Daily Forex News and Watchlist: EUR/CHF

Weak PMI reports did a number on the euro earlier today!

How low can the common currency go against CHF before the bulls come back?

Before moving on, ICYMI, yesterday’s watchlist checked out AUD/USD’s potential pullback zone ahead of China’s data dump. Be sure to check out if it’s still a good play!

And now for the headlines that rocked the markets in the last trading sessions:

Fresh Market Headlines & Economic Data:

BOE held interest rates at 5.25%; and talked down the idea of rate cuts

ECB left interest rates at 4% for the second meeting in a row; Lagarde warns that the ECB shouldn’t lower their guard on inflation

ECB Quarterly Economic Projections (December 2023): sees headline inflation to fall from 5.4% in 2023 to 2.7% in 2024 and 2.1% in 2025; the economy should grow by 0.6% in 2023, by 0.8% in 2024, and by 1.5% in 2025 and 2026.

U.S. Retail Sales for November (Adv. Est): 0.3% m/m (-0.1% m/m forecast; -0.2% m/m previous); Core retail sales was 0.2% m/m (-0.1% m/m forecast; 0.0% m/m previous)

U.S. weekly initial jobless claims were at 202K (223K forecast; 221K previous); continuing claims rose to 1.876M from 1.856M previous

BusinessNZ: New Zealand’s manufacturing sector contracted at a slower pace, up from 42.9 to 46.7 in November

Australia’s flash manufacturing PMI higher from 47.7 to 47.8 in December; Services PMI also improved from 46.0 to 47.6

U.K.’s GfK consumer confidence inched up from -24 to -22 as consumers looked forward to better inflation and economic conditions

Japan’s Jibun flash manufacturing PMI for November slowed down from 47.2 to 47.0; Services PMI shot up from 50.8 to 52.0

China’s industrial production in November: 6.6% y/y (5.6% y/y forecast, 4.6% y/y previous)

China’s retail sales growth accelerated from 7.6% y/y to 10.1% y/y in November

China’s fixed asset investment grew by another 2.9% ytd/y (vs. 3.0% ytd/y expected) in November

China’s unemployment rate remained at 5.0% as expected in November

PBOC kept its interest rates unchanged but added a net 800B CNY ($112B) worth of one-year loans into the banking system – the biggest monthly increase on record – and boosted its daily USD/CNY reference rate to the strongest level since June

France’s flash manufacturing PMI for December slipped from 42.9 to 42.0; Services PMI dipped from 45.4 to 44.3

Germany’s flash manufacturing PMI for December improved from 42.6 to 43.1; Services PMI also weakened from 49.6 to 48.4

Euro Area’s flash manufacturing PMI for December steadied at 44.2; Services PMI slipped from 48.7 to 48.1

U.K.’s flash manufacturing PMI for December dipped from 47.2 to 46.4; Services PMI shot up from 50.9 to 52.7

Price Action News

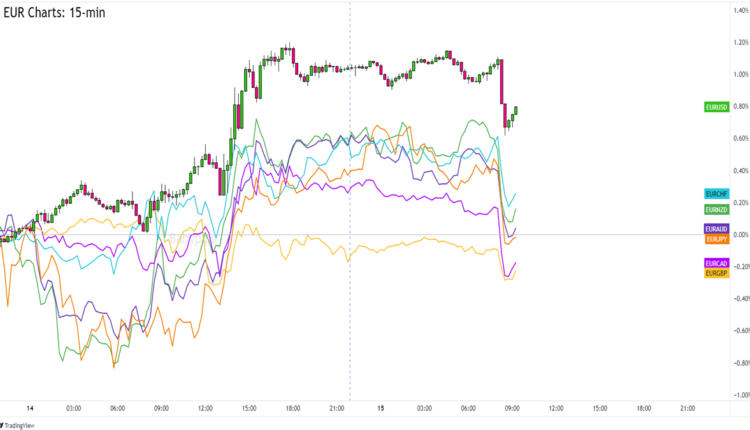

Overlay of EUR vs. Major Currencies Chart by TradingView

The common currency was one of the biggest movers in the Asian and Early European session trading after PMI reports in the region mostly disappointed market estimates.

Despite EUR’s weakness, European equities and other “risk” assets seem to be doing pretty well amid interest rate cut speculations from the major central banks.

EUR is currently trading the weakest against AUD, NZD, and CAD and is registering the least losses against GBP and USD.

Upcoming Potential Catalysts on the Economic Calendar:

France’s manufacturing and services PMIs at 8:15 am GMT

Germany’s manufacturing and services PMIs at 8:30 am GMT

Euro Area’s manufacturing and services PMIs at 9:00 am GMT

U.K.’s manufacturing and services PMIs at 9:30 am GMT

Canada’s housing starts at 1:15 pm GMT

U.S. manufacturing and services PMIs at 2:45 pm GMT

BOC Gov. Macklem to give a speech at 5:25 pm GMT

Use our new Currency Heat Map to quickly see a visual overview of the forex market’s price action! ️

EUR/CHF 15-min Forex Chart by TradingView

As mentioned above, weaker-than-expected PMI reports from France, Germany, and the Euro Area weighed on EUR against its major counterparts.

EUR/CHF, in particular, dropped like a rock from its consolidation near .9530 to trade just under the .9500 mark.

How low can EUR/CHF go before we see some buying? Take note that EUR actually saw demand after the European Central Bank (ECB) pushed back a bit harder than the Fed against interest rate cut bets.

If there are no fresh bearish catalysts, then the .9480 – .9490 area of interest may draw in bulls in the next trading sessions. For starters, it’s near the S1 (.9480) Pivot Point line in the 15-minute time frame.

The .9480 level also lines up with a resistance from the previous week and is just under the 200 SMA in the chart. A bounce and then some bullish follow-through after a retest of the level may inspire EUR buyers to push EUR/CHF back to its .9540 intraweek highs.

The day’s not over yet, though. The 200 SMA could serve as support and push EUR/CHF higher already. The U.S. will also be printing its own PMI data, which may affect overall risk-taking in the last trading hours of the week.

Good luck and good trading this setup!

Comments are closed.