Dow Jones, Nasdaq 100, Canadian Dollar, BoC, AUD/USD, NZD/USD

Body:

Recommended by Daniel Dubrovsky

Get Your Free Equities Forecast

Global market sentiment was a mixed bag last week. On Wall Street, the Dow Jones plummeted 2.38% as the tech-heavy Nasdaq 100 soared 1.27%. Things looked worse across the Atlantic Ocean, the DAX 40 and FTSE 100 fell -0.35% and -0.94%, respectively. Markets were rosier in the Asia-Pacific region. The Nikkei 225 and Hang Seng Index rose 1.66% and 1.41%, respectively.

A rally in the tech sector helped boost market sentiment on Friday as Google’s parent company Alphabet announced the most layoffs on record. Meanwhile, markets enjoyed comments from Fed officials that hinted towards a moderation in tightening. Fed Funds Futures continue pointing to rate cuts later this year, putting markets on a divergent path from central bank projections.

An example of what can happen when this occurs was seen by the Bank of Japan this past week. The BoJ disappointed markets with a policy hold, plunging JPY initially. However, the currency recovered as markets looked beyond the near term to when Governor Kuroda’s term ends in April, focusing on what may come after. Still, this produced intense volatility.

Ahead, the Canadian Dollar is awaiting the Bank of Canada interest rate announcement. Looking at market pricing, traders anticipate Wednesday’s 25 basis point rate hike to be the last of this tightening cycle. Much like with the BoJ, this is leaving markets increasingly vulnerable to disappointment, opening the door for the Loonie to pull ahead.

Other notable event risks in the week ahead include New Zealand’s and Australia’s inflation rates for NZD/USD and AUD/USD, respectively. Later on, the Fed’s preferred inflation gauge is seen softening further. The earnings season remains in full swing, with Microsoft and Tesla reporting. What else is in store for the week ahead?

Recommended by Daniel Dubrovsky

Get Your Free USD Forecast

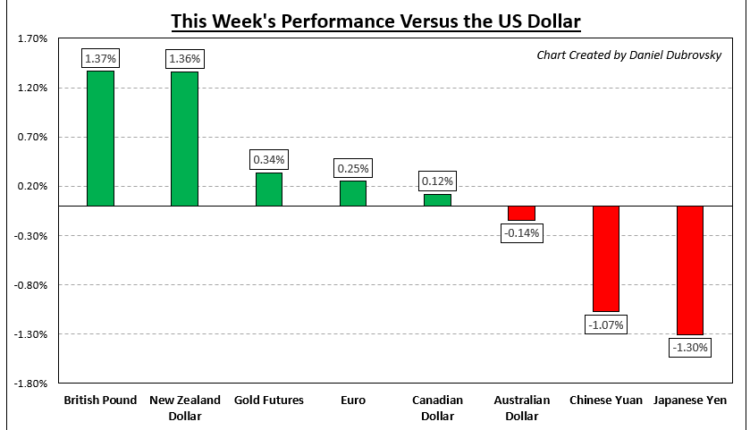

How Markets Performed – Week of 1/16

Fundamental Forecasts:

S&P 500 and Nasdaq 100 Fundamental Forecasts for the Week Ahead

US equity markets have been on the back foot for most of the week as the US earnings season gets into full flow.

Pound Fundamental Forecast: Constrained Consumers Send GBP Lower

The pound continues to grapple with many fundamental challenges. The main ones include stubbornly high prices, declining economic activity (spending).

Australian Dollar Outlook: CPI Moves into View

The Australian Dollar made a six-month peak last week as the US Dollar continues to weaken with the Fed in focus. Local CPI data is due this week. Will it push AUD/USD higher?

Dollar Searches for Break from Range with EURUSD and USDJPY Prime Candidates

The holidays are passed, but the restrictive trading conditions seem to have carried over into the second half of January. The Dollar has been trapped in a tight range through this week as market participants await a clear signal. Will we get it amid key event risk like the US 1Q GDP release next week?

Canadian Dollar Outlook: Markets Think Next Week’s BoC Rate Hike Will be the Last

The Canadian Dollar is eyeing next week’s Bank of Canada monetary policy announcement. A 25-basis point rate hike is priced in. Will it conclude the tightening cycle?

Technical Forecasts:

US Dollar Technical Forecast: EUR/USD, GBP/USD, AUD/USD, USD/CAD

The US Dollar set a fresh seven-month-low this week while testing a key spot of support at the 50% mark of the two-year-trend.

Gold Price Outlook: XAU/USD Resilience Holds at Nine-Month High

Gold prices ended their fifth consecutive week of gains marginally higher after rising to a nine-month high $1,939. RSI moves into overbought territory.

S&P 500 and NASDAQ 100 INDEX Technical Outlook: Still Not Out of the Woods

US equity indices have lagged behind the performance of some of their peers in recent weeks and it appears that they are still not out of the woods. What is the outlook on the S&P 500 index and the Nasdaq 100 index and what are the levels to watch?

Japanese Yen Technical Forecast: USD/JPY Bounces After Kuroda Comment

USD/JPY has made a loud turn from the bullish trend that dominated in the first nine months of last year. But for how long can USD/JPY pull back?

— Article Body Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

— Individual Articles Composed by DailyFX Team Members

To contact Daniel, follow him on Twitter:@ddubrovskyFX

Comments are closed.