Employment Data Lifts Canadian Dollar

USD/CAD News and Analysis

- Unemployment rate remains firm despite estimates of a move higher

- USD/CAD technical considerations – 200 SMA and ascending trendline remain key

- IG client sentiment provides a mixed outlook despite the sizeable long positioning

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

Get Your Free USD Forecast

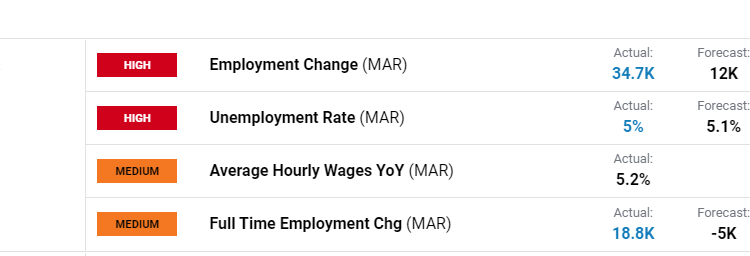

Unemployment Rate Remains Firm Despite Estimates

Employment data for March revealed an additional 34.7k jobs were added, resulting in the unemployment rate holding steady at 5%. Initial estimates suggested the unemployment rate would reach 5.1%, somewhat inline with easing US jobs data this week. US ADP data eased, as did the unemployment sub-components of manufacturing and non-manufacturing PMI data earlier this week.

Customize and filter live economic data via our DailyFX economic calendar

USD/CAD Technical Considerations

USD/CAD is on track for a third straight day of gains as the US dollar appears to recoup some of its recent decline. The USD/CAD bearish trend found support at the confluence zone of ascending trendline and 200 simple moving average (SMA).

USD/CAD trades within a broader consolidation since October of 2022. The near to mid-term downtrend follows on from the lack of USD drivers filtering through at the moment. Market expectations of multiple rate cuts in the second half of the year and the relative calm around the banking industry weighs on the greenback.

Resistance appears at 1.3520 before 1.3650 while a retest of the ascending trendline, as support, is not out of the question. The 200 SMA continues to act as dynamic support and thereafter, 1.333 comes into play.

USD/CAD Daily Chart

Source: TradingView, prepared by Richard Snow

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

IG Client Sentiment Mixed Despite 63% Net Long Positioning

Source: TradingView, prepared by Richard Snow

USD/CAD:Retail trader data shows 63.72% of traders are net-long with the ratio of traders long to short at 1.76 to 1.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/CADprices may continue to fall.

The number of traders net-long is 4.62% lower than yesterday and 10.91% higher from last week, while the number of traders net-short is 4.13% higher than yesterday and 12.84% lower from last week.

Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed USD/CAD trading bias.

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Comments are closed.