Daily Forex News and Watchlist: USD/CHF

FOMC Chairman Powell is up today!

How will his speech factor in today’s themes and USD/CHF’s current uptrend?

Before moving on, ICYMI, yesterday’s watchlist checked out AUD/NZD’s range support ahead of New Zealand’s quarterly inflation data. Be sure to check out if it’s still a good play!

And now for the headlines that rocked the markets in the last trading sessions:

Fresh Market Headlines & Economic Data:

On Tuesday, Chicago Fed President Goolsbee and Minneapolis Fed President Kashkari re-emphasized that the Fed’s main focus is to bring inflation back to the 2% target

U.S. Balance of Trade for September: -$61.5B (-$59.5B forecast; $58.7B previous); net positive growth in both imports & exports

Federal Reserve Governor Christopher Waller said the U.S. jobs market is normalizing, fortunately without a big spike in the unemployment rate

Canada Balance of Trade for September: C$2.0B surplus (C$1.1B forecast; C$950M previous)

New Zealand’s inflation expectations fell from 2.83% q/q to a two-year low of 2.76% q/q in Q3 2023

Japan’s leading indicators weakened from 109.2% to 108.7% in September (vs. 108.8% expected)

Germany’s final CPI reading maintained at 3.8% in October as expected

Price Action News

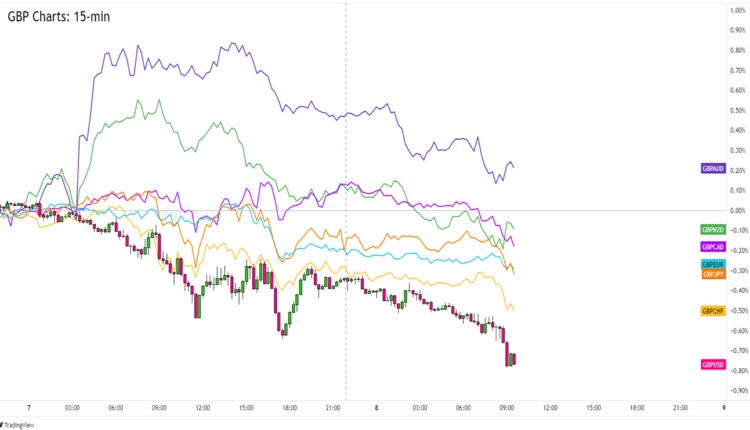

Overlay of GBP vs. Major Currencies Chart by TradingView

The markets took on a more cautious tone compared to yesterday as traders reassessed the possibility of interest rates peaking for the major central banks.

It also didn’t help that some traders were taking profits ahead of Fed Chairman Powell’s speech where he’s expected to repeat the central bank’s hawkishness and commitment to fight high inflation rates.

GBP, in particular, took relatively heavier losses at the start of the European session. The British pound’s prices may have also taken their cues from Bank of England (BOE) Governor Andrew Bailey citing the “fragmentation” of the global economy as a relevant risk to the U.K.’s financial systems.

GBP is currently losing the most pips against USD and CAD and is seeing the least losses against EUR and CHF.

Upcoming Potential Catalysts on the Economic Calendar:

BOE Gov. Bailey to give a speech at 9:30 am GMT

Eurozone retail sales at 10:00 am GMT

Canada’s building permits at 1:30 pm GMT

FOMC Chairman Powell to give a speech at 2:15 pm GMT

BOJ’s Opinions Summary at 11:50 pm GMT

China’s CPI and PPI reports at 1:30 am GMT (Nov 9)

Use our new Currency Heat Map to quickly see a visual overview of the forex market’s price action! 🔥 🗺️

USD/CHF 15-min Forex Chart by TradingView

Looking for a U.S. dollar pair to trade during Fed Chairman Powell’s speech?

If you are, then you may want to consider USD/CHF testing its R1 (.9020) resistance near an ascending channel in the 15-minute time frame.

Word around is that JPow will attempt to talk down interest rate cut speculations by repeating the Fed’s hawkish stance.

If we do see hawkish statements from the Fed head honcho, then USD/CHF could trade above its current consolidation and make a play for its .9050 area of interest.

But keep in mind that USD/CHF has already popped up by at least half of its daily average volatility. The R1 Pivot Point resistance could also draw in sellers especially if Powell doesn’t come off as hawkish as USD traders are expecting.

Until we see a sentiment-changing headline, though, we can continue to bet on the current USD-friendly themes possibly extending in the next trading sessions.

Consider either a trip to the .9050 R2 zone that would represent a full average volatility move or a potential pullback to the .9010 Pivot Point line and mid-channel levels.

Good luck and good trading this one!

Comments are closed.