Gold Price Latest – $2,000/oz. Support Stands Firm as US Inflation Reports Near

Gold Price Analysis, Prices, and Charts

- US rate expectations still suggest 75bps of cuts this year.

- Gold holds support and pushes higher.

Recommended by Nick Cawley

Get Your Free Gold Forecast

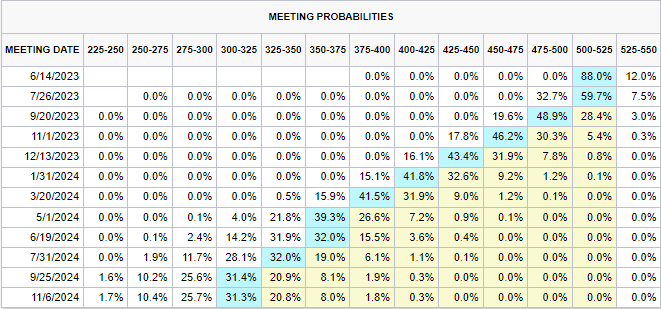

Last week’s US Jobs Report showed the US unemployment rate falling to 3.4%, matching a five-decade low, while workers' wages grew further, underlying the strength of the US labor market. Friday’s NFP report gave the US dollar a short-term nudge higher as traders reassessed their US interest rate predictions, but this move subsequently reversed as traders went back to pricing in a series of rate cuts for this year and next. The latest CME Fed Fund rate predictions suggest that the US central bank will cut rates by 75 basis points by the end of the year, and by another 125 bps by the end of 2024.

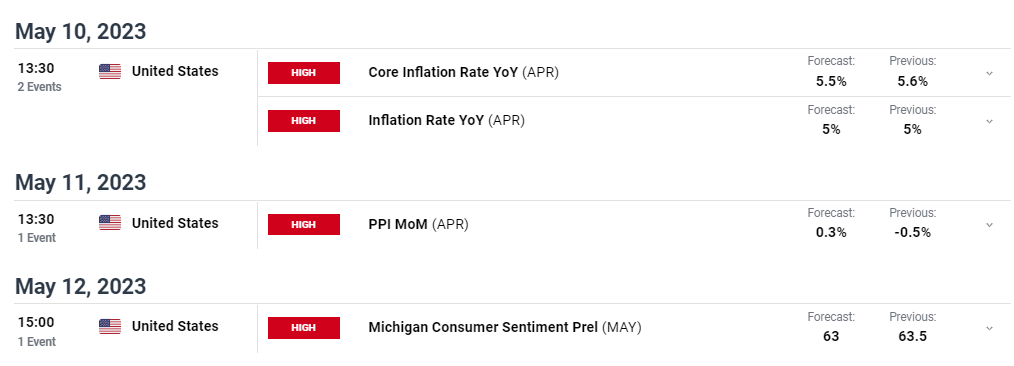

Ahead this week, important US inflation reports will give the market greater clarity on US price pressures, both consumer and producer, while the Michigan Consumer Sentiment survey on Friday is a closely watched index of how consumers see their own financial situation.

For all market-moving data releases and events, see the DailyFX Economic Calendar

