Daily Forex News and Watchlist: AUD/USD

Australia just printed stronger than expected jobs data while the U.S. CPI turned out much weaker than expected.

Can AUD/USD go for more gains from here?

Before moving on, ICYMI, yesterday’s watchlist checked out AUD/NZD’s uptrend ahead of Australia’s employment report. Be sure to check out if it’s still a valid play!

And now for the headlines that rocked the markets in the last trading sessions:

Fresh Market Headlines & Economic Data:

U.S. headline CPI slowed from 0.4% m/m in February to 0.1% in March, falling short of estimates at 0.2% and bringing the year-over-year rate down from 6.0% to 5.0%

BOC kept interest rates on hold at 4.50% as expected for second straight month, citing expectations that inflation and growth will slow down

BOC Governor Macklem dashed hopes for interest rate cuts in the near-term, explaining that it doesn’t look like the most likely scenario for now

FOMC minutes indicated that policymakers considered keeping interest rates unchanged in March meeting due to banking sector jitters

FOMC minutes also showed that Fed staff projects a mild recession later this year from tightening credit conditions

North Korea launched another ballistic missile, prompting evacuation orders from Japanese government in Hokkaido island

BOJ Governor Ueda in G7 meeting reiterated that inflation is likely to slow, so it would be appropriate to maintain easy monetary policy for now until target is reached stably and sustainably

Australian economy added 53K jobs in March vs. estimated 20.8K gain and previous 63.6K increase, keeping jobless rate steady at 3.5% instead of rising to 3.6% consensus

Chinese trade surplus narrowed from $116.9 billion to $88.2 billion in March vs. $40 billion forecast, as exports surprised with a 14.8% year-over-year jump vs. estimated 7.1% decline

U.K. economic growth stagnated in February vs. estimated 0.1% expansion and previous 0.4% growth figure, as declines in services and production were offset by growth in construction

U.K. industrial production dipped 0.2% m/m in February vs. estimated 0.2% uptick, January figure downgraded to show 0.5% decline from initially reported 0.3% reduction

Price Action News

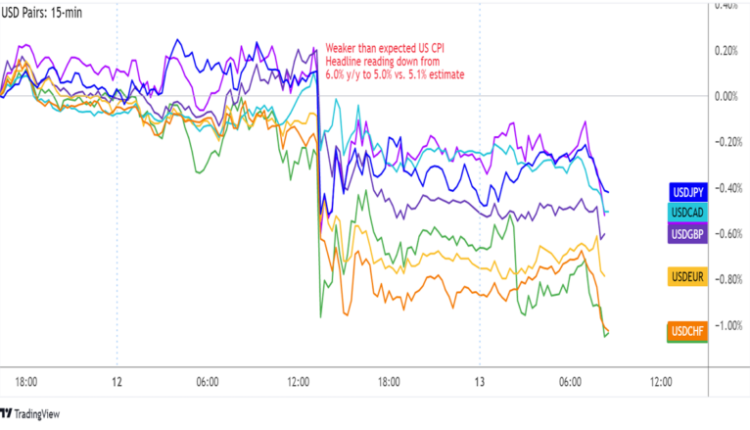

Overlay of USD Pairs 15-min

Dollar pairs were in consolidation mode ahead of the U.S. CPI release, which then turned out weaker than expected and spurred a downside breakout across the board.

A bit more dollar weakness came into play during the release of the FOMC minutes, as the transcript revealed that some policymakers considered keeping rates on hold and the staff projected a mild recession this year.

From there, the U.S. currency resumed its sideways price action, as traders are likely holding out for the release of the PPI figures today and retail sales data tomorrow.

U.S. headline and core PPI at 12:30 pm GMT

U.S. initial jobless claims at 12:30 pm GMT

BOC Governor Macklem’s speech at 1:00 pm GMT

Use our new Currency Heat Map to quickly see a visual overview of the forex market’s price action! 🔥 🗺️

AUD/USD 1-hour Forex Chart by TradingView

The Aussie got a fresh boost from upbeat jobs data earlier today while the dollar remains under weak footing.

Can this inspire a bullish triangle breakout for AUD/USD?

It might all boil down to the outcome of the U.S. PPI report, as a sharp decline in producer prices would signal that weaker consumer inflation is in the cards.

If that’s the case, the pair could bust through the triangle top near R1 (.6730) and go for a move up to R2 (.6760) and beyond.

On the other hand, strong PPI figures might keep hopes alive for a May rate hike and spur a bearish triangle break for AUD/USD.

Still, keep an eye out for support at the pivot point near the .6700 major psychological level and a short-term rising trend line.

Just make sure you account for the average daily AUD/USD volatility of 73.5 pips when setting entries and exits!

Comments are closed.