Gold Prices Feel the Squeeze as Yields Rocket Ahead of NFP, Key XAU/USD Levels

GOLD PRICES FORECAST:

- Gold prices retreat for a second consecutive day amid rising yields after better-than-expected U.S. economic data

- Traders should focus on the ISM services PMI and the U.S. labor market report in the coming days

- This article looks at key XAU/USD’s levels to watch this week

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Most Read: S&P 500 on Edge Before Apple & Amazon, Gold Tanks as Yields Soar ahead of NFP

Gold prices retreated on Wednesday (XAU/USD: -0.4% to $1,936), extending losses for the second consecutive session, pressured by rising nominal rates and a stronger U.S. dollar. In early afternoon trading, Treasury yields were sharply higher, especially those at the long end of the curve, with the 10-year note topping 4.10% and hitting its highest level since November 2022.

The rise in yields came in response to better-than-expected ADP economic data, which revealed that the private sector added a remarkable 324,000 jobs in July, almost double the consensus estimates, a sign that the labor market is still firing on all cylinders. Fitch Ratings' decision to downgrade U.S. debt was also likely a factor in today's bond moves, prompting some traders to reduce exposure to these fixed-income securities.

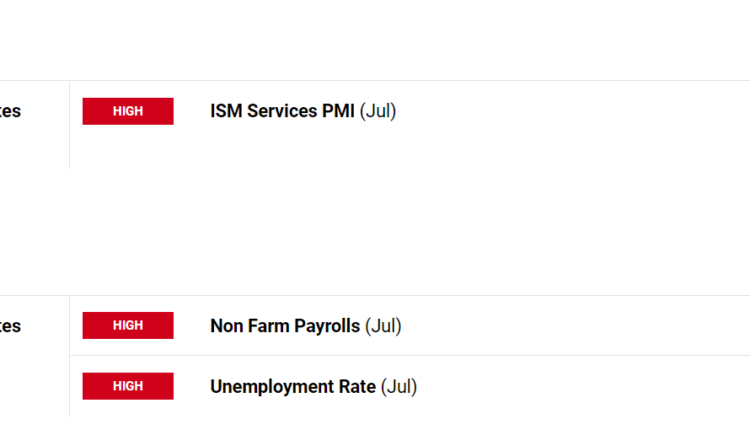

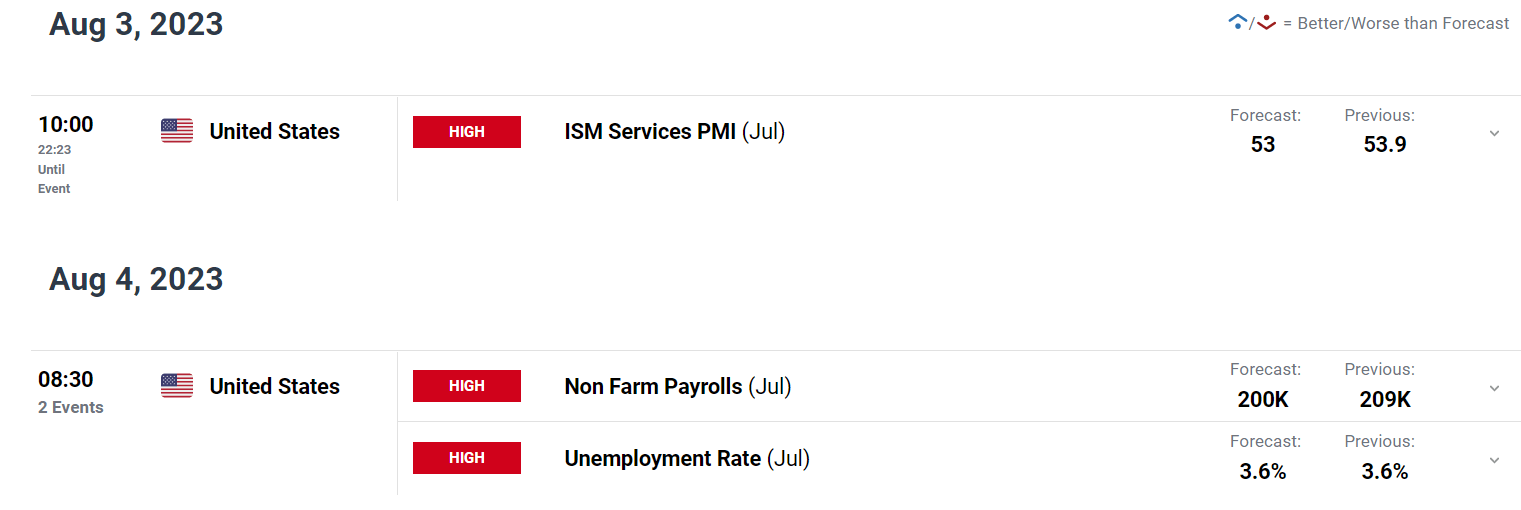

Looking ahead, it is important to keep a close eye on the ISM non-manufacturing PMI to be published on Thursday morning. According to Wall Street analysts, business activity in the services sector slowed in July to 53.00 from 53.9 previously, allowing the prices paid index to moderate to 52.1 from 54.1 previously, a positive development for the fight against inflation.

However, the main focus for retail investors should be the official U.S. employment survey, which will be released on Friday morning. U.S. employers are forecast to have hired 200,000 workers last month, following a 209,000 increase in payrolls in June. The unemployment rate, meanwhile, is seen holding steady at 3.6%.

