Daily Forex News and Watchlist: CAD/JPY

The BOJ kept policy on hold as expected, causing the yen to sell off across the board.

Can the upcoming Canadian CPI releases spur a pullback on CAD/JPY?

Before moving on, ICYMI, yesterday’s watchlist checked out USD/CHF’s trend line resistance pullback. Be sure to check out if it’s still a good play!

And now for the headlines that rocked the markets in the last trading sessions:

Fresh Market Headlines & Economic Data:

New Zealand ANZ business confidence index up from 30.8 to 33.2 in December, highest level since March 2015 despite lower inflation expectations

Oil shipping companies reroute shipments away from Red Sea, following attacks by Houthi terrorists on tankers

RBA monetary policy meeting minutes: Board considered a 0.25% interest rate cut in December as they saw “encouraging signs” of inflation

BOJ kept interest rates and YCC ceiling unchanged as expected in unanimous decision, no changes to forward guidance but notes that inflation expectations rose moderately

BOJ head Ueda says that policymakers are waiting on the spring wage negotiations before determining next policy steps

Price Action News

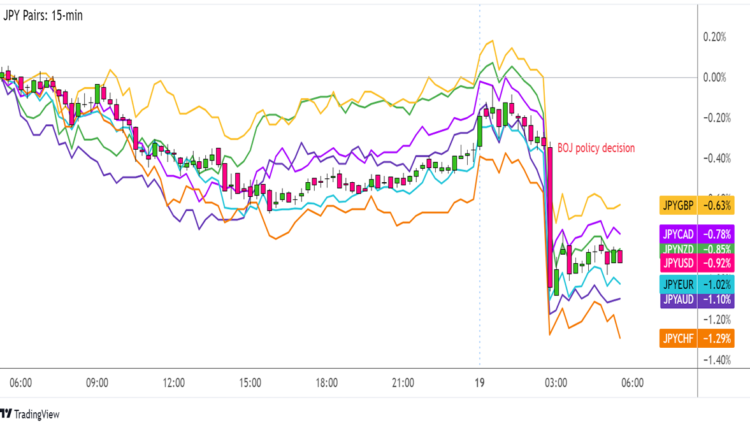

Overlay of JPY vs. Major Currencies Chart by TradingView

Yen pairs were on the move during today’s Asian session, as the unanimous decision by BOJ members to keep policy unchanged weighed on future tightening bets.

The central bank decided to keep interest rates at -0.10% and maintain the 10-year JGB yield target around 0% below the upper reference rate of 1%. Their statement acknowledged the green shoots in spending and inflation, but stopped short of changing their forward guidance.

During the presser, BOJ head Ueda reiterated their plans to wait for the wage negotiations in April next year before figuring out what to do next. The yen extended its selloff when the BOJ Governor noted that “it is difficult to present a firm picture on exit” since they “don’t have a detailed picture on what steps and the order of it when it comes to exiting negative interest rates.”

Upcoming Potential Catalysts on the Economic Calendar:

Canadian CPI reports at 1:30 pm GMT

U.S. building permits and housing starts at 1:30 pm GMT

FOMC member Barkin’s speech at 2:30 pm GMT

New Zealand GDT auction coming up

RBNZ Governor Orr’s speech at 7:00 pm GMT

PBOC prime loan rates setting at 1:15 am GMT (Dec. 20)

Use our new Currency Heat Map to quickly see a visual overview of the forex market’s price action! ️

CAD/JPY 15-min Forex Chart by TradingView

The BOJ decision to keep interest rates and the yield curve control ceiling unchanged triggered a sharp drop for the Japanese currency, as bulls pared tightening bets in the near-term.

Even though policymakers acknowledged that the economy has recovered moderately and that inflation expectations are rising, the vote to hold was unanimous and officials refrained from making any changes in forward guidance.

With that, the short-term uptrend on CAD/JPY could gain traction, as more yen bears join in. The pair is already trading above a rising trend line and appears to be forming a tiny bullish flag pattern.

A break above the consolidation and R2 (107.36) could set off a steeper climb to the next upside targets near R3 (107.76) or higher. Note that the 100 SMA is above the 200 SMA to confirm that the climb is more likely to resume than to reverse.

A pullback, on the other hand, could gather buying pressure at the trend line and pivot point level (106.56). After all, Stochastic is already indicating overbought conditions, so the correction might keep going as the oscillator heads south.

Just make sure you keep an eye out for the release of Canada’s inflation readings in the upcoming trading session, as any major surprises could impact BOC tightening expectations!

Comments are closed.