Gold Fends Off Attack on $2000, USD/CAD Sinks, GBP/USD on Cusp of Epic Breakout

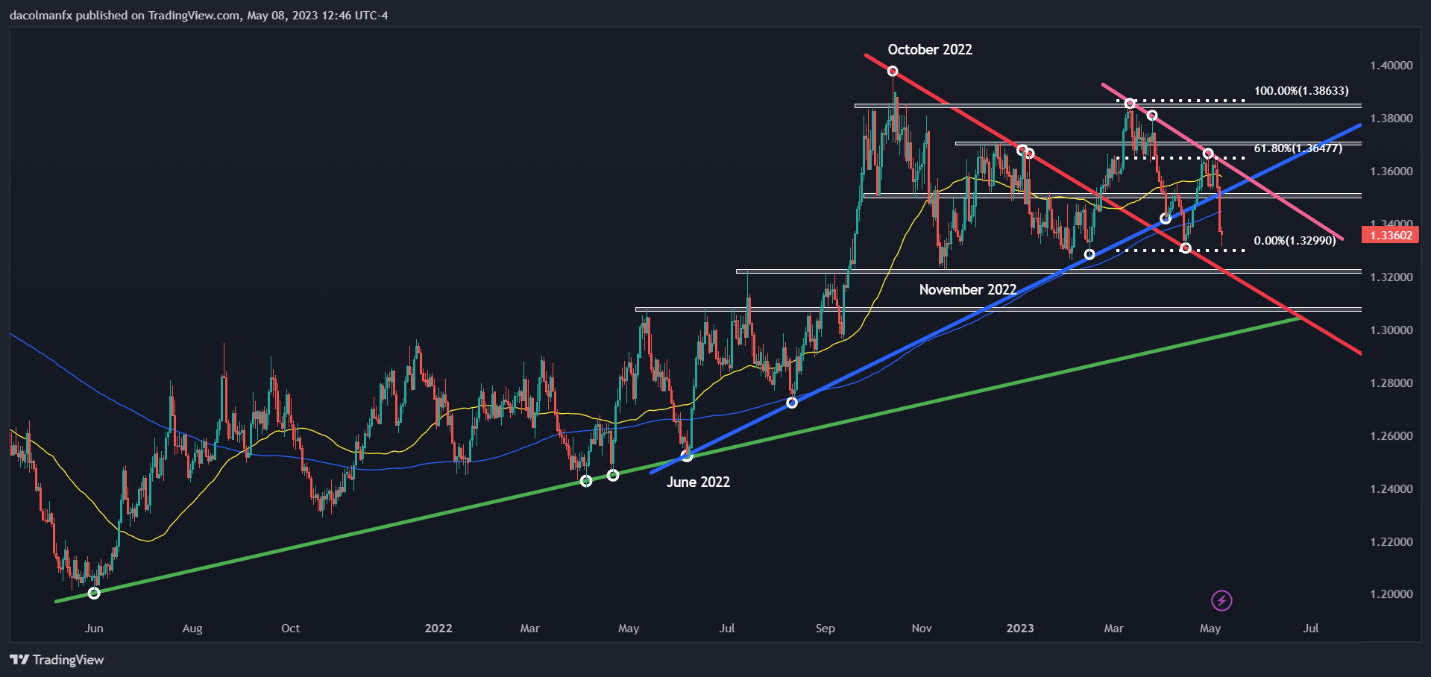

GOLD PRICES TECHNICAL ANALYSIS

Gold sold off on Friday, but bulls managed to fend off an attack on the psychological $2,000 level, allowing prices to establish a base and rally on Monday, a sign that the path of least resistance remains to the upside, with precious metals benefiting from the view that the Fed's peak rate has been reached.

If XAU/USD remains on its bullish trajectory, the first barrier to watch appears at the $2,050 mark, followed by the 2023 highs just below $2,070. Successfully piloting above this technical hurdle could reinforce the upward impetus, paving the way for a move toward the channel resistance at $2,100.

In case of a setback, initial support rests at $2,000, but a breakdown could lure sellers and create the right conditions for a pullback towards $1,975. On further weakness, the next downside target shifts to the 50-day simple moving average hovering around $1,958.

