Daily Forex News and Watchlist: GBP/AUD

The Australian dollar caught a bid today thanks to higher iron ore prices, but can it hold on to its gains?

I’m gonna keep an eye on these GBP/AUD pullback levels to see how the pair reacts to U.K. flash PMIs!

Before moving on, ICYMI, yesterday’s watchlist checked out EUR/USD’s potential support-turned-resistance zone. Be sure to check out if it’s still a good play!

And now for the headlines that rocked the markets in the last trading sessions:

Fresh Market Headlines & Economic Data:

New Zealand headline retail sales fell 1.0% q/q in Q2 vs. projected 0.4% dip, core retail sales slumped 1.8% q/q vs. estimated 0.2% decline

Australia’s flash manufacturing PMI fell from 49.6 to 49.4 in August, services PMI down from 47.9 to 46.7 to reflect sharper pace of contraction

Japanese flash manufacturing PMI ticked higher from 49.6 to 49.7 in August to signal slightly slower pace of contraction

French flash manufacturing PMI rose from upgraded 45.1 reading to 46.4 in August, services PMI down from 47.1 to 46.7 vs. 47.5 forecast

German flash manufacturing PMI ticked higher from 38.8 to 39.1 vs. 38.9 forecast in August, services PMI tumbled from 52.3 to 47.3 to reflect major shift to industry contraction

Price Action News

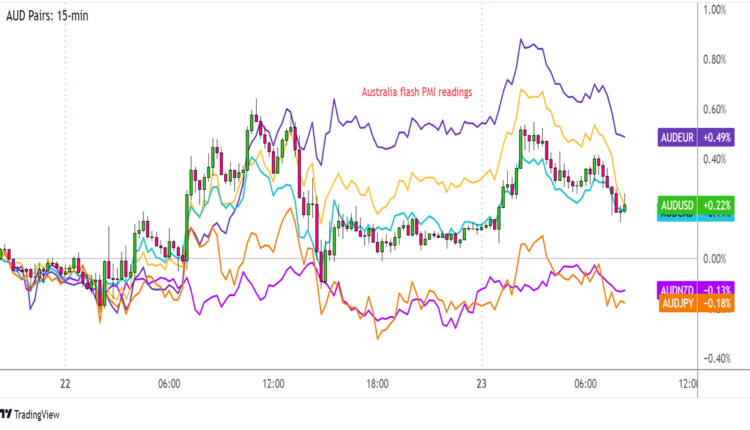

Overlay of AUD Pairs 15-min

The Aussie seemed to shrug off weaker than expected flash PMI readings for August, as the currency was off to a strong start during the Asian market hours.

Analysts say that the rally was mostly due to higher iron ore prices in China possibly lifting trade profits for the economy. Meanwhile, the Kiwi also seemed to be unbothered by downbeat retail sales data, as it trailed behind the Aussie in its rallies.

However, the gains were soon erased leading up to the London session, with market players likely bracing for a fresh batch of flash PMI readings.

U.K. flash manufacturing and services PMI at 8:30 am GMT

Canadian headline and core retail sales at 12:30 pm GMT

U.S. flash manufacturing and services PMI at 1:45 pm GMT

U.S. new home sales at 2:00 pm GMT

Use our new Currency Heat Map to quickly see a visual overview of the forex market’s price action! 🔥 🗺️

GBP/AUD 15-min Forex Chart by TV

This forex pair recently fell through a rising trend line on its short-term chart, indicating that a downtrend is in the works.

GBP/AUD is in pullback mode for now and is currently testing resistance at the 50% Fib, which happens to line up with the pivot point (1.9840).

A higher correction could reach the 61.8% Fib retracement level at 1.9860, which is closer to the former trend line support.

If any of these are able to keep gains in check, GBP/AUD could slump back to the swing low near S1 (1.9760) and the 1.9750 minor psychological mark.

The upcoming flash PMI reports from the U.K. economy are worth keeping tabs on to see if the pair might resume its selloff soon. Both manufacturing and services sectors are slated to report slower activity, so weaker than expected results could revive growth concerns.

Don’t forget that the Australian dollar was able to power through downbeat PMI figures thanks to a rally in Dalian iron ore prices, so the commodity currency might still have some bullish vibes in play.

Comments are closed.