Gold and Silver Prices in Peril as Yields Surge, Technical Setup on XAU/USD

GOLD AND SILVER FORECAST:

- Gold and silver prices slide as U.S. yields surge across the Treasury curve

- Non-yielding precious metals tend to perform poorly when higher nominal rates boost returns on competing assets, such as government bonds

- This article looks at key XAU/USD’s levels to watch in the coming trading sessions

Recommended by Diego Colman

Get Your Free Gold Forecast

Most Read: USD Wobbles but Outlook Brightens, EUR/USD & USD/JPY Embark on Divergent Trends

Gold and silver prices fell on Wednesday, weighed down by soaring U.S. yields following Bank of Canada's unexpected decision to resume its tightening campaign after a brief pause. In late afternoon trading, XAU/USD was retreating 1.2% to $1,957, while XAG/USD was down about 0.5% to $23.55. In general, non-yielding precious metals tend to perform poorly when higher nominal rates boost returns on competing assets, such as government bonds.

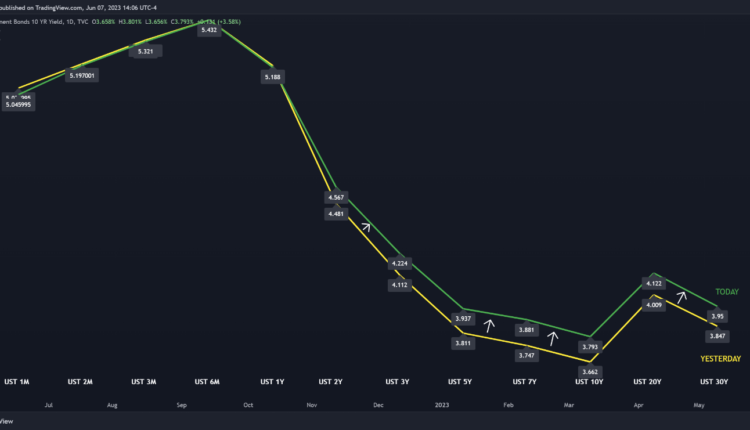

The chart below shows the Treasury curve shifted sharply upwards compared to the previous session.

US TREASURY YIELD CURVE UPWARD SHIFT

Source: TradingView

BoC’s resumption of its tightening campaign after holding rates steady at the previous two meetings was a wake-up call for markets. Many traders believe that if the Fed mistakenly employs a similar strategy and hits the pause button in June, it could start hiking again in July and do so in a more aggressive manner, especially if the brief hiatus allows inflation to regain strength. This could lead to a higher peak rate and no easing through 2024.

The risk that the U.S. central bank will have to maintain a restrictive monetary policy stance for longer than initially anticipated to restore price stability will keep bond yields skewed to the upside, boosting the U.S. dollar in the process. In this environment, gold and silver will struggle to stay afloat, meaning a deeper pullback could be around the corner in the near term.

The chart below shows how U.S. dollar strength and the rising U.S. 10-year nominal yield have undermined gold and silver prices in recent weeks (gold and silver are shown on an inverted scale).

Recommended by Diego Colman

How to Trade Gold

GOLD, SILVER, US DOLLAR AND 10-YEAR YIELDS CHART

Source:TradingView

GOLD PRICES TECHNICAL ANALYSIS

Gold's recent decline seems to be a corrective move within a medium-term uptrend, but the bias could turn bearish very quickly if prices breach the rising trendline that has been guiding the market higher since November of 2022. That said, the level to watch is $1,950 on the gold futures chart.

In terms of possible scenarios, if gold futures break below $1,950, bulls may throw in the towel, setting the stage for a selloff toward $1,905, the 38.2% Fib retracement of the Sep 2022/May 2023 advance. On further weakness, the focus shifts to $1,880.

Conversely, if gold establishes a base around current levels and begins to rebound, initial resistance appears at $1,980. Clearance of this ceiling may rekindle buying interest, paving the way for rally toward the psychological $2,000 mark.

| Change in | Longs | Shorts | OI |

| Daily | 7% | -15% | 0% |

| Weekly | 6% | -15% | 0% |

GOLD FUTURES TECHNICAL CHART

Gold Futures Chart Prepared Using TradingView

Comments are closed.