Daily Forex News and Watchlist: EUR/USD

It’s a relatively quiet day in the forex arena, so I’m just keeping an eye for this consolidation play.

Will EUR/USD bust out of its triangle soon?

Before moving on, ICYMI, yesterday’s watchlist checked out GBP/USD’s selloff after the U.K. CPI release. Be sure to check out if it’s still a good play!

And now for the headlines that rocked the markets in the last trading sessions:

Fresh Market Headlines & Economic Data:

U.S. CB consumer confidence index improved from 101.0 to 110.7 vs. 104.6 forecast to reflect stronger optimism, chalking up steepest climb since early 2021

U.S. EIA crude oil inventories rose by a surprise 2.9 million barrels vs. estimated reduction of 2.3 million barrels and earlier 4.3 million barrel drop

Philadelphia Fed President Harker says that job of controlling inflation is not yet done but that they might not need to hike rates anymore

New Zealand credit card spending recovered by 3.3% year-over-year in November after earlier 2.8% slump

Chinese government suspended tariffs cuts on Taiwanese imports due to heightened concerns about “discriminatory prohibitions and restrictions”

Japanese Cabinet Office half-yearly report featured upgrades on GDP and inflation forecasts, as firms likely to pass cost increases to consumers

Price Action News

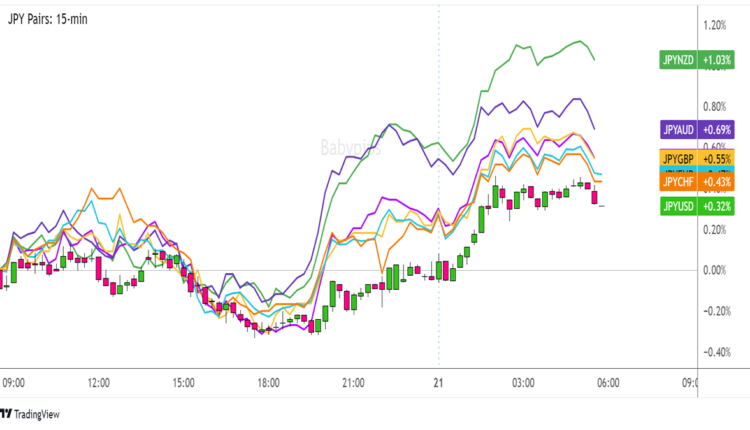

Overlay of JPY vs. Major Currencies Chart by TradingView

After selling off during the BOJ decision earlier this week, the Japanese yen staged a bit of a rebound in the Asian session thanks to some optimism from Japan’s Cabinet Office.

Members upgraded their GDP forecast while also projecting that inflation could soon hit 3% since firms are expected to pass higher costs to consumers. This might have been enough to revive hopes that the central bank could lift interest rates and adjust their YCC targets sometime next year.

Elsewhere, major currencies were in consolidation mode, as traders might be bracing for top-tier catalysts before the end of the week or starting to pare liquidity ahead of holiday festivities.

Upcoming Potential Catalysts on the Economic Calendar:

Canadian headline and core retail sales at 1:30 pm GMT

U.S. final GDP q/q at 1:30 pm GMT

U.S. initial jobless claims at 1:30 pm GMT

U.S. Philly Fed index at 1:30 pm GMT

Japanese national core CPI at 11:30 pm GMT

BOJ monetary policy meeting minutes at 11:50 pm GMT

Use our new Currency Heat Map to quickly see a visual overview of the forex market’s price action! ️

EUR/USD 15-min Forex Chart by TV

Most majors are stuck in ranges so far today, including EUR/USD which has formed lower highs and higher lows inside a symmetrical triangle pattern.

Price is hanging out at the Pivot Point level (1.0950) and minor psychological mark, after having bounced off the triangle support. A continuation of the climb could spur a test of the triangle top or R1 (1.0970).

Technical indicators are suggesting that resistance is more likely to hold than to break, as the moving averages are gearing up for a bearish crossover. Also, Stochastic is already heading south, so EUR/USD could follow suit until oversold conditions are met.

Stronger bearish vibes and a triangle breakdown could see a test of the next downside targets at S1 (1.0920) or even S2 (1.0900) at a major psychological support. Note that the triangle spans roughly 120 pips, so keep an eye out for a selloff that’s the same size as the chart pattern.

Dollar traders have the final U.S. GDP reading for Q3 2023 to keep tabs on, as any major revisions might still impact Fed policy expectations. Don’t forget that the December FOMC decision hinted at rate cuts in 2024, so a downgrade could mean more downside for the U.S. currency.

Comments are closed.