Recommended by Nick Cawley

How to Trade Gold

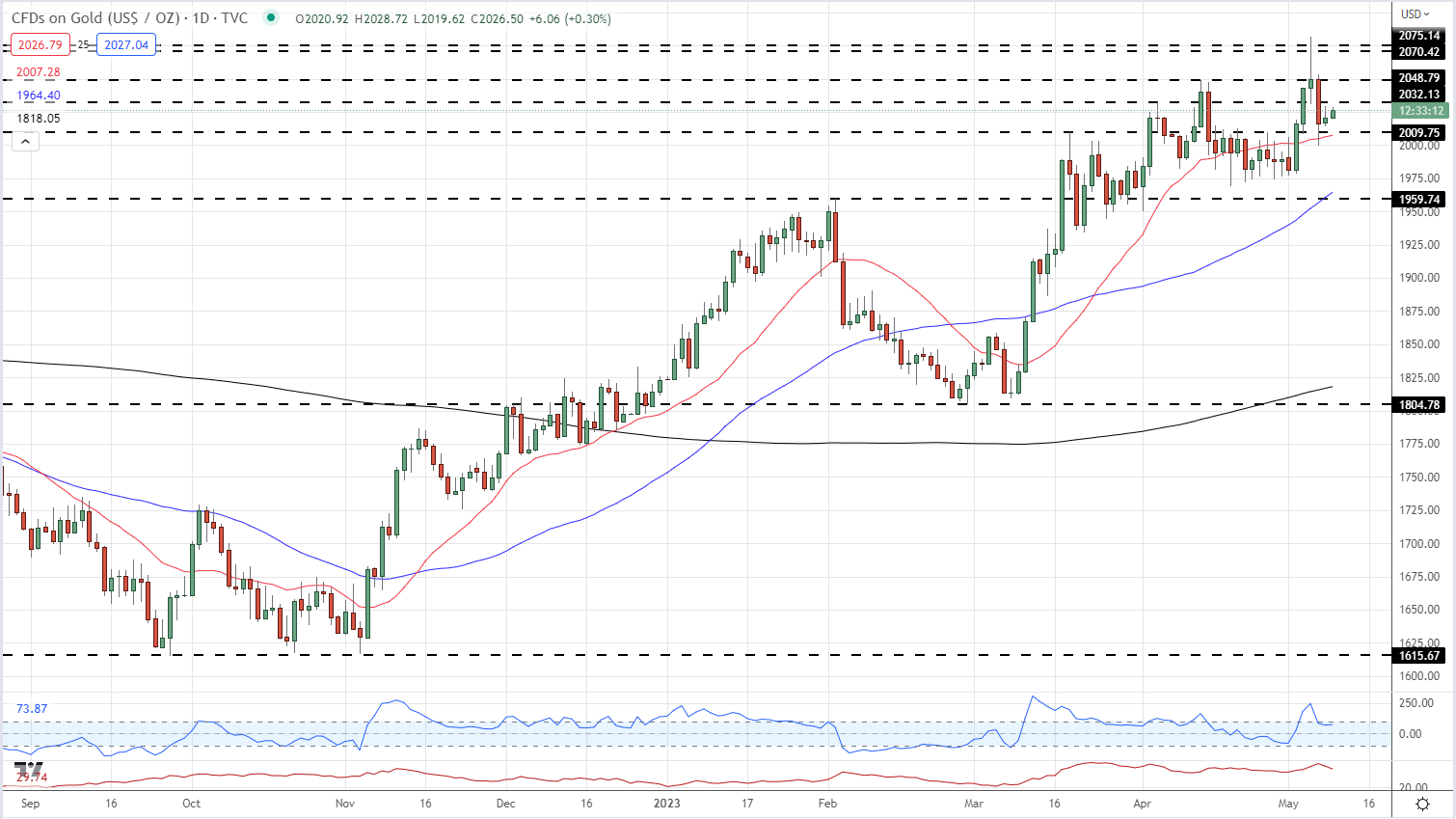

After bouncing off support around $2,000/oz. gold is now pushing back toward an old line of horizontal resistance at $2,032/oz. Above here, is another slightly more important level of resistance at $,2050/oz. comes into view and this may be slightly harder to break ahead of the US inflation reports. All three moving averages remain positive, with the 20-dma holding last Friday’s sell-off, while the CCI indicator suggests a mildly overbought market, but not by much.

Gold Price Daily Chart – May 9, 2023

Chart via TradingView

| Change in | Longs | Shorts | OI |

| Daily | -2% | 8% | 3% |

| Weekly | -14% | 26% | 1% |

Retail trader data show 54.27% of traders are net-long with the ratio of traders long to short at 1.19 to 1.The number of traders net-long is 2.23% higher than yesterday and 14.73% lower from last week, while the number of traders net-short is 8.06% higher than yesterday and 24.78% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Gold prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current Gold price trend may soon reverse higher despite the fact traders remain net-long.

What is your view on Gold – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

Comments are closed.