GBP/USD break of pivotal supports risks further weakness

GBP/USD Forecast: Pound Sterling closes in on key 1.2050 support

GBP/USD turned south in the early European session and dropped below 1.2100 after spending the Asian trading hours in a tight range near 1.2150. The risk-averse market atmosphere and rising US Treasury bond yields help the US Dollar outperform its rivals on Thursday and make it difficult for the pair to shake off the bearish pressure.

The benchmark 10-year US Treasury bond yield extended its weekly rally and climbed to its highest level since 2007 near 5% on Thursday. Later in the day, Federal Reserve Chairman Jerome Powell will speak before the Economic Club of New York. Read more…

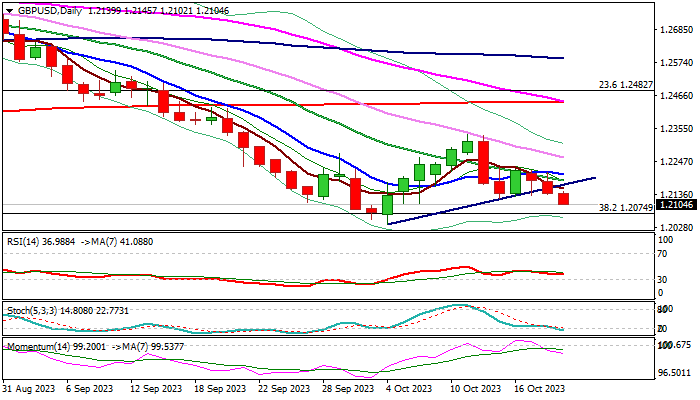

GBP/USD outlook: Break of pivotal supports risks further weakness

Fresh leg lower extends into third straight day, with increasing downside risk seen after break of pivotal supports at 1.2170/22 (trendline support / Oct 13 former higher low). Close below 1.2122 to confirm signal and expose targets and key near-term supports at 1.2037/00 Oct 4 new multi-month low/psychological).

Daily chart studies are bearish, as south-heading 14-d momentum is going deeper into negative territory and moving averages remain in bearish setup, adding to weakening near-term structure, though bears may face headwinds from oversold conditions. Read more…

Pound Sterling falls back as stubbornly high inflation triggers slowdown fears

The Pound Sterling (GBP) strives for a cushion, remaining vulnerable due to persistent inflation fears. The GBP/USD pair struggles for traction as the UK Consumer Price Index (CPI) report for September released on Wednesday showed inflation remains stubborn due to higher Oil prices, services inflation and strong wage growth.

Inflation in the UK is the highest among G7 economies. The decline in inflation towards the 2% target has lost steam, keeping Bank of England(BoE) policymakers on their toes. Meanwhile, market sentiment remains cautious due to persistent fears of Iran’s intervention in the Israel-Palestine conflict. Read more…

Comments are closed.