Gold Price Trapped Ahead of a Busy Week as US Dollar Pauses. Where to for XAU/USD?

Gold, XAU/USD, US Dollar, FOMC, Fed, Treasury Yields, GVZ Index – Talking Points

- The gold price appears poised for action this week after a stint of range trading

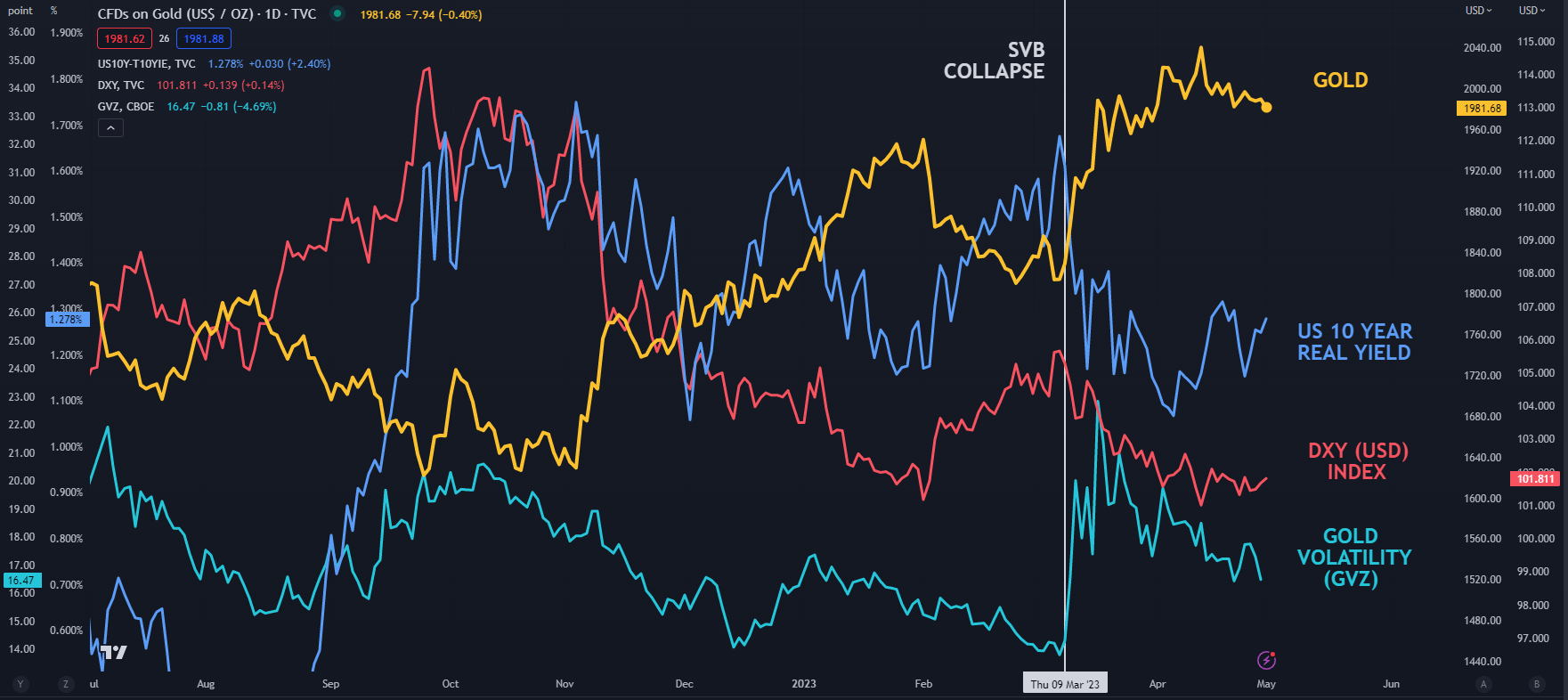

- Treasury and real yields are tinkering at the edges for direction ahead of FOMC

- If the Fed surprises markets, will real yields and USD break out to drive gold’s direction?

Recommended by Daniel McCarthy

Get Your Free Gold Forecast

Gold continues to tread water ahead of a crucial week of US data points and a Federal Open Market Committee (FOMC) meeting.

