Euro keeps the negative price action near 1.0530, looks at US data

- The Euro trades on the defensive against the US Dollar.

- Stocks in Europe now give away initial gains.

- EUR/USD meets daily contention around 1.0530.

- The USD Index (DXY) clings to gains around the mid-106.00s.

- Germany, Eurozone Economic Sentiment surprised to the upside.

- US Retail Sales, Industrial Production, Fedspeak will be in the limelight.

The Euro (EUR) commences the European session with modest losses against the US Dollar (USD), prompting EUR/USD to gyrate around the 1.0550 region on Tuesday.

The Greenback experiences a slight advance to the 106.30–106.40 band when tracked by the USD Index (DXY), setting aside Monday’s negative performance as selling pressure in the US fixed-income market persists.

Continuing to centre attention on monetary policy, investors anticipate that the Federal Reserve (Fed) will uphold its position of not implementing any interest rate adjustments throughout the remainder of the year. Meanwhile, participants in the financial markets contemplate the possibility of the European Central Bank (ECB) halting its interest-rate policy as well, despite inflation levels surpassing the bank's target and mounting concerns about an economic downturn or stagflation in the European region.

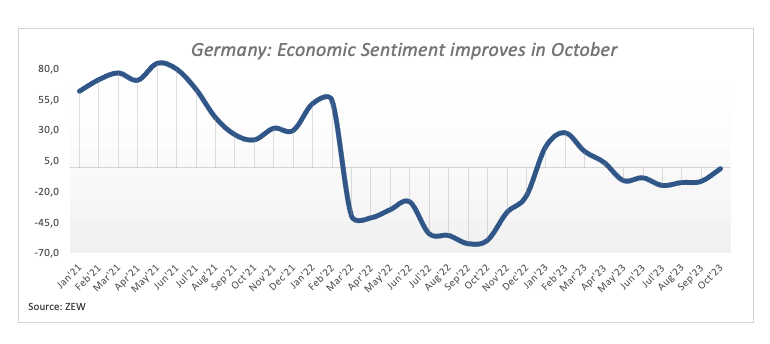

On the euro docket, the Economic Sentiment in both Germany and the broader euro area tracked by the ZEW Institute came in above expectations at -1.1 and 2.3 for the month of October.

In the US, Retail Sales take centre stage along with Industrial Production, the NAHB Housing Market Index, Business Inventories and speeches by FOMC Governor Michelle Bowman (permanent voter, hawk), NY Fed President John Williams (permanent voter, centrist), and Richmond Fed President Thomas Barkin (2024 voter, centrist).

Daily digest market movers: Euro struggles to regain the 1.0600 zone

- The EUR faces some selling pressure against the USD.

- US and German yields keep the uptrend well in place.

- Investors see the Fed leaving interest rates steady in the next few months.

- Investors anticipate that the ECB will pause its rate-hiking cycle.

- ZEW officials suggest the worst has now passed.

- Middle-Eastern geopolitical tensions remain high.

- BoE's Swati Dhingra sees some looseing in the labour market.

- The RBA Minutes showed a hawkish stance from policymakers.

Technical Analysis: Euro faces key contention around 1.0450

EUR/USD comes under some mild downside pressure and returns to the 1.0550 region on Tuesday.

Should the current upward trend persist, EUR/USD may revisit the October 12 high at 1.0639 ahead of the September 20 top of 1.0736 and the noteworthy 200-day Simple Moving Average (SMA) at 1.0821. A break above this point could lead to an attempt to surpass the August 30 peak of 1.0945 and approach the psychological milestone of 1.1000. Any further advances beyond the August 10 high of 1.1064 might potentially propel the pair towards the July 27 pinnacle at 1.1149 and even reach the 2023 top of 1.1275 seen on July 18.

Conversely, in the event that selling pressure resumes, there is a chance of revisiting the 2023 low at 1.0448 seen on October 3 and possibly testing the significant support of 1.0400. If this threshold is breached, it could open the path to a retest of the lows at 1.0290 (November 30, 2022) and 1.0222 (November 21, 2022).

As long as EUR/USD remains below the 200-day SMA, the potential for sustained downward pressure persists.

ECB FAQs

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy for the region.

The ECB primary mandate is to maintain price stability, which means keeping inflation at around 2%. Its primary tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

In extreme situations, the European Central Bank can enact a policy tool called Quantitative Easing. QE is the process by which the ECB prints Euros and uses them to buy assets – usually government or corporate bonds – from banks and other financial institutions. QE usually results in a weaker Euro.

QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The ECB used it during the Great Financial Crisis in 2009-11, in 2015 when inflation remained stubbornly low, as well as during the covid pandemic.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the European Central Bank (ECB) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the ECB stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Euro.

Comments are closed.