GBP/USD: The pound will benefit from the tight policy of the Bank of England – Analytics & Forecasts – 29 June 2023

Speaking in Sintra, Portugal, on Wednesday, Bank of England Governor Andrew Bailey said that “the UK economy has proven to be much more resilient” and that the British central bank will do “everything necessary to bring inflation to its target level” as “the data showed clear indications of sustained inflation.

Most economists now believe that the Bank of England will continue to tighten monetary policy and may increase the interest rate to 5.50% already at the next two meetings and up to 6.25% later. In the long term, such a serious adjustment in the cost of borrowing will negatively affect the economy and may lead to its recession. But for now, this will support the pound, making it more attractive in relation to its other main competitors in the foreign exchange market.

Tomorrow (at 06:00 GMT) the UK National Statistics Office will publish the final data on the country's GDP for the 1st quarter of 2023.

From the latest data, it can be seen that the dynamics of British GDP tends to slow down. But so far, this does not seem to worry the leadership of the Bank of England, which has focused on combating high inflation in the country.

As a result of the May and June meetings, the Bank of England raised interest rates by 25 bp. and 50 b.p. to 5.00%, reiterating in its accompanying statement that “if evidence of more sustained pressure emerges, further tightening of monetary policy will be required.”

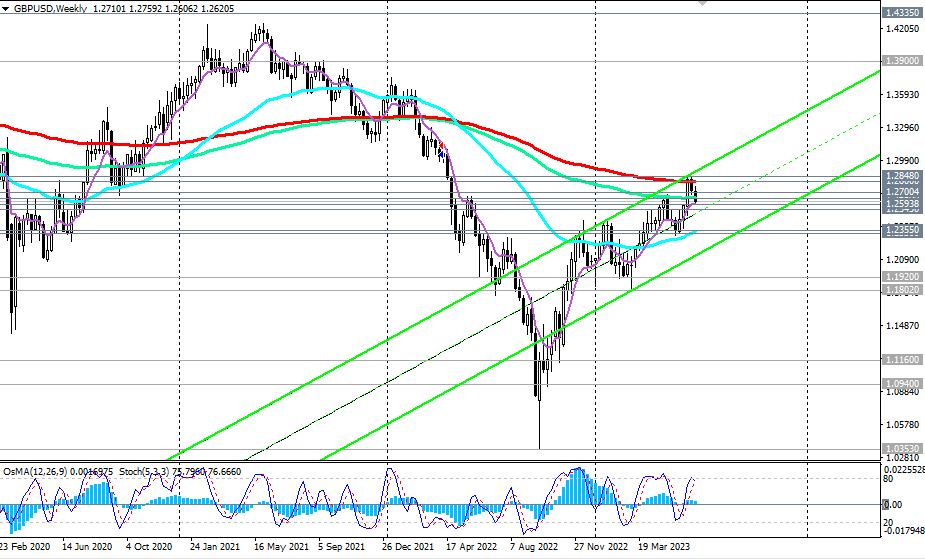

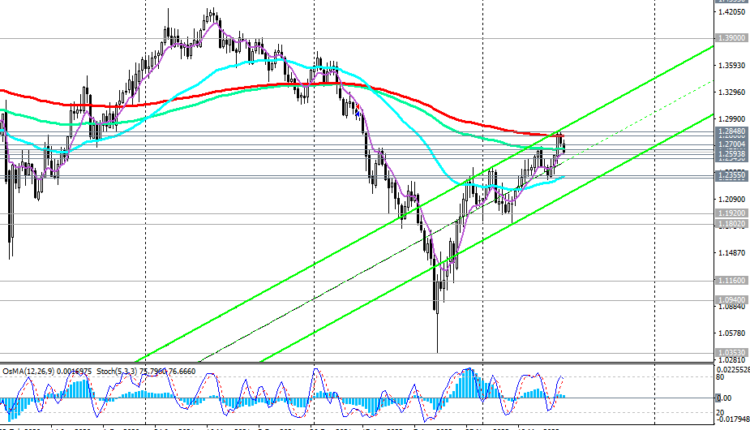

From a technical point of view, the GBP/USD pair remains trading in the zone of a long-term bear market, below the key long-term resistance levels 1.2800 and 1.2848. Their breakdown will bring the pair into the zone of a long-term bull market, sending it to the strategic resistance level 1.4335, which separates the global GBP/USD bear market from the bull market.

Support levels: 1.2594, 1.2545, 1.2500, 1.2400, 1.2335, 1.2330, 1.2300

Resistance levels: 1.2700, 1.2800, 1.2848, 1.3900, 1.4335

Comments are closed.