Gold On the Cusp of Another Breakdown

GOLD OUTLOOK & ANALYSIS

- Higher oil prices & global growth concerns push USD higher.

- US ISM services PMI’s in focus later today.

- Cautious gold traders look to fundamentals for guidance.

Recommended by Warren Venketas

Get Your Free Gold Forecast

XAU/USD FUNDAMENTAL FORECAST

Gold prices are under threat of another collapse as reflation fears have been stoked by OPEC+ whereby Saudi Arabia and Russia are expected to maintain production cuts through to the end of the year. While extending supply cuts were somewhat anticipated, the duration was not. This should keep the US dollar elevated with China and European growth concerns adding fuel to USD upside.

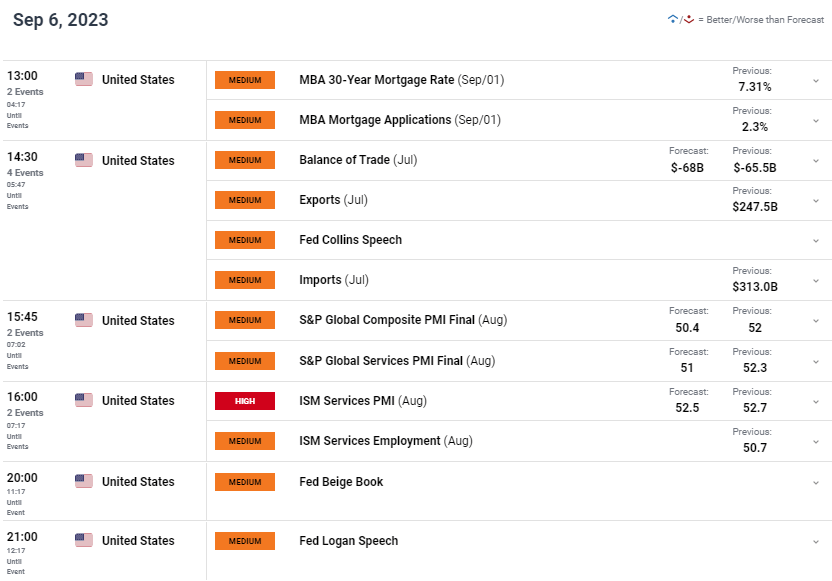

Later today, the US ISM services PMI report will be released. Being a primarily services driven economy, this report carries a lot more weight than the manufacturing metric. Estimates are projected slightly lower than the prior figure but should not deter from a buoyant greenback unless there is a significant miss.

Fed speakers will be scattered throughout the trading day and could stoke some short-term volatility for both the USD and gold respectively.

GOLD ECONOMIC CALENDAR

Source: DailyFX

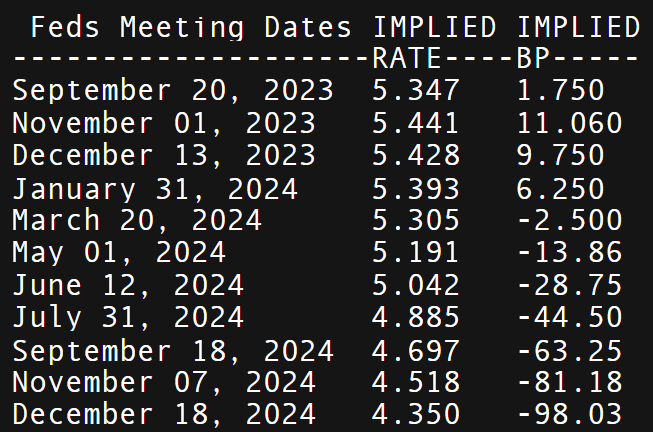

Money market pricing (see below) has been revised lower in terms of cumulative rate cuts by the end of 2024 which was around 110bps a week ago, now 98bps. The threat of additional rate hikes could harm the non-interest bearing yellow metal but further US specific data will be needed to confirm a more hawkish stance – increasing real yields.

