Daily Forex News and Watchlist: NZD/USD

Risk-off flows have been favoring the dollar these days, so we might just see another leg lower for NZD/USD.

Do you think mid-tier U.S. data could keep the safe-haven dollar supported?

Before moving on, ICYMI, yesterday’s watchlist checked out AUD/USD for another pullback after the downbeat Australian CPI release. Be sure to check out if it’s still a good play!

And now for the headlines that rocked the markets in the last trading sessions:

Fresh Market Headlines & Economic Data:

Fed Chairperson Powell mentioned during the ECB forum that monetary policy might not be restrictive enough, with a strong labor market lifting the odds of more hikes this year

ECB Chairperson Lagarde also noted the impact of tight labor markets on wage increases, which are further stoking inflationary pressures

In the same forum, BOE head Bailey pointed to noticeable signs of sustained inflation in the U.K. economy and that they would take all steps necessary to bring it back to target

BOJ Governor Ueda reiterated their plans to keep monetary policy unchanged while policymakers monitor the impact of higher rates on economic activity

U.S. EIA crude oil inventories showed a draw of 9.6 million barrels vs. the estimated reduction of 1.4 million barrels and earlier draw of 3.8 million barrels

New Zealand ANZ business confidence index improved from -31.1 to -18.0 in June, reflecting weaker pessimism

People’s Bank of China set yuan reference rate stronger than expected again, as central bank seems committed to slow the currency’s decline

Australian retail sales posted 0.7% month-over-month uptick in consumer spending for May, following earlier flat reading

Price Action News

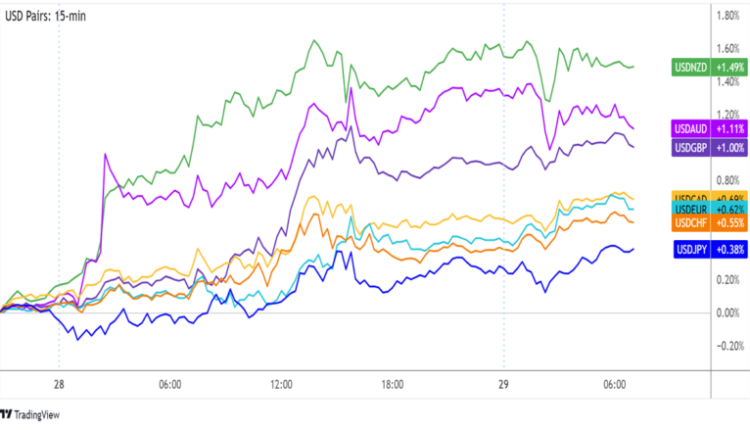

Overlay of USD Pairs 15-min Charts

The Greenback staged quite a steady climb for the most part of the previous day, as hawkish remarks from top central bankers during the ECB forum kept risk-taking in check.

AUD and NZD were on the back foot, as the prospect of even higher borrowing costs due to stubborn inflation led traders to be wary of slower global economic activity and weaker demand for commodities down the line.

Earlier in today’s Asian trading session, the PBOC announced its decision to set the yuan reference rate slightly stronger than expected once more, as policymakers attempt to slow down the currency’s slide.

Fed Chairperson Powell to testify at 6:30 am GMT

Spanish flash CPI y/y at 7:00 am GMT

U.S. final GDP q/q at 12:30 pm GMT

U.S. initial jobless claims at 12:30 pm GMT

U.S. pending home sales at 2:00 pm GMT

Chinese official manufacturing and non-manufacturing PMI at 1:30 am GMT (June 30)

Use our Currency Heat Map to quickly see a visual overview of the forex market’s price action! 🔥 🗺️

NZD/USD 15-min Forex Chart by TV

After a steady selloff, NZD/USD is pausing from the slide to consolidate right above the .6075 mark.

Is this a bearish flag pattern pointing to potential trend continuation?

A break below the latest lows could set off another decline, possibly taking the pair down to S1 (.6040) or S2 (.6010).

On the other hand, a move higher could lead to a test of the ceiling at R1 (.6140), which happens to line up with a former support zone.

Dollar pairs could take cues from another speech by Fed head Powell, followed by the release of the final U.S. GDP reading for Q1.

As in previous trading weeks, the initial jobless claims figure might also have an impact on dollar direction since this tends to affect NFP expectations.

After that, better keep an eye out for the Chinese official PMI readings in the next Asian session since these figures would likely impact overall market sentiment.

Use our brand new Risk-On Risk-Off Meter to help you gauge the overall risk sentiment of the market and make trades that best align with the current market conditions! 🟥 🟩

Comments are closed.