Daily Forex News and Watchlist: GBP/CAD

With Canada expected to print slightly lower labor market numbers, you can bet that I have my eye on CAD pairs today.

Specifically, I’m looking at GBP/CAD’s potential reversal pattern.

Are you seeing the same pattern on the 15-minute chart?

Before moving on, ICYMI, yesterday’s watchlist checked out NZD/USD’s short-term range ahead of U.S. initial jobless claims release. Be sure to check out if it’s still a good play!

And now for the headlines that rocked the markets in the last trading sessions:

Fresh Market Headlines & Economic Data:

Final read for Euro Area Q2 2023 GDP: 0.1% q/q (0.3% q/q forecast; 0.1% q/q previous); Employment Change was 0.2% q/q (0.2% q/q forecast; 0.5% q/q previous)

U.S. weekly initial jobless claims fell to 216K (239K forecast; 229K previous)

U.S. unit labor costs in the nonfarm business sector increased 2.2% in Q2 2023, reflecting a 5.7% increase in hourly compensation and a 3.5% increase in productivity.

EIA crude oil stockpiles fell for a fourth consecutive week, down by another 6.3M barrels (vs. 2.1M barrel draw expected) in the week to September 1; U.S. gasoline stocks fell by 2.7M barrels

Canada Building Permits for July: -1.5% m/m (1.9% m/m forecast; 7.5% m/m previous)

Canada Ivey PMI for August: 53.5 vs. 48.6 previous; Prices Index rose to 66.7 vs. 65.1 previous; Employment Index rose to 54.8 vs. 54.2 in July

In a speech in Calgary, Alberta, BOC Gov. Macklem said that, aside from the delayed impact of higher interest rates, one possible reason for inflation staying above target is that “monetary policy is not yet restrictive enough.”

FOMC member Lorie Logan: “Another skip could be appropriate” in September but her base case is that “there is work left to do” to combat excess inflation.

Japan’s bank lending jumped 3.1% y/y in August (vs. 2.8% expected, 2.9% previous)

Japan’s final GDP was revised lower from 6.0%y/y to 4.8% y/y in Q2 due to weak capital spending

Japan’s cash earnings were up by 1.3% y/y in July (vs. 2.4% expected, 2.3% previous); real wages fell by 2.5% y/y and marked its 16th consecutive monthly decline

Japan’s current account surplus expanded from 2.35T JPY to 2.77T JPY in July (vs. 2.24T JPY expected) as lower crude oil prices helped reduce imports

Japan’s Finance Minister Shunichi Suzuki said that the government is monitoring currency market developments “with a heightened sense of urgency,” and that they will “appropriate action…” without excluding any options.”

Japan’s Economy Watchers Survey index dipped from 54.4 to 53.6; said “the economy is recovering at a moderate pace”

As expected, Germany’s final CPI unchanged at 0.3% (6.1% y/y) in August

France’s industrial production improved from inched up by 0.8% (vs. 0.2% expected, -0.9% previous) in July

Price Action News

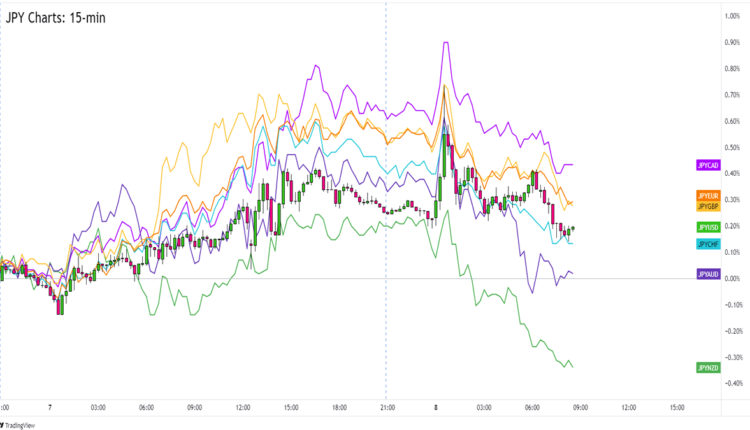

Overlay of JPY Pairs 15-min

The Japanese yen saw some of the biggest moves in the last couple of hours after Japanese Finance Minister Suzuki warned that the government was watching currency developments “with a heightened sense of urgency” and that they’re not “excluding any options” in countering excessive currency volatility.

It didn’t help the safe haven yen that Japan also printed a downgraded Q2 GDP and lower real wages earlier today.

JPY spiked higher near the Asian session open but soon erased all of its gains and even made new intraday lows by the start of the European session.

Canada’s labor market data at 12:30 pm GMT

FOMC member Michael Barr to participate in a moderated discussion at 1:00 pm GMT

China’s CPI and PPI reports at 1:30 am GMT (Sept 9)

Use our new Currency Heat Map to quickly see a visual overview of the forex market’s price action! 🔥 🗺️

GBP/CAD 15-min Forex Chart by TV

In a few hours, Canada will be printing its August labor market numbers.

If you haven’t read the Event Guide for Canada’s August Jobs Report, then you should know that the markets are expecting slightly lower numbers after a few leading indicators hinted at weaknesses for the month.

A weak jobs report just might be what GBP/CAD needs to bust through a potential reversal pattern in the 15-minute chart.

I’m talking about the Reverse Head and Shoulders pattern, yo!

As you can see, GBP/CAD has retested and looks ready to break above the 1.7100 resistance zone.

It didn’t even help CAD that BOC Governor Macklem had been sharing his willingness to raise the central bank’s interest rates further if needed. Meanwhile, a lack of catalysts has been keeping GBP in a tight(ish) range since early yesterday.

If Canada’s labor market report came in weaker than expected, then GBP/CAD could break above 1.7100. The 1.7140 Pivot Point line is a good area to aim for if you’re a bull but you can also target the 1.7180 previous high if there’s enough anti-CAD momentum.

Stronger-than-expected Canadian jobs numbers, on the other hand, may weigh on GBP/CAD. The pair could get rejected at the 1.7100 previous support zone and return to previous inflection points like 1.7050 or 1.7000.

Comments are closed.