Daily Forex News and Watchlist: USD/JPY

Another day, another U.S. bank in trouble!

Can liquidity woes drag USD/JPY much lower ahead of the NFP release?

Before moving on, ICYMI, yesterday’s watchlist looked at USD/CAD testing its range levels ahead of BOC Governor Macklem’s speech. Be sure to check out if it’s still a good play!

And now for the headlines that rocked the markets in the last trading sessions:

Fresh Market Headlines & Economic Data:

ECB hiked interest rates from 3.50% to 3.75% as expected, with Chairperson Lagarde citing that inflation has been too high for too long

Lagarde: Central bank is not pausing from tightening, as governors are all determined to fight inflation

UBS considers selling Credit Suisse after acquiring the troubled bank a few weeks back, possibly keeping the investment arm while unloading the rest

Western Alliance Bancorp reportedly exploring potential sale according to FT, company shares tumble 30% and halt trading

U.S. initial jobless claims accelerated from 229K to 242K, outpacing the consensus at 239K to reflect much faster increase in unemployment

Canadian Ivey PMI down from 58.2 to 56.8 vs. estimated 59.0 figure, reflecting slower expansion instead of the expected faster growth pace

BOC Governor Macklem says they are not done hiking interest rates, especially if inflation climbs back above 2%

Russian deputy oil minister Novak says that they will stick to output pledge of cutting production by 500K barrels per day

Chinese Caixin services PMI down from 57.8 to 56.4 vs. 57.1 forecast in April, as activity and new work reflected slower gains while input cost inflation rose to one-year high

RBA statement on monetary policy: More rate hikes may be required in order for inflation to reach target within reasonable timeframe, reducing risk of wage spiral

Price Action News

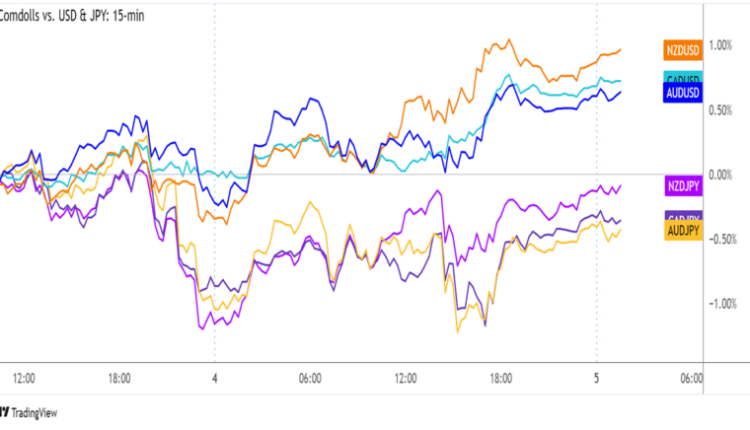

Comdolls vs. USD & JPY 15-min Charts by TV

The prospect of another U.S. bank collapsing sent the Greenback on one more wave lower across the board.

Interestingly enough, the higher-yielding commodity currencies managed to benefit from the dollar (and yen!) selloff that took place, even as risk assets like equities took hits.

The Canadian dollar, in particular, managed to outpace most of its peers thanks to relatively hawkish remarks from BOC Governor Macklem. He cited that the central bank is open to resuming its rate hikes if inflation climbs back above their 2% threshold.

Upcoming Potential Catalysts on the Economic Calendar:

Swiss CPI at 6:30 am GMT

French industrial production at 6:45 am GMT

SNB foreign currency reserves at 7:00 am GMT

SNB Chairperson Jordan’s speech at 9:00 am GMT

Canadian employment change at 12:30 am GMT

U.S. non-farm payrolls at 12:30 am GMT

Use our new Currency Heat Map to quickly see a visual overview of the forex market’s price action! 🔥 🗺️

USD/JPY 15-min Forex Chart by TV

Thanks to rumors of Western Alliance Bancorp’s potential sale, the dollar took another major nosedive against its forex rivals.

USD/JPY closed nearly 150 pips lower on the day, before pulling up to its short-term descending trend line that’s been holding for the past few days.

If resistance holds at the pivot point (134.21) once more, the pair could tumble to the previous day lows near the 133.50 minor psychological mark and S1 (133.55).

Stronger selling pressure on account of more banking sector troubles or perhaps a downbeat NFP release could send USD/JPY to S2 (132.83) or lower.

On the other hand, profit-taking activity or another strong upside surprise from the U.S. jobs report could lead to a rally above the trend line and a test of the next resistance levels at R1 (134.93) or R2 (135.60).

Just make sure to account for the average USD/JPY daily volatility of 127.5 pips when setting entries and exits!

Comments are closed.