EUR/USD: Growth of the American economy is stronger than the growth of the European one – Analytics & Forecasts – 7 August 2023

Inflation in the US is declining. It is a fact. But it still remains above the Fed's 2% target. If at a meeting in July the Fed leaders, even in the face of declining inflation and approaching its target level, nevertheless raised the interest rate and expressed their readiness to continue the cycle of tightening monetary policy, then the renewed acceleration of inflation will force the Fed to at least keep the interest rate at high levels, and as a maximum – continue to increase it. This is definitely a bullish fundamental factor for the dollar.

And vice versa, if the data from the US expected this week confirm further slowdown in inflation, then we should expect the weakening of the dollar.

The euro is declining today both in major cross-pairs and against the dollar.

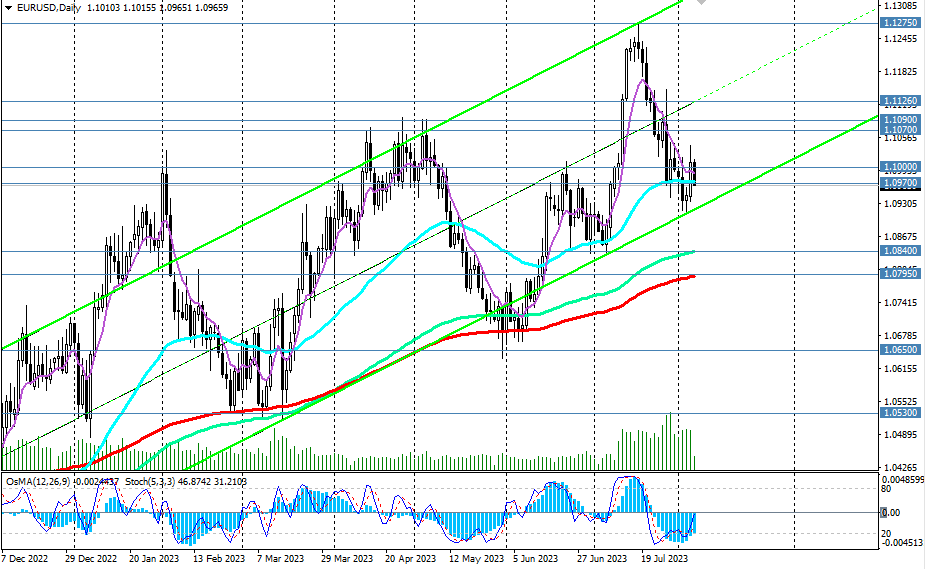

Thus, at the time of publication of this article, the EUR/USD pair was trading near the 1.0966 mark, testing an important support level 1.0970 for a breakdown.

At the moment, EUR/USD is in the zone of the medium-term bull market, above the key support levels 1.0840, 1.0795, while remaining in the zone of the long-term bear market, below the key resistance level 1.1070. In this situation, a breakdown of the support level 1.0970 or resistance at 1.1000 may determine the direction of the pair's movement in the medium term in one direction or another (for more details, see EUR/USD: dynamics scenarios for 08/07/2023).

Here it is worth noting that macro statistics from the Eurozone published last week and earlier did not provide tangible support for the single currency.

Thus, according to preliminary data, the GDP of the Eurozone in the 2nd quarter grew by +0.6% (against the forecast of +0.5%) and by +0.3% year on year (against the forecast of +0.2%). Let's compare the dynamics of US GDP: according to preliminary estimates, it grew by +2.4% in the 2nd quarter (against the forecast of growth by +1.8% after growth by +2.0% in the 1st quarter). Positive data on GDP confirmed the reduced risks of the US economy going into recession, and GDP growth may give the Fed more time to keep interest rates at high levels.

Weak macro statistics from the Eurozone, which pointed to an increase in the risks of a deepening economic downturn in the region, may help keep the ECB interest rate at the current level.

Support levels: 1.0970, 1.0915, 1.0900, 1.0840, 1.0800, 1.0795, 1.0700, 1.0650, 1.0530

Resistance levels: 1.1000, 1.1070, 1.1090, 1.1126, 1.1200, 1.1275, 1.1300, 1.1400, 1.1500, 1.1600, 1.1700

*) see also

Comments are closed.