Euro Attempts Fightback Post Powell, US Data to Come

EUR/USD ANALYSIS

- Powell lays the groundwork for a EUR comeback.

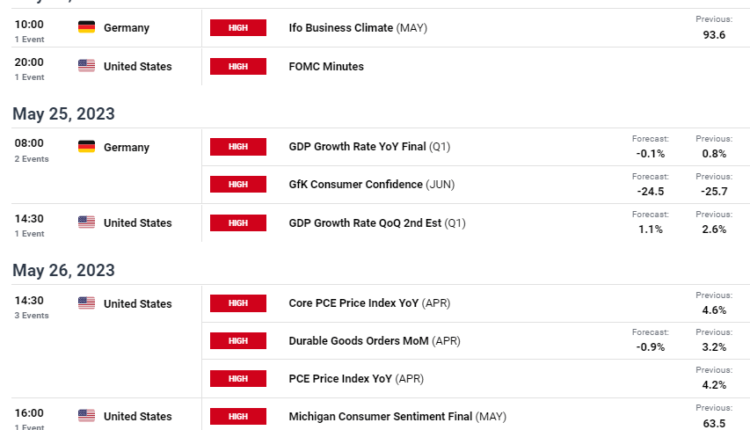

- US economic data under the spotlight including core PCE, GDP and durable goods orders.

- Key area of confluence in question this week.

Recommended by Warren Venketas

Get Your Free EUR Forecast

EURO FUNDAMENTAL FORECAST: BULLISH

The euro heads into the week on the front foot after Fed Chair Jerome Powell’s comments saw Fed interest rate probabilities ‘dovishly’ re-priced. The likelihood of another 25bps hike in June has now been diminished while European Central Bank (ECB) officials continue on their hawkish path.

German data will lead the way from a eurozone perspective being the major economic nation and is often used as a proxy for the EU region. The US will however dominate headlines with data dependency gaining traction. Core PCE and US GDP are the highlights and could dismantle Friday’s comments should inflation remain sticky. The core PCE print is the Fed’s favored level of inflation bringing more attention to the release.

From a debt ceiling perspective, the positivity around a possible successful deal has given reduced the safe haven appeal for the greenback and could play into the hands of the EUR as the week goes on.

Foundational Trading Knowledge

Macro Fundamentals

Recommended by Warren Venketas

EUR/USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX economic calendar

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

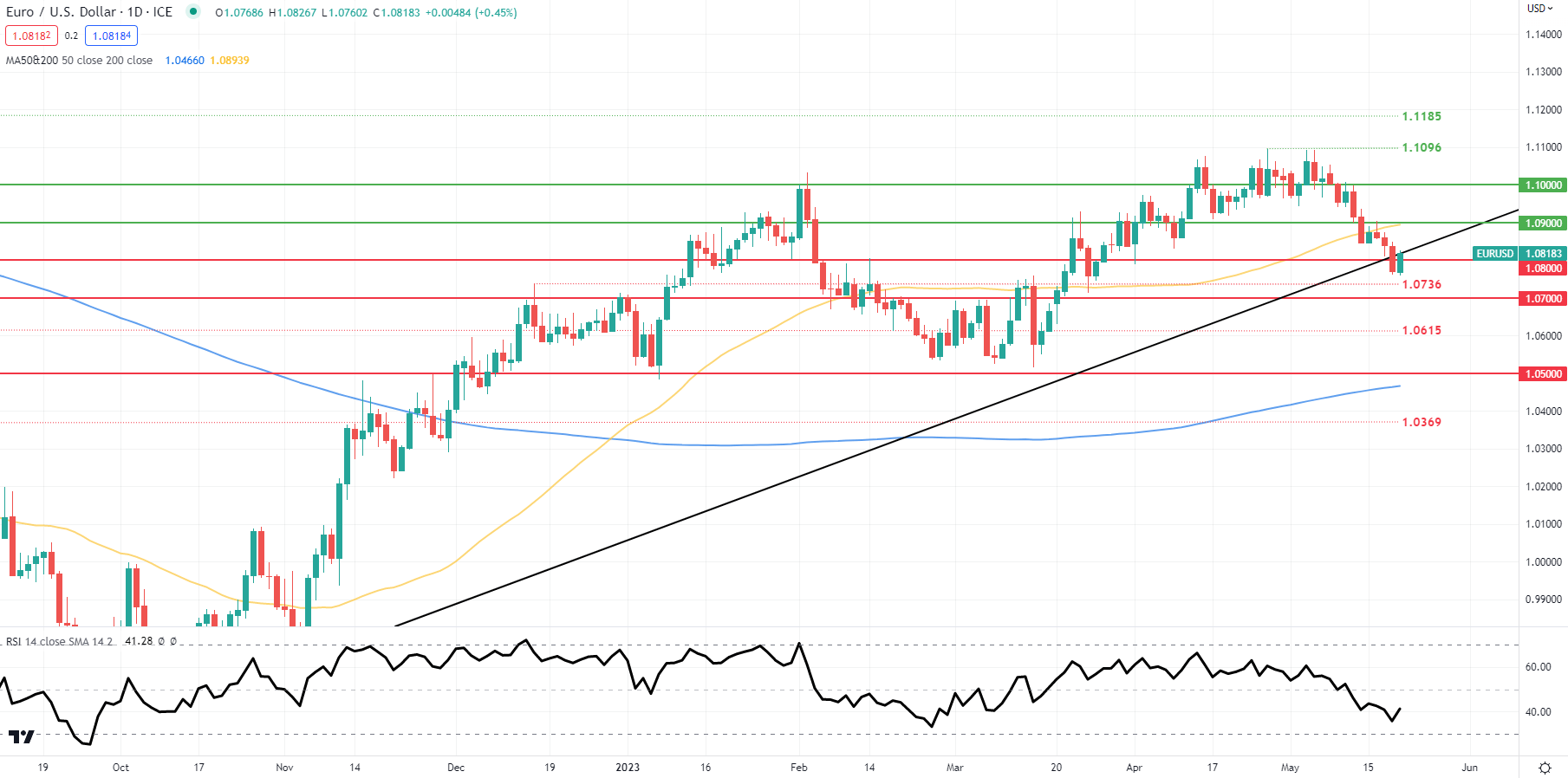

TECHNICAL ANALYSIS

EUR/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Daily EUR/USD price action is at an interesting level trading around the 1.0800 psychological handle after a key trendline break. A daily close above this zone could provide a floor for the euro next week.

Resistance levels:

- 1.0900/ 50-day MA (yellow)

- Trendline support

Support levels:

IG CLIENT SENTIMENT DATA: BEARISH

IGCS shows retail traders are currently LONG on EUR/USD, with 57% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment resulting in a short-term downside disposition.

Contact and followWarrenon Twitter:@WVenketas

Comments are closed.