Recommended by Diego Colman

Get Your Free Gold Forecast

GOLD PRICE TECHNICAL CHART

Gold Chart Created Using TradingView

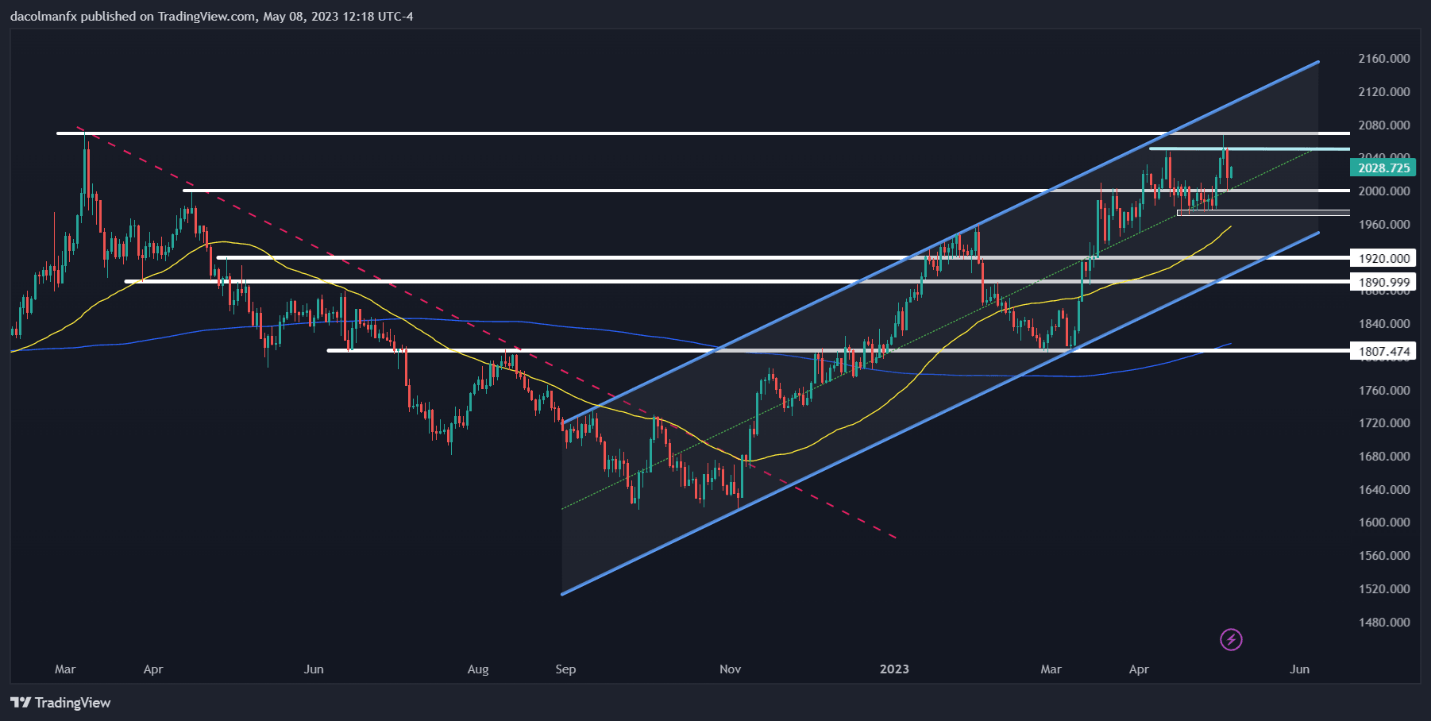

USD/CAD TECHNICAL ANALYSIS

USD/CAD has completely erased the rally of the second half of April in recent days, with selling accelerating following the breach of two key levels: one at 1.3500, established by a rising trendline in play for almost a year, and the other at 1.3445, created by the 200-day simple moving average.

With bears back in control of the market, traders should carefully watch technical support near the psychological 1.3300 mark, which also aligns approximately with the 2023 lows. If this floor caves in, USD/CAD’s broader outlook will turn quite negative, opening the door for a slide toward 1.3220.

