Gold Price Falters Ahead of Fed Powell Speech – XAU/USD Drifts Lower

Gold Price, US Dollar (USD) Talking Points:

Recommended by Tammy Da Costa

Get Your Free Gold Forecast

Gold prices have faltered ahead of Jerome Powell’s testimony, placing additional pressure on price action. With XAU/USD currently threatening the $1,840 psychological level, the monetary policy report could drive prices in either direction.

Visit the DailyFX Educational Center to discover how to trade the impact of politics on global markets

As the Chairman of the Federal Reserve delivers the report to congress, investors will be waiting for signs of when the Fed may end its tightening cycle.

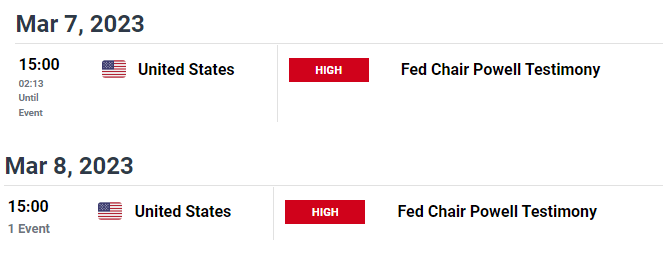

Although market participants are anticipating rates to rise to 5.5% by year end, the pace of tightening remains a concern. While the Fed Chair addresses the Senate and House committees over the next two-days, any hawkish commentary (higher probability of a 50-basis point rate hike) could drive precious metals lower.

DailyFX Economic Calendar

In preparation of the March FOMC meeting, persistently high inflation has been pushing rate expectations higher. This has supported rising yields which has had a negative impact on gold.

Gold (XAU/USD) Technical Analysis

After a period of indecision, gold prices fell below the 20-day MA (moving average) currently holding as resistance at $1,851. With a cross of the 20 and 50-day MA (moving average) suggesting that more pain could be looming ahead, XAU/USD has continued to eye $1,840. If prices break lower, the $1,830 mark could assist in driving the imminent move, bringing the next big level of support into play at $1,800.

Gold (XAU/USD) Daily Chart

Chart prepared by Tammy Da Costa using TradingView

Gold Price Sentiment

Gold: Retail trader data shows 73.14% of traders are net-long with the ratio of traders long to short at 2.72 to 1.The number of traders net-long is 4.42% higher than yesterday and 1.15% lower from last week, while the number of traders net-short is 6.49% lower than yesterday and 10.34% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Gold prices may continue to fall.

| Change in | Longs | Shorts | OI |

| Daily | 1% | -5% | -1% |

| Weekly | -5% | 10% | -2% |

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707

Comments are closed.