Daily Forex News and Watchlist: GBP/USD

The downbeat U.S. Philly Fed index dragged the Greenback lower against most of its peers in the previous session.

Can the U.K. PMI releases spur another leg higher for GBP/USD today?

Before moving on, ICYMI, yesterday’s watchlist checked out the range breakdown on NZD/USD ahead of mid-tier U.S. releases. Be sure to check out if it’s still a valid play!

And now for the headlines that rocked the markets in the last trading sessions:

Fresh Market Headlines & Economic Data:

ECB head Lagarde reiterates that inflation remains too strong and that central bank needs to do all it can to keep price pressures in check and reach 2% target

U.S. initial jobless claims came in at 245K, higher than projected 240K figure, marking third consecutive weekly downbeat surprise

Philly Fed index fell from -23.2 to -31.3 in April vs. estimated improvement to -19.1, reaching its lowest reading since May 2020 as price pressures took hits

U.S. existing home sales slowed 2.4% m/m from 4.55 million to 4.44 million vs. projected 4.50 million figure in March

FOMC official Mester also assessed that inflation remains too high and that Fed has more work to do, possibly needing to hike beyond 5% and keep rates there for a while

Japanese flash manufacturing PMI ticked higher from 49.2 to 49.5 in April to reflect slightly slower pace of industry contraction vs. estimated increase to 49.9

Price Action News

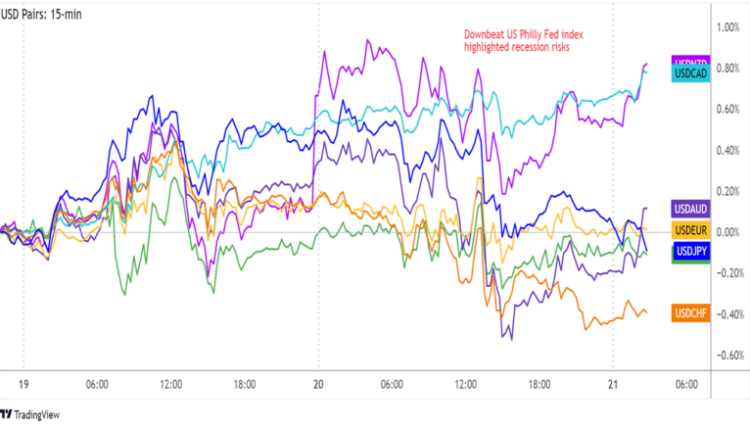

Overlay of USD Pairs 15-min

After a bit of a solid start during the Asian market hours, the Greenback slowly returned its recent winnings and then some, especially after the Philly Fed index was released.

As it turns out, the report highlighted the growing likelihood of a U.S. recession, as traders focused more on the downturn in overall activity. Treasury yields took hits as well.

Still, the U.S. currency managed to pull higher against the Kiwi and the Loonie, as risk-off flows stemming from the Tesla selloff weighed on commodities and higher-yielding currencies late in the day.

Upcoming Potential Catalysts on the Economic Calendar:

French flash manufacturing and services PMIs at 7:15 am GMT

German flash manufacturing and services PMIs at 7:30 am GMT

Eurozone flash manufacturing and services PMIs at 8:00 am GMT

U.K. flash manufacturing and services PMIs at 8:30 am GMT

Canadian headline and core retail sales at 12:30 pm GMT

U.S. flash manufacturing and services PMIs at 1:45 pm GMT

Use our new Currency Heat Map to quickly see a visual overview of the forex market’s price action! 🔥 🗺️

GBP/USD 15-min Forex Chart by TradingView

The U.S. dollar struggled to hold on to its gains when the Philly Fed index was printed, causing Cable to retreat from the top of its short-term range.

Price is hanging out around the middle of its consolidation pattern, which is right around the pivot point (1.2440) while waiting for the next big catalysts.

Luckily for pound traders, we’ve got the U.K. PMI reports coming up soon. Analysts are expecting some improvements, so GBP/USD might pop back up to its range resistance near R1 (1.2470) again.

If the actual figures disappoint and bearish pressure persists, the pair could slump to the bottom of the range that lines up with S1 (1.2410).

Don’t forget that Uncle Sam also has PMI readings due later on, too, so dollar moves might be limited.

Then again, another set of downside surprises could spur a bullish rectangle breakout and take Cable up to R2 at the 1.2500 handle next.

Comments are closed.