Gold Fades but Upside Still Favored as Debt-Limit Talks Hit Crunch Time

GOLD PRICES FORECAST:

- Gold prices retreat on Monday, undercut by higher U.S. Treasury yields

- The precious metal may reverse higher in the coming days if U.S. lawmakers fail to reach an agreement to raise the debt ceiling soon

- This article looks at key XAU/USD’s tech levels to watch this week

Recommended by Diego Colman

Get Your Free Gold Forecast

Most Read: Nasdaq 100 Entrenched in Indisputable Uptrend but Poor Market Breadth Is Ominous

Gold prices (XAU/USD) were subdued at the start of the week on the back of higher rates across most segments of the U.S. Treasury curve. In early afternoon trading, XAU/USD was down about 0.2% to $1,976 per ounce troy, pressured by rising yields following hawkish commentary from several Fed officials who signaled support for further policy tightening as part of the ongoing fight to curb inflation.

Although the precious metal was lower on the session, losses were largely contained as traders remained somewhat cautious, with U.S. debt-limit saga entering a crucial moment and stealing the spotlight ahead of a key meeting between President Joe Biden and House Speaker Kevin McCarthy to resume talks and unblock negotiations related to fiscal spending.

The debt-ceiling debate has become an unpleasant sideshow for investors, who already must contend with heightened uncertainty about the FOMC’s policy outlook and growing recession risks. Failure to reach an agreement to raise the country’s borrowing capacity could result in a catastrophic default as soon as June 1, the so-called “x-date” when the Treasury Department may run out of cash to pay its obligations.

Related Reading: How to Trade Gold: Top Trading Strategies and Tips

Recommended by Diego Colman

How to Trade Gold

While lawmakers are likely to reach a deal at some point, that may not happen until the last minute, when markets have already begun to convulse. History suggests only panic tends to unite Congress – that is the nature of politics in Washington. Against this backdrop, volatility could rise sharply in the coming days, with risky assets vulnerable to heavy losses the longer the situation remains unresolved.

If sentiment starts to sour rapidly and traders head for the hills, defensive assets could regain decisive leadership and stage a strong bullish move on safe-haven flows. This scenario could boost both gold prices and the U.S. dollar, even if they don’t often rise in tandem. Meanwhile, the S&P 500 and Nasdaq 100 could take a sharp turn to the downside, erasing some of their “AI” induced gains this year.

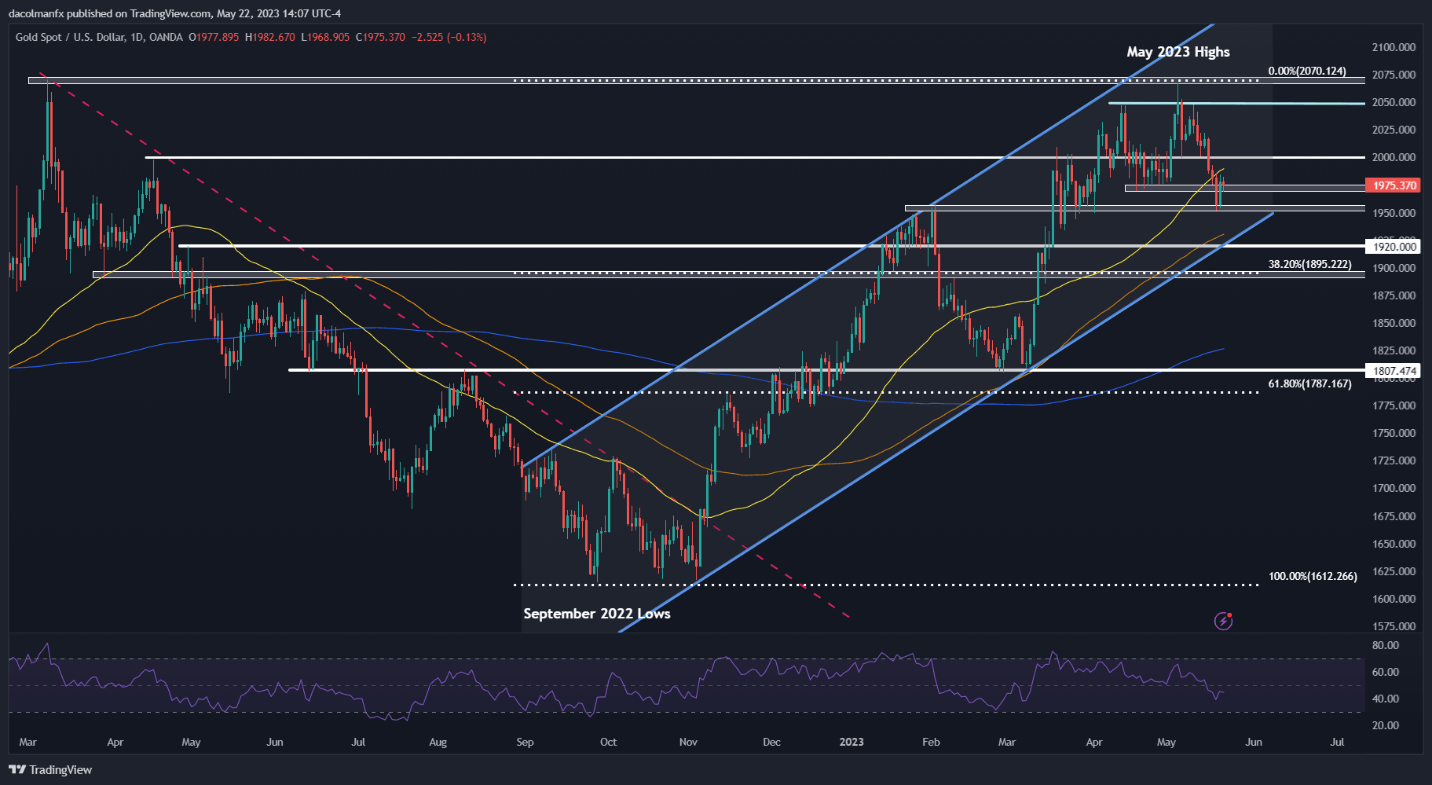

GOLD PRICES TECHNICAL ANALYSIS

After early May's selloff, gold appears to be stabilizing, with the metal recapturing the $1,975 threshold in recent days. If prices manage to remain above this area, bulls could slowly start to return to the market, setting the stage for a move toward the psychological $2,000 level. On further strength, the crosshairs will center on $2,050.

On the flip side, if $1,975 is taken out decisively, XAU/USD could head towards this month’s low near $1,950, but further losses may be in store on a push below this floor, with the next downside target at $1,920 – the lower limit of an ascending channel in play since September of last year.

| Change in | Longs | Shorts | OI |

| Daily | 3% | 12% | 6% |

| Weekly | 17% | -22% | 0% |

GOLD PRICES TECHNICAL CHART

Gold Prices Chart Created Using TradingView

Comments are closed.