Gold Prices Gain On More Signs Global Inflation Rolling Over

Gold (XAU/USD) Price, Analysis, and Charts

- UK CPI came in at a two-year low for October

- The Core measure also ticked lower

- Gold prices are closing back in on $2000

Learn How to Trade Gold With Our Complimentary Guide

Recommended by IG

How to Trade Gold

Gold Prices continued to rise in Wednesday’s European session, although they did pare gains, as the United Kingdom joined the growing list of developed economies in which inflation’s sinister grip seems to be loosening. Official data showed an annual headline consumer price rise of 4.6% in October. That’s a two-year low and a massive deceleration from the 6.7% seen just a month previously. To be sure, lower fuel prices were behind that slide and they can’t be relied upon to stay down. However, the core inflation measure, which strips them out of the calculation entirely, ticked down as well, to 5.7%, from 6.1%. The figures came just a day after comparable numbers from the US also showed a reduction in price pressures, which also boosted gold.

US factory gate prices were also found to have receded on Wednesday, but their impact on financial markets tends to be markedly less pronounced.

Still, investors are starting to hope in earnest that the battle against inflation has been won by the world’s monetary authorities, the vast majority of whom have raised interest rates considerably. The markets are starting to look forward to interest rate cuts, perhaps in the first half of next year.

For all the yellow metal’s vaunted properties as an inflation hedge, it has suffered as borrowing costs have risen. Investors have been inclined to abandon it and other non-yielding assets for better returns in the bond markets. This explains at least partially why weaker inflation figures can do the trick of lifting both supposed haven assets like gold and traditionally riskier bets such as equities.

It’s of course possible that the markets are getting a little ahead of themselves. Despite its relative recent weakness, inflation remains well above central bank targets in much of the world. Interest rates are sure to stay put for at least as long as that’s so. Moreover, those old enough to remember the inflationary days 1970s will also be well aware that inflation can be very difficult to kill once it’s entrenched and may not fade away in quite the linear fashion markets now seem to expect.

Still, for now, prices are moving the gold bulls’ way, with gloomy geopolitics in Ukraine and the Middle East also lending support. There’s more heavyweight price data on Friday, with the Eurozone’s final core CPI rate in the spotlight. It’s expected to have eased a little, to 4.2% from 4.5%. It’s safe to assume the gold market will like an as-expected print.

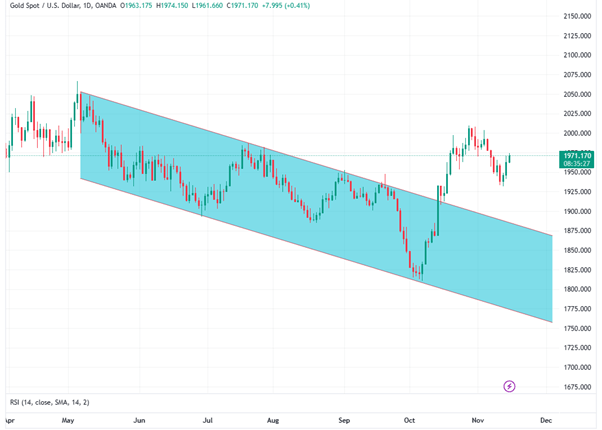

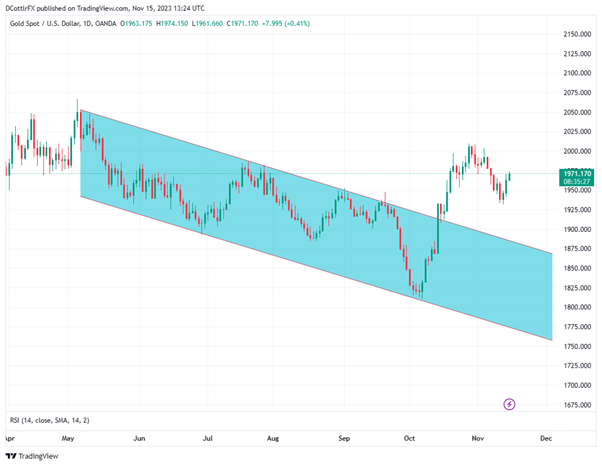

Gold Prices Technical Analysis

Recommended by IG

The Fundamentals of Breakout Trading

Chart Compiled Using TradingView

Gold has now seen a strong, three-day bounce from the $1935/ounce level which probably not coincidentally aligns with the 200-day moving average. It’s as well for the bulls that that level held, as the chart above shows that a move below it would have put the previously dominant downtrend channel uncomfortably close to the market. However, it remains comfortably far off, at $1883.70, a level that now provides support.

For now, the $1935 region remains as a likely near-term prop, with the psychologically important $2000 resistance mark in the bulls’ immediate sights.

The Relative Strength Indicator crossed above the 50 point barrier in the last session and remains above it. But there’s clearly no sign of overbuying at this point, suggesting that the rally could have enough strength to get back to $2000 and, possibly up to late October’s peak of $2009. November 3’s daily close just above $1993 is probably the next key resistance level for the metal.

IG’s own sentiment data finds traders still bullish at the current price, with 65% net long, or expecting prices to rise.

| Change in | Longs | Shorts | OI |

| Daily | 5% | -5% | 1% |

| Weekly | 6% | -27% | -8% |

–By David Cottle for DailyFX

Comments are closed.