Gold Elevated as Markets Continue to Dismiss Fed Guidance

GOLD OUTLOOK & ANALYSIS

- Markets overruling the Fed which may be a fatal blow for gold should the Fed follow through on their promises.

- Fed speakers to dominate headlines today

- Overbought price action possibly hinting at short-term bearishness?

Recommended by Warren Venketas

Get Your Free Gold Forecast

XAU/USD FUNDAMENTAL BACKDROP

Gold is continuing to press higher challenging levels last seen in April 2022 on the back of weaker U.S. data. These include softer inflation, weaker PMI data and signs of slowing wage pressures. On the contrary, the labor market remains tight keeping hawks relevant and while inflationary pressures are on the decline, the inflation rates (both core and headline) are significantly higher than the Fed’s target rate.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

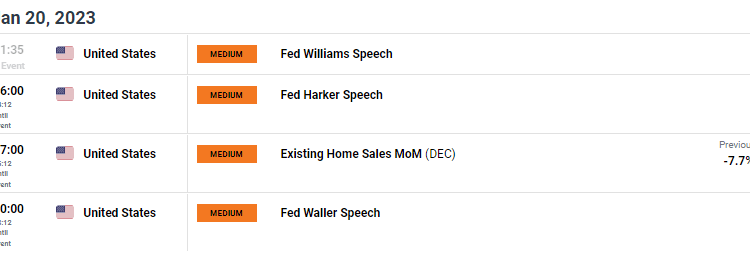

The economic calendar (see below) highlights Fed speakers throughout the trading day and after yesterday’s united front by Fed officials in reiterating the 5% terminal rate in 2023. It will be interesting to see whether today’s speakers follow a similar trend.

ECONOMIC CALENDAR

Source: DailyFX Economic Calendar

Looking at money market pricing, it is clear that market participants are questioning the Fed’s credibility by forecasting a 4.9% peak rate at present – refer to table below. If the Fed intends to stick to their rhetoric, gold prices could be in for significant downside.

FEDERAL RESERVE INTEREST RATE PROBABILITIES

Source: Refinitiv

TECHNICAL ANALYSIS

GOLD PRICE DAILY CHART

Chart prepared by Warren Venketas, IG

The daily spot gold chart highlights the immense rally from the end of November last year. The trade may be slightly overcrowded at this point but it seems many traders are ignoring any potential market mispricing. The Relative Strength Index (RSI) is currently hovering around the overbought zone of the oscillator and could suggest impending downside to come. The golden cross (green) could be showing signs of fatigue leaving room for a likely consolidation or a leg lower.

Resistance levels:

Support levels:

IG CLIENT SENTIMENT: BULLISH

IGCS shows retail traders are currently distinctly LONG on gold, with 55% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment however, due to recent changes in long and short positioning we arrive at a short-term upside bias.

Contact and followWarrenon Twitter:@WVenketas

Comments are closed.