Daily Forex News and Watchlist: GBP/AUD

Start-of-week trading put the British pound ahead of its peers today.

How will GBP/AUD traders react to the pair possibly hitting key short-term resistance levels?

Before moving on, ICYMI, I’ve listed the potential economic catalysts that you need to watch out for this week. Check them out before you place your first trades today!

And now for the headlines that rocked the markets in the last trading sessions:

Fresh Market Headlines & Economic Data:

Over the weekend, oil exporters Saudi Arabia and Russia reaffirmed their additional voluntary oil output cuts of 1 million bpd and 300K bpd respectively until the end of December

Melbourne Institute inflation gauge: -0.1% m/m in October (0.0% previous)

New Zealand’s commodity prices in NZD are up by another 3.1% m/m in October, its third monthly increase, on USD strength and improved Chinese demand

ANZ-Indeed Australian Job Ads fell by another 3.0% m/m in October (vs. -0.5% in September); “The imbalance between labour demand and supply is gradually easing”

In a speech, BOJ Gov. Kazuo Ueda shared: “The inflation rate will not return to the range of 0% and 1%…because the virtuous cycle between wages and prices is expected to strengthen”

On Monday, the PBOC added liquidity to China’s banking system by conducting 18B yuan ($2.51B) worth of seven-day reverse repos at 1.8% interest rate

In an Import Expo in China, Premier Li Qiang said that China will “promote opening up“ and “protect the rights and interests of foreign investors”

Germany’s factory orders unexpectedly grew by 0.2% m/m in September (-1.3% expected, 1.9% previous)

Price Action News

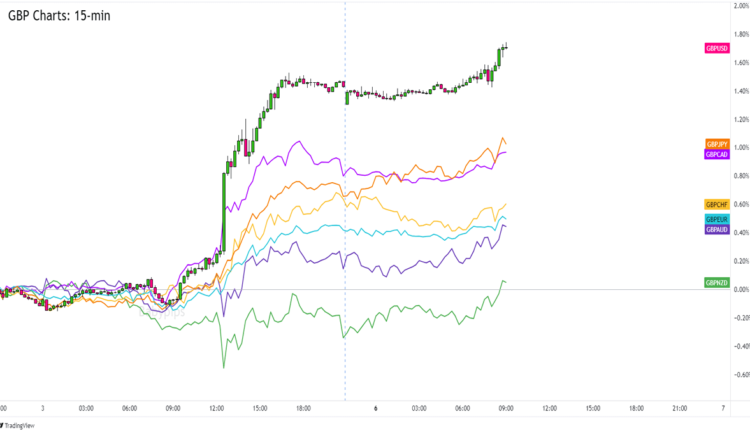

Overlay of GBP vs. Major Currencies Chart by TradingView

The major currencies were locked in tight ranges during the Asian session. Luckily for GBP traders, London session bulls were more open to taking risks. Some may have also caught up to pricing in “peak interest rate” bets for the Bank of England (BOE).

There were a number of gainers in the early European session trading but GBP is probably one of the strongest.

It’s currently up the most against JPY and NZD and is registering the least gains against EUR and CHF.

Upcoming Potential Catalysts on the Economic Calendar:

Eurozone’s final services PMI at 9:00 am GMT

Eurozone Sentix investor confidence at 9:30 am GMT

U.K.’s construction PMI at 9:30 am GMT

Canada’s IVEY PMI at 3:00 pm GMT

Japan’s average cash earnings at 11:30 pm GMT

Use our new Currency Heat Map to quickly see a visual overview of the forex market’s price action! 🔥 🗺️

GBP/AUD 15-min Forex Chart by TradingView

As mentioned above, a round of risk-taking helped GBP gain pips against its major counterparts.

GBP/AUD, in particular, broke above its R1 (1.9050) Pivot Point resistance after breaking its consolidation near 1.9030.

The pair is currently about 40 pips away from the 1.9100 psychological level that lines up with its R2 (1.9100) and trend line resistance in the 15-minute time frame.

Can GBP/AUD sustain its bullish momentum enough to hit its short-term resistance area?

Tomorrow at 3:30 am GMT, the Reserve Bank of Australia (RBA) is expected to raise its interest rates to 4.35% after keeping them steady at 4.10% for five consecutive meetings.

GBP/AUD may see bearish pressure if AUD bulls rush in after the RBA event. The pair could turn from its resistance levels and revisit previous inflection points like the R1 (1.9050) Pivot Point or 1.9030 previous resistance areas.

Don’t discount a potential upside breakout though!

If the Australian dollar sees a buy-the-rumor, sell-the-news situation, or if GBP demand extends to the U.S. or early Asian session trading, then GBP/AUD may extend its upswing.

Keep close tabs on how GBP/AUD reacts to today’s themes or RBA’s event so you can take advantage of any fundamental and technical catalyst!

Comments are closed.