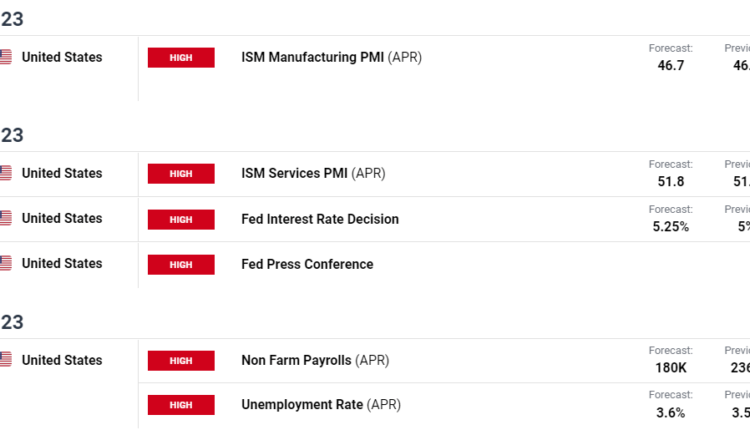

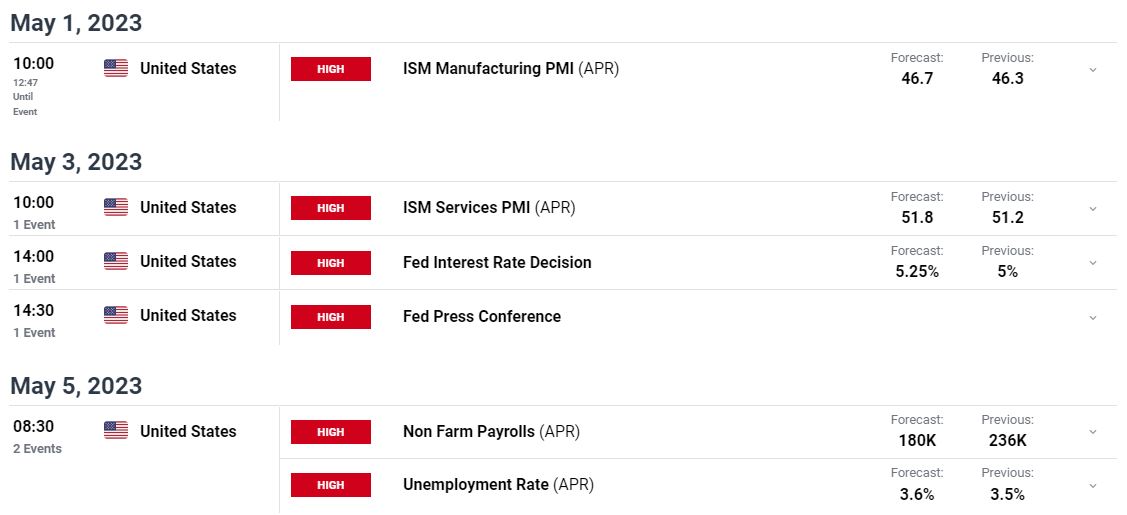

While ISM and non-farm payrolls data will be closely watched, the FOMC gathering will be the focus for markets. The interest rate market has pretty much baked in a 25 basis point lift in the Fed funds target rate on Wednesday.

The economic data releases below are marked US local time but can be viewed live and adjusted for your time zone via the DailyFX economic calendar.

The post-FOMC press conference might hold sway as forecasts for further hikes have been all but discounted by the market and potential cuts toward the end of the year are anticipated by rates traders.

The reaction to Wednesday’s decision further out on the yield curve might see more impact for gold. After dipping lower last week, both nominal and real yields have recovered going into this week.

The real yield is the nominal yield less the market-priced inflation rate derived from Treasury inflation protected securities (TIPS) for the same tenor.

Recommended by Daniel McCarthy

How to Trade Gold

The 10-year real yield touched 1.13% early last week but then climbed to 1.36% on Friday and is trading just under 1.30% at the time of going to print today.

That peak was a seven-week high for the instrument but there was little correlation to gold with the price remaining in the US$ 1,969 – 2,049 range of the last month.

Significant moves in the real yield of Treasuries may influence the price of the yellow metal due to it being a non-interest-bearing asset.

With a lack of direction in real yields, the broad DXY (USD) index has also been caught in a range of late.

The lack of direction in XAU/USD and the US Dollar index more generally has seen gold volatility continue to slide lower.

While it jacked higher on the SVB collapse and concerns for the USA banking sector, the move lower might be an acceptance by the market for the overall higher levels of gold.

The GVZ index is a measure of volatility in the gold price similar to the VIX index’s measure of volatility in the S&P 500.

This week’s Fed meeting might provide the catalyst for the next move in the ‘big dollar’ and XAU/USD.

GOLD AGAINST US DOLLAR (DXY), US 10-YEAR REAL YIELDS AND VOLATILITY (GVZ)

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCathyFX on Twitter

Comments are closed.