Daily Forex News and Watchlist: USD/JPY

USD/JPY is pulling back to its Asian session range after a downside breakout earlier today!

Could the pair see a break-and-retest setup ahead of today’s U.S. session trading?

Before moving on, ICYMI, yesterday’s watchlist checked out AUD/USD’s short-term support and resistance zones ahead of Australia’s CPI report. Be sure to check out if it’s still a good play!

And now for the headlines that rocked the markets in the last trading sessions:

Fresh Market Headlines & Economic Data:

Japan’s industrial production unexpectedly fell by 0.4% in April, its first decline in three months.

Japan’s retail sales up by 5.0% y/y in April, slower than March’s 6.9% growth and the expected 7.1% uptick.

ANZ: New Zealand business confidence lifted 13 points from -43.8 to -31.1, while expected own activity rose from -7.6 to -4.5 in May

Australia’s monthly CPI accelerated from 6.3% y/y in March to 6.8% y/y in April (vs. 6.4% expected)

China’s manufacturing PMI unexpectedly fell down from 49.2 to 48.8 vs. 49.5 expected in May on weakening demand

China’s services PMI eased from 56.4 to 54.5 in May, marking the slowest expansion in four months

Japan’s consumer sentiment rose from 35.4 to 36 in May, the highest reading since January 2022

Japan’s housing starts dropped by 11.9% y/y in April, faster than March’s 3.2% decline and the expected 0.9% dip

Price Action News

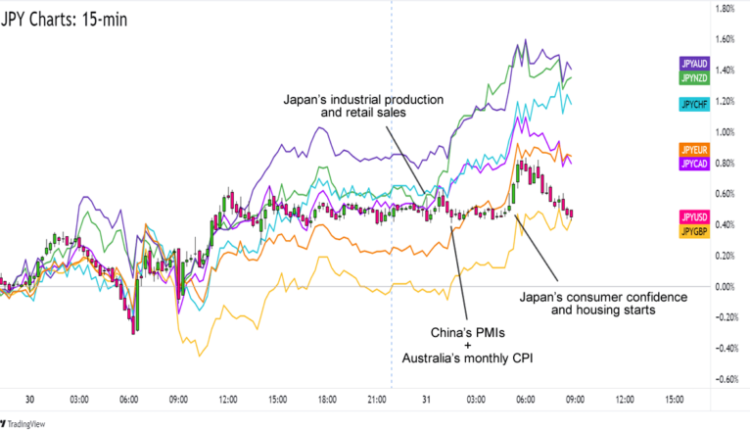

Overlay of JPY Pairs 15-min

The Japanese yen was staying within its U.S. session ranges when a combo of higher-than-expected Australian CPI and lower-than-expected Chinese PMI reports hit the markets.

The prospect of slower global growth amidst higher interest rates did not sit well with risk-takers and the safe haven yen gained ground.

It even broke its ranges against the U.S. dollar near the start of European session trading especially after France’s slower CPI backed a less hawkish European Central Bank (ECB) stance.

Canada’s monthly GDP at 12:30 pm GMT

FOMC member Michelle Bowman to give a speech at 12:50 pm GMT

Chicago PMI at 1:45 pm GMT

U.S. JOLTS job openings at 2:00 pm GMT

SNB Chairman Jordan to give a speech at 3:05 pm GMT

U.S. Beige Book report at 6:00 pm GMT

Japan’s capital spending at 11:50 pm GMT

Australia’s capital expenditure (q/q) at 1:30 am GMT (June 1)

Australia’s retail sales at 1:30 am GMT (June 1)

Use our new Currency Heat Map to quickly see a visual overview of the forex market’s price action! 🔥 🗺️

USD/JPY 15-min Forex Chart Chart by TV

Breakout alert!

USD/JPY just broke a trend line support that’s been around for more than a week.

Thing is, the pair also just bounced from the S1 (139.26) of today’s Standard Pivot Points and now USD/JPY is back to its Asian session range levels.

Are you also seeing a potential break-and-retest play over here?

The U.S. dollar could extend its losses against the yen if more traders take profits ahead of the House vote on the U.S. debt deal, the U.S. NFP report, or the end of the month.

If USD/JPY turns lower from the 140.00 psychological handle, then the pair could dip back to its intraday lows near 139.25.

But if USD/JPY trades (and stays) back above the broken trend line, then you can also consider a continuation of the pair’s weeks-long uptrend.

Comments are closed.