Daily Forex News and Watchlist: EUR/NZD

Is that a reversal pattern I’m seeing on EUR/NZD?

And can the RBNZ’s not-so-hawkish announcement keep the rally going?

Before moving on, ICYMI, yesterday’s watchlist looked at USD/CHF testing an area of interest ahead of the U.S. PMI releases. Be sure to check out if it’s still a good play!

And now for the headlines that rocked the markets in the last trading sessions:

Fresh Market Headlines & Economic Data:

U.S. flash manufacturing PMI slipped from 50.2 to 48.5 to reflect contraction in May vs. estimated dip to 50.0, flash services PMI improved from 53.6 to 55.1 to signal faster industry growth

U.S. Richmond manufacturing index declined from -10 to -15 to indicate worsening conditions in May instead of expected improvement to -8

U.S. new home sales rose from downgraded 656K in March to 683K in April vs. estimated 665K figure, reflecting ongoing rebound in housing market

New Zealand headline retail sales slumped 1.4% in Q1 2023 vs. estimated 0.2% uptick, previous quarter’s reading revised down from -0.6% to -1.0%

RBNZ hiked interest rates by 0.25% as expected from 5.25% to 5.50% but signaled possibility of pausing soon, as policymakers had a split decision to tighten

U.K. headline CPI fell from 10.1% to 8.7% year-over-year in April vs. estimated 8.2% figure to reflect stubborn inflationary pressures, core CPI up from 6.2% to 6.8% instead of holding steady

U.K. producer input prices fell 0.3% month-over-month in April vs. projected 0.1% uptick, output prices stayed flat instead of showing 0.2% gain

German Ifo business climate index down from 93.6 to 91.7 in May vs. projected 93.0 reading, suggesting worsening economic conditions

Price Action News

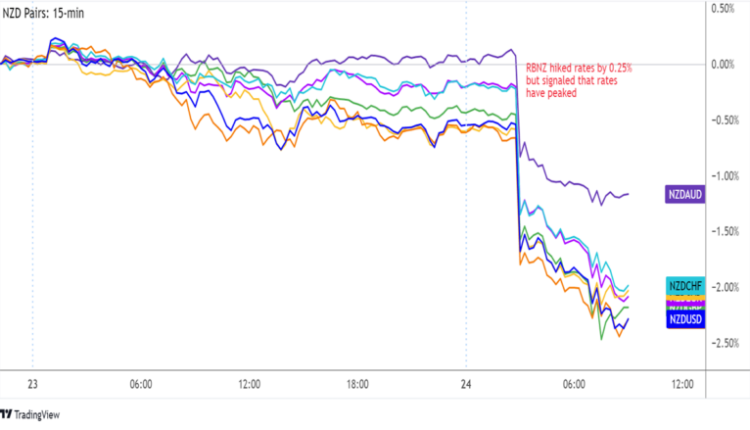

Overlay of NZD Pairs 15-min

After consolidating for the most part in the previous trading sessions, the Kiwi took a sharp tumble across the board when the RBNZ announced its policy decision in early Asian market hours.

Even though the central bank still hiked rates by 0.25% as expected, RBNZ officials suggested that interest rates have peaked and that they actually had a split vote to tighten this time.

In their official statement, policymakers noted that global growth remains weak while inflationary pressures are subsiding. On the domestic front, they also pointed out that businesses are reporting slower demand conditions.

Later on during the London session, the British pound got a bit of a boost thanks to stronger than expected inflation data, as these would likely force the BOE to tighten monetary policy again.

BOE Governor Bailey’s speeches at 9:30 am and 1:00 pm GMT

U.S. Treasury Secretary Yellen’s speech at 2:05 pm GMT

FOMC meeting minutes at 6:00 am GMT

Use our new Currency Heat Map to quickly see a visual overview of the forex market’s price action! 🔥 🗺️

EUR/NZD 1-hour Forex Chart by TV

Check out this steep climb by EUR/NZD!

The pair rallied off the lows around the 1.7200 area and zoomed straight up to its double bottom neckline near the 1.7500 mark.

A break past this resistance level could set off an uptrend that’s at least the same height as the chart pattern or 300 pips.

In that case, the pair could make it all the way past R2 (1.7670) and onto R3 (1.7810) if bullish pressure is sustained.

On the other hand, a return in bearish vibes could lead to a dip back to R1 (1.7440) or even the pivot point (1.7310) near the previous day lows.

Just note that EUR/NZD moves an average of 148.4 pips per day, so keep this figure in mind when setting entries and exits.

Comments are closed.