Gold Price on Meltdown Alert as USD Eyes Breakout Before Fed, XAU/USD Levels

GOLD PRICE FORECAST

- Gold prices lack directional conviction as the U.S. dollar charges toward multi-month highs.

- Precious metals retain a somewhat bearish outlook from a fundamental standpoint.

- This article looks at XAU/USD’s key technical levels to watch in the coming days.

Most Read: US Dollar Setups: USD/CAD, USD/JPY, and AUD/USD; Major Tech Levels Identified

Gold prices (XAU/USD) were directionless and largely flat on Thursday, languishing near a two-week low, just beneath the $1,910 threshold. Bullion’s value was contained by widespread U.S. dollar strength in FX markets, in a context of rising U.S. Treasury yields, with the 10-year government bond threatening to recapture the 4.30% level.

Examining some of the trading session’s primary drivers, the U.S. currency, as measured by the DXY index, skyrocketed past the 105.00 handle, reaching its strongest reading in more than six months. This ascent followed hot wholesale inflation and retail sales data in the US, along with lower-than-forecast unemployment claims, which collectively underscore the economy's remarkable resilience.

Gain a trading advantage by exploring market positioning. Download the sentiment guide to decode gold price behavior. It is totally free!

| Change in | Longs | Shorts | OI |

| Daily | -1% | -1% | -1% |

| Weekly | 4% | -9% | 0% |

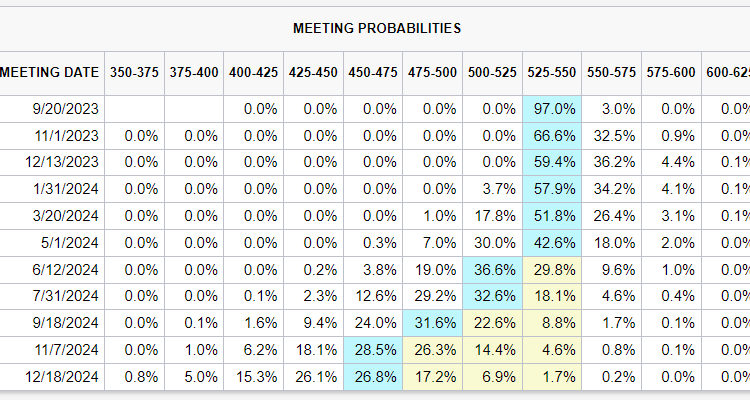

Despite the strength of recent economic indicators, the Fed’s monetary policy outlook, as indicated by fixed income markets, hasn’t repriced materially higher. This could change, however, if incoming information doesn’t reflect a noticeable cooling in activity and a sustained reduction in overall price pressures in the broader economy.

As of now, traders don’t expect any action from the Fed in September, but assign a moderate probability of 32% to a quarter-point hike at the November FOMC meeting. These expectations have the potential to increase should the U.S. economic momentum observed during the summer continue into the fall. In such a scenario, gold prices might remain under pressure for an extended duration.

Acquire the knowledge needed for maintaining trading consistency. Grab your “How to Trade Gold” guide for invaluable insights and tips!

Recommended by Diego Colman

How to Trade Gold

FOMC MEETING PROBABILITIES

Source: FedWatch Tool – CME

Take your trading skills up a notch with the long-term fundamental and technical outlook for gold prices. Download it today!