On the flip side, if the exchange rate perks up and begins to rebound, the 200-day moving average should act as resistance to prevent a significant bullish turnaround. However, if this barrier is taken out, bulls could launch an assault on the 1.3500 handle.

| Change in | Longs | Shorts | OI |

| Daily | 39% | 1% | 26% |

| Weekly | 62% | -46% | 6% |

USD/CAD TECHNICAL CHART

USD/CAD Chart Prepared Using TradingView

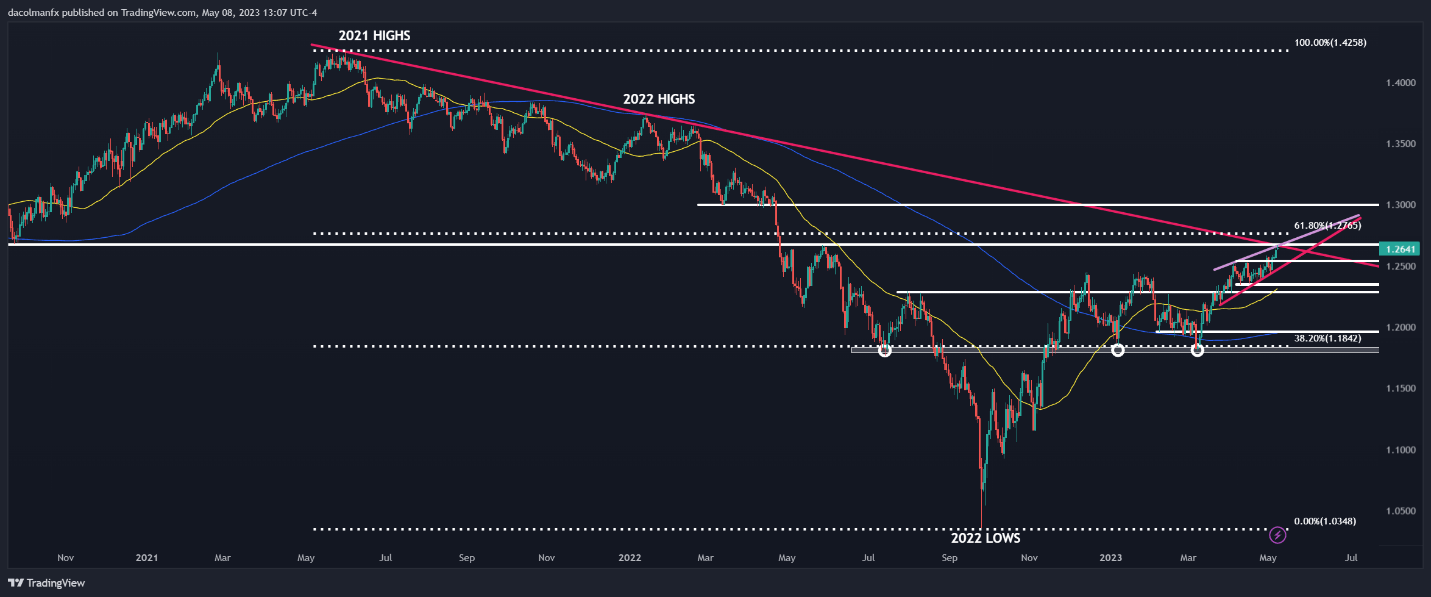

GBP/USD TECHNICAL ANALYSIS

GBP/USD has staged a solid rally since early March, overwhelming bears and pushing steadily higher. However, prices appear to be approaching key technical resistance near 1.2975, created by a descending trendline extended off the 2021 highs. This dynamic barrier could block sterling's upward path.

To gain insight into the near-term outlook and the next directional move, traders should monitor the pair’s reaction around current levels, with two possible scenarios worth considering at this point: a bullish breakout or a rejection lower.

A topside breach of technical resistance at 1.2675 would reinforce positive momentum and pave the way for a rally toward 1.2765, the 61.8% Fibonacci retracement of the 2021/2022 slump. Conversely, if GBP/USD gets rejected from resistance and heads south, support lies at 1.2540, followed by 1.2475.

Recommended by Diego Colman

Get Your Free GBP Forecast

GBP/USD TECHNICAL CHART

GBP/USD Chart Prepared Using TradingView

Comments are closed.