IMPLIED FED FUNDS FUTURES

Source: Refinitiv

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

TECHNICAL ANALYSIS

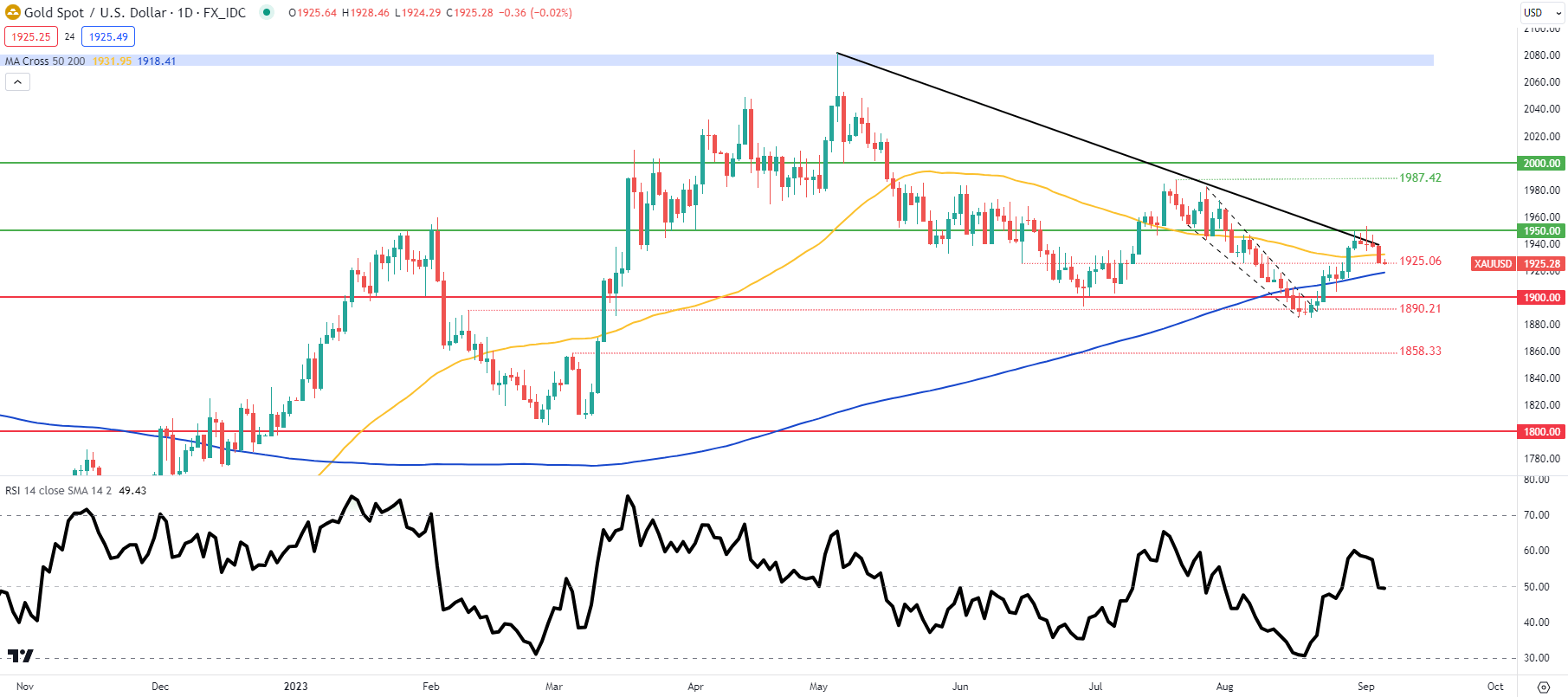

GOLD PRICE DAILY CHART

Chart prepared by Warren Venketas, IG

Daily XAU/USD price action above has respected the longer-term trendline resistance (black) and now hovers around the 1925.06 swing support low. The Relative Strength Index (RSI) suggests hesitancy by gold traders with no inclination to the upside nor downside. Fundamental data mentioned above will likely drive directional bias and any additional dollar support could see gold prices re-test the 200-day moving average (blue) once more.

Resistance levels:

- 1950.00

- Trendline resistance

- 50-day MA (yellow)

Support levels:

IG CLIENT SENTIMENT: BEARISH

IGCS shows retail traders are currently distinctly LONG on gold, with 71% of traders currently holding long positions (as of this writing). Download the latest sentiment guide (below) to see how daily and weekly positional changes affect GOLD sentiment and outlook.

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas

Comments are closed.