EUR/USD soars above 1.0700, refreshes two-month highs post-US NFP weak data

- EUR/USD rallies amid a softer US labor market, with Nonfarm Payrolls missing the 180K target.

- Speculation grows for Fed rate cuts in H2 2024 as hiring slows and unemployment ticks up.

- Despite EU's own economic slowdown, the Euro benefits from broad USD weakness and reduced rate hike bets.

EUR/USD rallies during Friday’s North American session after data from the United States (US) paints a looser US jobs market, as Nonfarm Payrolls missed estimates. Hence, traders reduced the chances for another Fed rate hike; instead, are expecting cuts for the second half of next year, a headwind for the US Dollar (USD). The major trades at 1.0726, gains 1%.

EUR/USD capitalizes on weaker US Dollar following disappointing Nonfarm Payrolls, hinting at Fed's rate hike pause

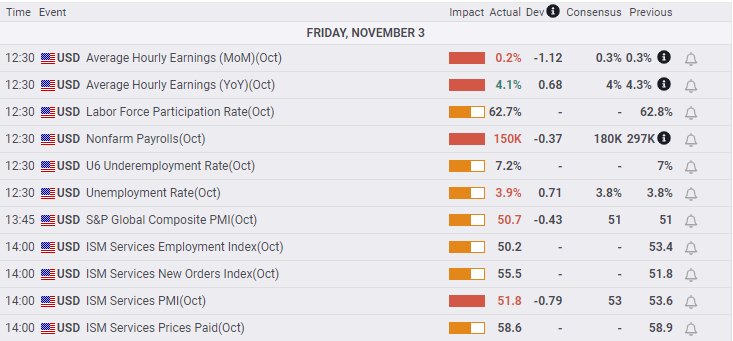

The US Dollar continues to weaken as the US Department of Labor showed the jobs market is cooling as hiring slowed, revealed Nonfarm Payrolls data. In October, the economy added a decent 150,000 jobs but missed forecasts of 180,000 and trailed the 290,000 jobs added to the workforce in September. That, along with the uptick in the Unemployment Rate and Average Hourly Earnings, sparked speculations the Fed is done raising rates.

Additionally, S&P Global and the Institute of Supply Management (ISM) revealed the Services PMI came above the 50 contraction/expansion threshold, though at a brisk of dropping toward the 40 handle.

All that said, last Wednesday’s Federal Reserve’s decision to hold rates is justified, as market participants seem convinced that no more rate hikes are needed. Even though Fed Chair Jerome Powell's hawkish remarks. Consequently, Wall Street is rallying, the Greenback is slumping, and US bond yields are falling.

Friday US economic data

On the data front, the Eurozone (EU) economic calendar showed that business activity in the bloc is slowing down amid a high inflation environment, which reignited stagflation woes. Therefore, money market futures estimate the European Central Bank (ECB) has finished its tightening cycle, which would likely weaken the Euro, but broad US Dollar weakness underpins the EUR/USD pair.

EUR/USD Price Analysis: Technical outlook

From a technical perspective, the EUR/USD downward bias is intact as the pair tests the top of a bearish flag. A break above the 1.0750 area could expose the 1.0800 figure, with the 200-day moving average (DMA) up next at 1.0810. Conversely, sellers could regain control if they push prices below the October 24 swing high of 1.0694, exerting downward pressure on the pair.

Comments are closed.