Daily Forex News and Watchlist: USD/CAD

Even with the dollar’s big moves lately, USD/CAD is still stuck in a range!

Will it bounce off these inflection points again?

Before moving on, ICYMI, yesterday’s watchlist looked at EUR/USD breaking out of its channel ahead of the ECB decision. Be sure to check out if it’s still a good play!

And now for the headlines that rocked the markets in the last trading sessions:

Fresh Market Headlines & Economic Data:

FOMC hiked interest rates by 0.25% as expected from 5.00% to 5.25%, as policymakers note that inflation remains above goal

Fed head Powell noted that there was strong support for interest rate hikes and that a pause was not yet discussed during their meeting

Powell also mentioned that policymakers believe they are approaching the end of their tightening cycle but that cutting would not be appropriate given inflation trends

U.S. ISM services PMI improved from 51.2 to 51.9 vs. 51.8 forecast in April, as new orders and prices paid indices increased while employment component dipped

U.S. regional bank PacWest is reportedly considering “strategic options” such as a sale of its assets

New Zealand ANZ commodity prices slipped 1.7% month-over-month in April vs. previous 1.3% gain, as exporter freight prices continue to soften

Australian trade surplus widened from 14.1 billion AUD to 15.27 billion AUD in March vs. estimated 13 billion AUD figure, thanks to 4% increase in exports

Chinese Caixin manufacturing PMI fell from 50.0 to 49.5 in April instead of holding steady, as input costs and selling prices tumbled at their fastest pace in seven years

Price Action News

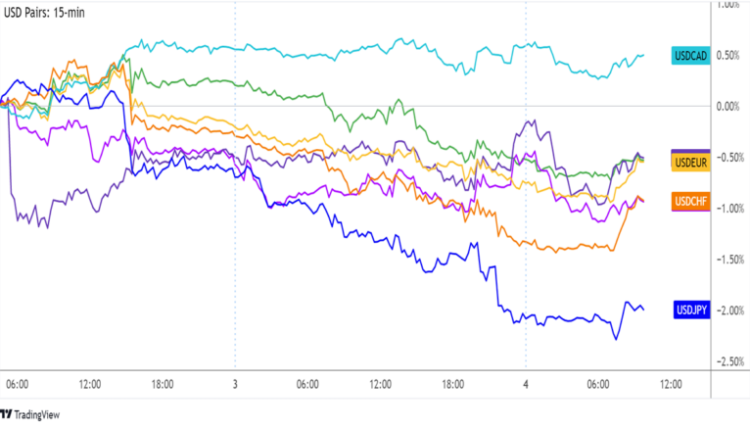

Overlay of USD Pairs 15-min Charts by TV

The FOMC statement kept the U.S. dollar in selloff mode, even as the central bank hiked interest rates and avoided hinting at a pause anytime soon.

The Greenback slid lower across the board, accelerating its decline against the Japanese yen as risk-off flows remained in play.

Meanwhile, the lower-yielding yen managed to strengthen against the rest of its rivals, as markets grew increasingly concerned about a possible U.S. recession and the likely collapse of another regional bank.

The dollar selloff extended until the early Asian hours before a bit of profit-taking allowed the U.S. currency to ease off its lows.

Upcoming Potential Catalysts on the Economic Calendar:

ECB monetary policy statement at 12:15 pm GMT

ECB press conference at 12:45 pm GMT

Canadian Ivey PMI at 2:00 pm GMT

BOC Governor Macklem’s speech at 4:50 pm GMT

Use our new Currency Heat Map to quickly see a visual overview of the forex market’s price action! 🔥 🗺️

USD/CAD 15-min Forex Chart by TV

This forex pair is still cruising calmly inside its good ol’ range, possibly because dollar and Loonie traders are holding out for the U.S. and Canadian jobs reports tomorrow.

USD/CAD is now closing in on the range resistance just slightly below R1 (1.3640) of the Standard Pivot Points.

If this holds, price could tumble back down to the bottom at 1.3580, which happens to line up with S1.

However, if the Greenback suffers another wave lower across the board, we might see a range breakdown that takes USD/CAD down to the next floor near S3 (1.3530).

Be sure to keep close tabs on the headlines, particularly on any updates involving more bank defaults, since these could mean more downside for the dollar.

Comments are closed.