Meanwhile, near-term US inflation expectations continue to dwindle. In the chart below, the 2-year breakeven rate has fallen to about 2%, the lowest since January 2021. The 5-year rate is also heading in a similar direction, though not as quickly. Expectations of looser US monetary policy are thus fueling a rally in gold as the US Dollar and Treasury yields weaken.

US Inflation Expectations

Gold Technical Analysis

Gold has left behind a Shooting Star candlestick pattern. Meanwhile, negative RSI divergence is showing that upside momentum is fading. This is as prices were unable to pierce through 2022 highs (2050 – 2070). As such, this has reinforced the latter as key resistance. A turn lower could open the door to a near-term reversal, placing the focus on the 20-day Simple Moving Average (SMA).

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

XAU/USD Daily Chart

Chart Created in TradingView

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

Comments are closed.