Gold Price Firms While US Dollar Eases as Treasury Yields Dip. Where to for XAU/USD?

Gold, XAU/USD, US Dollar, Fed, FOMC, Crude Oil, Fibonacci – Talking Points

- Gold steadied again today as the US Dollar continued its descent

- The Fed continues to signal more hikes, but Treasury yields are lower

- Wednesday’s US CPI may provide some market volatility. Higher XAU/USD?

Recommended by Daniel McCarthy

Get Your Free Gold Forecast

The gold price eked out some gains through the Asian session today as markets digest Fed commentary and Treasury yields slipping overnight.

The tighter policy chorus line included the Federal Reserve’s Vice Chair for Supervision, Michael Barr, that was joined by Cleveland Federal Reserve President Loretta Mester and San Francisco Federal Reserve President Mary Daly.

On policy tightening, their remarks swayed between ‘we’re close, we have a lot of work to do’ and ‘we’re likely to need a couple more rate hikes’.

Somewhat counterbalancing those comments, Atlanta Federal Reserve President Raphael Bostic said that the Fed can be patient, acknowledging the restrictive stance of the bank.

Overall, it seems that the market is anticipating a potentially soft US CPI number on Wednesday to allay fears of an aggressive stance by the Fed at its July 26th Federal Open Market Committee (FOMC) meeting.

Treasury yields have retreated from their highs seen last week with the benchmark 10-year note dunking under 4% after nudging up against 4.10% last Friday.

The US Dollar appears to have been undermined with the Japanese Yen continuing to see the largest gains. USD/JPY traded above 145 at the end of June and is now below 141.

Crude oil has steadied through the Asian session with the WTI futures contract near US$ 73.50 bbl while the Brent contract is a touch above US$ 78 bbl.

APAC equities are mostly higher with Hong Kong’s Hang Seng Index (HSI) and South Korea’s KOSDAQ index leading the way.

China announced some support for its property sector, and it seems to have led to expectations that more stimulatory measures might be forthcoming.

UK jobs data as well as German CPI and ZEW survey might provide some market movement. The RBNZ will be making a decision on its cash rate tomorrow.

The full economic calendar can be viewed here.

Recommended by Daniel McCarthy

How to Trade Gold

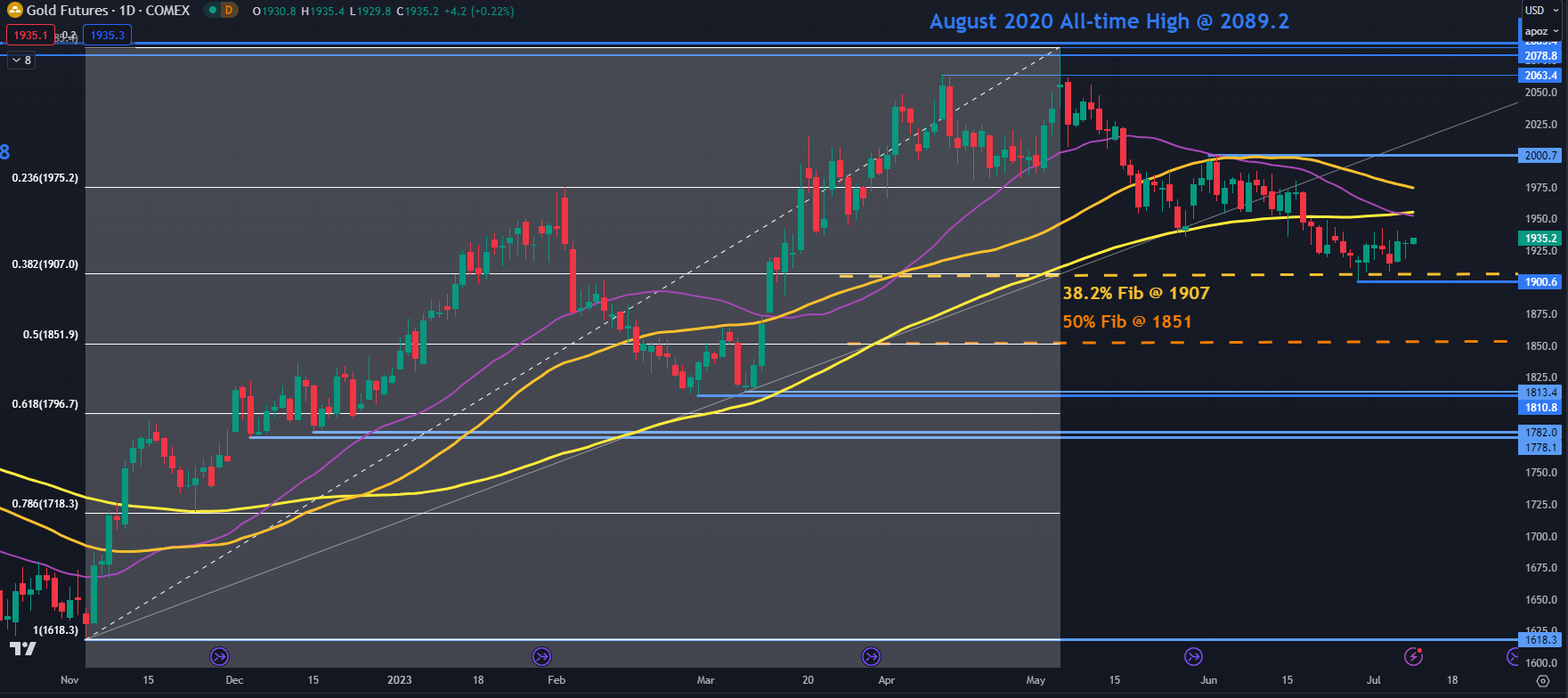

GC1 (GOLD FUTURES) TECHNICAL ANALYSIS

The gold price appears to be establishing a new range, trading between 1900 and 2000 for almost 2 months.

On the downside, support may lie at the Fibonacci Retracement levels of the move from 1618 up to 2085. The 38.2% retracement level is at 1907 and the 50% at 1851. The recent low 1900 might also see some support.

On the topside, resistance could be offered in the 1950 – 1975 area where the 34-, 55- and 100-day simple moving averages (SMA) reside. The peak of 200 may offer resistance ahead of a potential resistance zone in the 2060 – 2090 area.

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter

Comments are closed.