Daily Forex News and Watchlist: NZD/CAD

NZD/CAD just busted through a trend line resistance!

Will we see more signs of a short-term reversal today?

Before moving on, ICYMI, yesterday’s watchlist checked out USD/JPY’s range support zone ahead of a “quiet” session for news traders. Be sure to check out if it’s still a good play!

And now for the headlines that rocked the markets in the last trading sessions:

Fresh Market Headlines & Economic Data:

U.S. Building Permits for May: 1.49M (1.425M forecast; 1.42M previous); Housing Starts at 1.63M vs. 1.4M forecast

Westpac-Melbourne leading index further declined from -0.78% to -1.09% in May, the tenth consecutive negative print for the index

BOJ’s meeting minutes showed one member wanting to ensure that their policy “does not fall behind the curve” as wages and inflation accelerate

U.K.’s producer input prices up by 0.5% ytd/y in May, down from 4.2% increase in April

U.K.’s factory gate prices up by 2.9% ytd/y in May vs. 5.2% increase in April

U.K.’s inflation remains at 8.7% y/y in May, marking the fourth month in a row that CPI exceeded market estimates

Price Action News

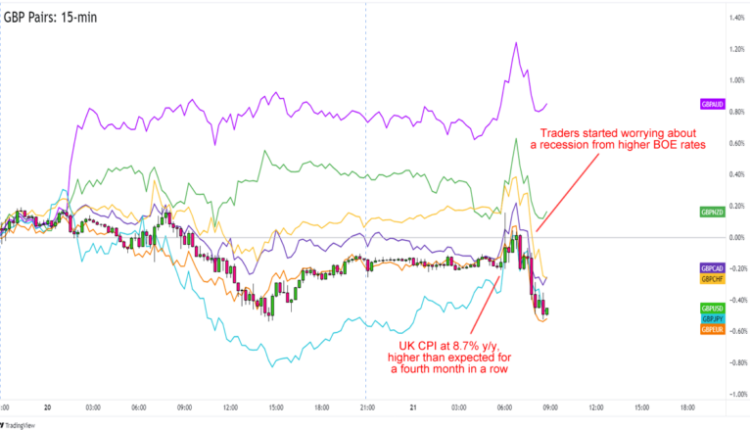

Overlay of GBP Pairs 15-min

Both JPY and AUD saw decent moves today, but it was GBP’s price action that got more headlines during the early European session trading.

See, the U.K. just dropped its May inflation data and the numbers hinted that the Bank of England (BOE) might need to raise its interest rates higher to control consumer price increases.

Instead of hawkish bets pushing GBP higher, though, markets are more concerned that higher BOE interest rates would make a recession more likely.

GBP popped up to new intraday highs before making new daily lows and even revisiting yesterday’s lows against most of its counterparts.

U.K. CBI industrial order expectations at 10:00 am GMT

Canada’s retail sales at 12:30 pm GMT

Fed Chairman Powell and members Cook and Jefferson to share testimony in DC at 2:00 pm GMT

FOMC member Goolsbee to participate in a discussion at 3:40 pm GMT

Use our new Currency Heat Map to quickly see a visual overview of the forex market’s price action! 🔥 🗺️

NZD/CAD 15-minute Forex Chart by TV

Not feeling like trading the dollar ahead of Powell’s testimony today?

I gotchu!

I don’t know if you noticed, but NZD/CAD is now trading above a trend line resistance that’s been limiting the pair’s gains all week.

NZD/CAD is now trading closer to .8150, which lines up with the broken trend line and an area of interest yesterday.

Are we looking at a break-and-retest scenario in the making?

Today’s Canadian retail sales data may help make or break NZD/CAD’s upside breakout.

Markets see Canada printing retail sales growth in April after seeing declines in March.

If Canada’s retail sales data disappoints, or if today’s Powell testimony encourages risk-taking, then NZD could gain ground against the oil-related CAD.

NZD/CAD could jump back up to its .8175 highs or even make new daily highs in the next trading sessions.

Watch this one closely, yo!

Comments are closed.