Discover the hidden opportunities in the gold market with our comprehensive quarterly outlook trading guide. Download now to gain valuable insights and make informed trading decisions on gold!

Recommended by Diego Colman

Get Your Free Gold Forecast

UPCOMING US ECONOMIC DATA

Source: DailyFX Economic Calendar

The strength of job growth, or lack thereof, will be key in determining gold's near-term outlook. Therefore, traders should carefully monitor the economic calendar to observe if incoming data significantly deviates from consensus estimates.

A headline print that closely aligns with market projections is likely to have a neutral effect on gold. However, a strong upside surprise, such as job figures surpassing 250,000, could weigh on prices by triggering a hawkish repricing of interest rate expectations.

Conversely, a bullish effect on precious metals is expected if employment numbers fall below 150,000. Such an outcome could drag yields and reduce the likelihood of the Fed maintaining an overly restrictive monetary policy stance for an extended period.

Ready to conquer the gold market? Download our ultimate trading guide and discover top strategies for successful gold trading

Recommended by Diego Colman

How to Trade Gold

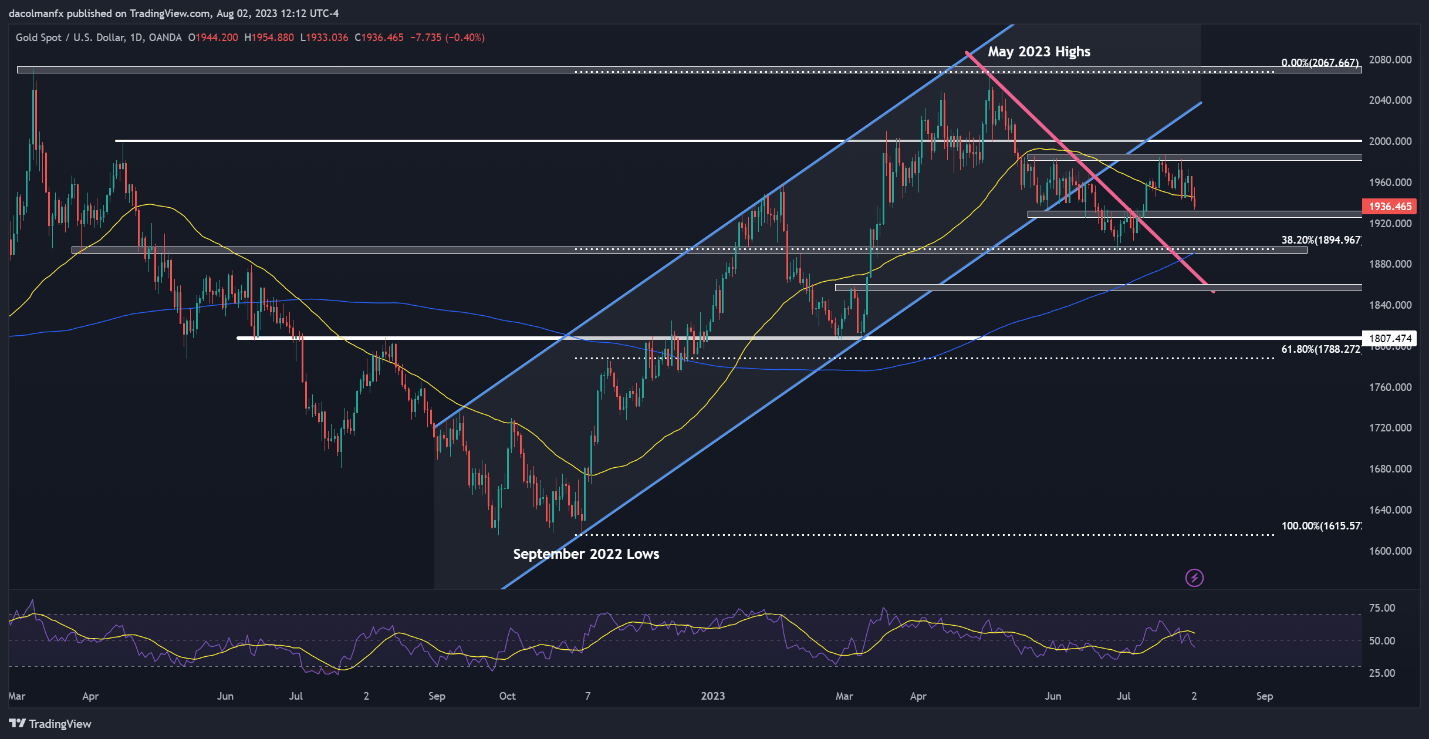

GOLD PRICES TECHNICAL ANALYSIS

After the recent pullback, gold appears to be approaching an important technical support near $1,930. While prices may establish a base and rebound from those levels, a breakdown could spark a deeper retrenchment, setting the stage for a move toward $1,895, a key floor where the 200-day simple moving average converges with the 38.2% Fibonacci retracement of the September 2022/May 2023 rally.

In contrast, if XAU/USD resumes its rebound, initial resistance is located around $1,985, followed by the psychological $2,000 mark.

GOLD PRICES TECHNICAL CHART

Gold Prices Chart Prepared Using TradingView

| Change in | Longs | Shorts | OI |

| Daily | 3% | -4% | 1% |

| Weekly | 24% | -30% | 4% |

Comments are closed.