Daily Forex News and Watchlist: USD/CHF

It’s another rangebound day for major forex pairs so far, but we might see bigger moves during the release of U.S. PMI figures.

Check out these inflection points I’m watching on USD/CHF.

Before moving on, ICYMI, yesterday’s watchlist looked at GBP/USD breaking below its double top neckline. Be sure to check out if it’s still a good play!

And now for the headlines that rocked the markets in the last trading sessions:

Fresh Market Headlines & Economic Data:

U.S. House Speaker McCarthy says no debt limit agreement yet, President Biden reiterated that a default is off the table

Australia’s flash manufacturing PMI unchanged at 48.0 in May, flash services PMI dipped from upgraded 53.7 reading to 51.8 to reflect slower industry expansion

Japanese May flash manufacturing PMI improved from 49.5 to 50.8 to signal a shift from contraction to industry growth

BOJ core CPI climbed from 2.9% to 3.0% year-over-year in April versus estimated dip to 2.8%, underscoring BOJ views of improving inflation

French May flash manufacturing PMI improved from 45.6 to 46.1 as expected, flash services PMI slipped from downgraded 54.6 figure to 52.8 vs. 54.0 consensus

German May flash manufacturing PMI fell from upgraded 44.5 figure to 42.2 vs. 44.9 forecast, flash services PMI rose from 56.0 to 57.8 vs. 55.0 forecast to reflect stronger expansion

U.K. May flash manufacturing PMI fell from upgraded 47.8 figure to 46.9 vs. 47.9 estimate, flash services PMI tumbled from upgraded 55.9 reading to 55.1 vs. 55.5 forecast to indicate slower growth

Price Action News

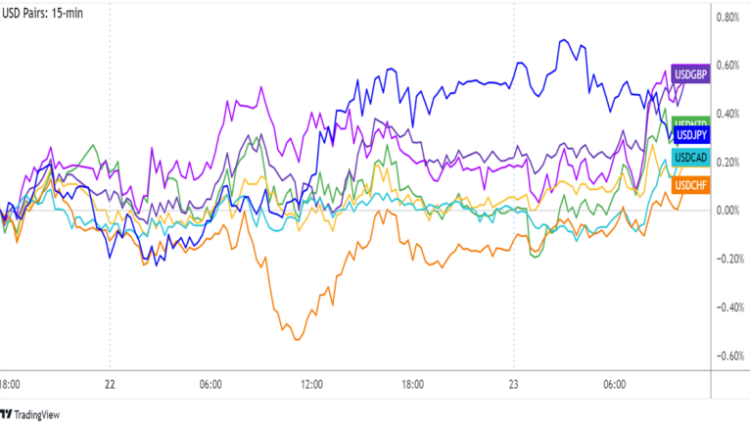

Overlay of USD Pairs 15-min

Dollar pairs are still in snooze mode in the latest trading sessions, as market players might be holding out for more significant updates from debt ceiling negotiations.

So far, House Speaker McCarthy has clarified that they haven’t reached an agreement on the debt limit yet, even as President Biden has reiterated that a default is off the table.

Meanwhile, some Republican negotiators say that they are not seeing much urgency from the White House. U.S. Treasury Secretary Yellen repeated that June 1 is the “hard deadline” to raise the debt ceiling.

During the European session, the dollar managed to squeeze out some gains against the pound and euro, as the U.K. and eurozone printed mostly downbeat flash PMI figures.

U.S. flash manufacturing and services PMIs at 1:45 pm GMT

U.S. new home sales at 2:00 pm GMT

U.S. Richmond manufacturing index at 2:00 pm GMT

New Zealand retail sales at 10:45 pm GMT

Use our new Currency Heat Map to quickly see a visual overview of the forex market’s price action! 🔥 🗺️

USD/CHF 15-min Forex Chart by TV

Take a look at this forex pair hovering around an area of interest!

USD/CHF is once again testing the support-turned-resistance zone near the .9000 major psychological handle, still deciding whether to make a bounce or a break.

If this holds as a ceiling, the pair could slide back to the pivot point (.8970) that’s near the previous day lows. Stronger bearish pressure could even drag it down to S1 (.8950) that has held as support over the past couple of days.

On the other hand, a break above the area of interest near R1 (.9000) could set off a move to the next upside barriers at R2 (.9030) or R3 (.9060).

USD/CHF moves an average of 67.1 pips per day, so keep this figure in mind when setting entries and exits.

Comments are closed.