Daily Forex News and Watchlist: NZD/USD

The Kiwi is on weaker footing after New Zealand printed a downbeat CPI report earlier today.

Will the FOMC speeches drag NZD/USD further south?

Before moving on, ICYMI, yesterday’s watchlist checked out the downtrend on NZD/USD ahead of the NZ CPI report. Be sure to check out if it’s still a valid play!

And now for the headlines that rocked the markets in the last trading sessions:

Fresh Market Headlines & Economic Data:

Fed Beige Book noted that overall economic activity was little changed in the past weeks, as only three out of nine districts reported modest growth and consumer spending was mostly flat

EIA reported sharp reduction of 4.8 million barrels in crude oil inventories versus projected dip of 0.4 million barrels and earlier increase of 0.6 million barrels

New Zealand Q1 CPI slumped from 1.4% to 1.2% q/q versus projected increase to 1.5%, dampening RBNZ tightening hopes as energy prices tumbled

Fed official Williams: Inflation is still running too high, so Fed needs to act to lower prices and would likely take two years to reach 2% target

PBoC kept one-year prime loan rate unchanged at 3.65% and five-year rate on hold at 4.30% for the eighth consecutive month

Price Action News

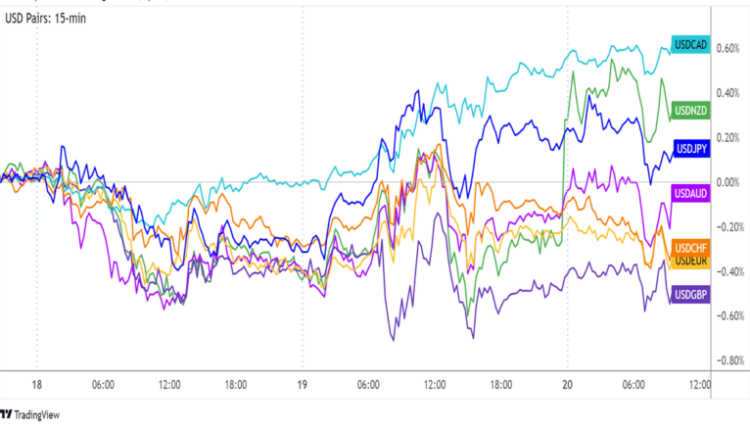

Overlay of USD Pairs 15-min

The U.S. dollar pulled up from its dive during yesterday’s European session to finish higher against some of its rivals, particularly the Loonie and the Kiwi.

Weaker than expected NZ quarterly CPI was mostly to blame for the Kiwi’s decline, as the slump in energy prices weighed on inflation and RBNZ tightening hopes.

Meanwhile, the pound managed to hold on to most of its gains and tread sideways against the dollar, following the upbeat U.K. CPI release.

Upcoming Potential Catalysts on the Economic Calendar:

U.S. initial jobless claims at 12:30 pm GMT

U.S. Philly Fed index at 12:30 pm GMT

U.S. existing home sales at 2:00 pm GMT

BOC Governor Macklem’s speech at 3:30 pm GMT

FOMC member Waller’s speech at 4:00 pm GMT

FOMC member Bowman’s speech at 7:00 pm GMT

Australia’s flash manufacturing and services PMI at 11:00 pm GMT

FOMC member Harker’s speech at 11:45 pm GMT

Use our new Currency Heat Map to quickly see a visual overview of the forex market’s price action! 🔥 🗺️

NZD/USD 15-min Forex Chart by TradingView

Downbeat New Zealand inflation data weighed heavily on the Kiwi earlier in the day, causing NZD/USD to break below its short-term range.

Price has since pulled up for a retest of the former support, which is the S1 (.6170) of the Standard Pivot Points.

If this holds as resistance, NZD/USD could slip back to the lows near S2 (.6150) or even carry on with its slide to S3 (.6120).

Upcoming catalysts for the dollar include speeches by three FOMC members (Waller, Bowman, and Harker) as additional confirmation that the Fed could keep tightening might be bullish for USD.

On the flip side, a move back inside the previous range might mean that there’s enough upside momentum. This might take NZD/USD up to the resistance near R1 (.6230) or at least until the area of interest at the pivot point or .6200 handle.

Comments are closed.