Recommended by Diego Colman

Get Your Free Gold Forecast

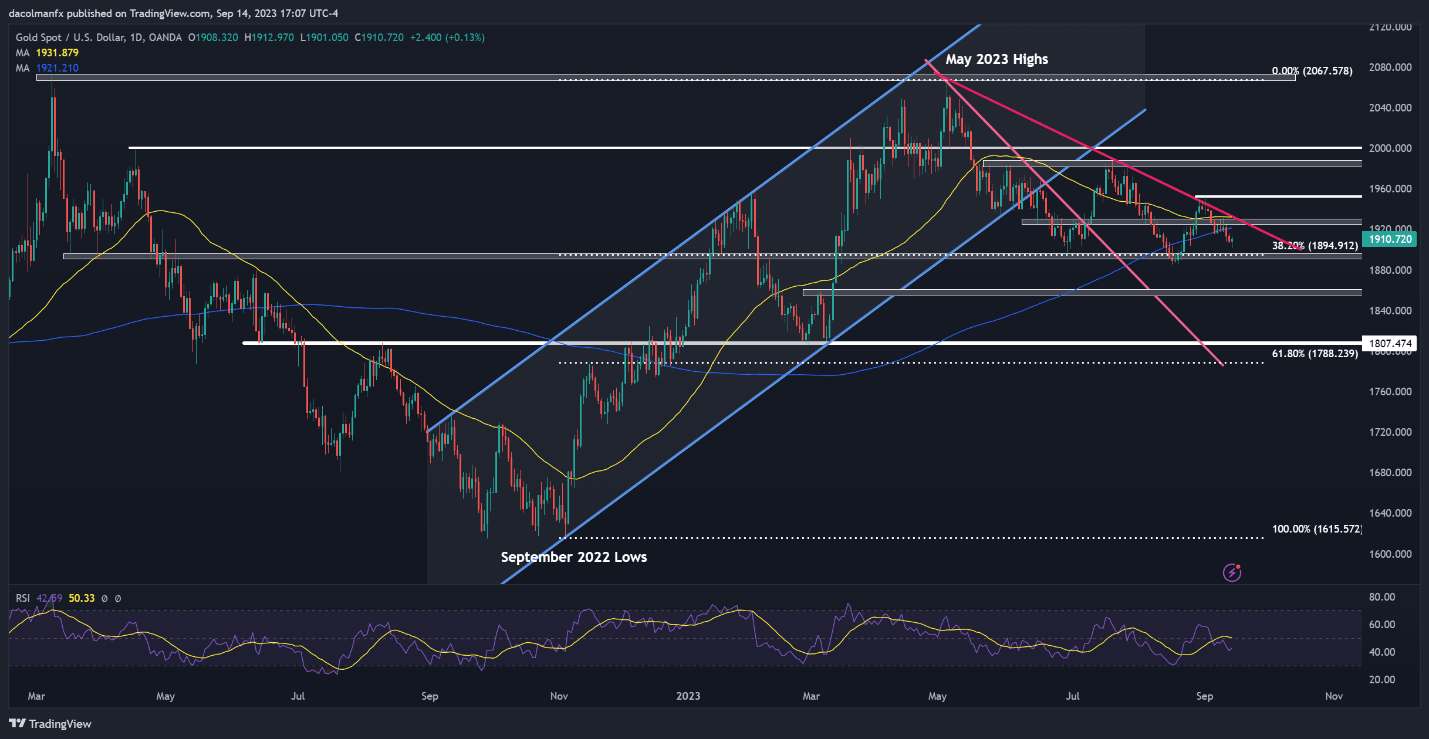

GOLD PRICE TECHNICAL ANALYSIS

Gold initiated a moderate rebound during the second half of August. However, its momentum dwindled after an unsuccessful attempt at clearing trendline resistance, which ultimately led to a pullback that resulted in prices slipping below the 200-day simple moving average this week.

Looking at the daily chart, XAU/USD has been on a downward trajectory over the past few days, with prices edging closer to Fibonacci support at $1,895 – a key floor defined by the 38.2% retracement of the Sept 2022-May 2023 rally. While this zone may serve as a formidable barrier against further declines, a break beneath it could heighten the bearish force, opening the door for a retreat towards $1,855.

In the event of a bullish reversal, initial resistance stretches from $1,920 through $1,930. Successfully piloting above this technical hurdle could rekindle buying interest, creating the right conditions for a move towards $1,955. On further strength, the focus shifts to $1,985, followed by the psychological $2,000 level.

GOLD PRICE TECHNICAL OUTLOOK

Gold Price Chart Prepared Using TradingView

Comments are closed.