Daily Forex News and Watchlist: AUD/USD

China’s central bank moves spurred a sharp rally for AUD pairs earlier today.

Can AUD/USD hold on to its gains ahead of the CPI release?

Before moving on, ICYMI, yesterday’s watchlist checked out EUR/USD for a simple break-and-retest setup. Be sure to check out if it’s still a good play!

And now for the headlines that rocked the markets in the last trading sessions:

Fresh Market Headlines & Economic Data:

U.K. BRC price shop index fell from 9.0% year-on-year to 8.4% in June to reflect weaker inflation among retailers

BOJ core CPI climbed from 3.0% year-over-year to 3.1% as expected, marking fourth consecutive monthly gain

PBOC set USD/CNY reference rate lower than expected at 7.2098 vs. 7.2194 estimate to slow down the pace of the yuan’s declines

Chinese Premier Li Qiang talked about the country still being on course to achieve its 5% economic growth target in 2023

Price Action News

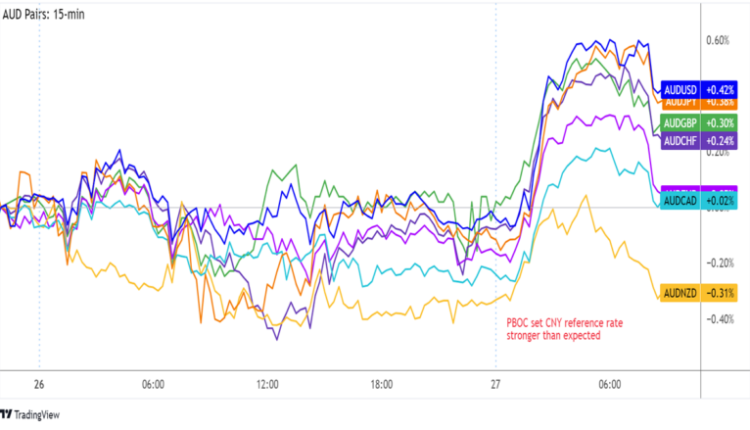

Overlay of AUD Pairs 15-min

After a tepid start to the week, higher-yielding currencies popped sharply higher when the PBOC surprised the markets with a stronger CNY reference rate setting.

This was interpreted to be some form of stimulus from the Chinese central bank, as policymakers have been keen on curbing excessive FX moves.

The Australian dollar was the biggest beneficiary of the move, still holding on to most of its gains against lower-yielding counterparts, but giving up some ground to its fellow commodity currencies later on.

Canada’s headline and core CPI at 12:30 pm GMT

U.S. headline and core durable goods orders at 12:30 pm GMT

U.S. CB consumer confidence index at 2:00 pm GMT

U.S. new home sales at 2:00 pm GMT

Australian CPI at 1:30 am GMT (June 28)

Use our new Currency Heat Map to quickly see a visual overview of the forex market’s price action! 🔥 🗺️

AUD/USD 1-hour Forex Chart by TV

It looks like this pair is in correction mode after its earlier rallies!

Applying the Fibonacci retracement tool on AUD/USD’s latest swing low and high shows that the 38.2% level lines up with the .6700 major psychological mark, which might still hold as a floor.

A larger pullback could dip to the 61.8% level that coincides with R1 (.6690) and a former resistance zone before AUD bulls decide to charge again.

If any of the Fibs hold as support, the pair could resume the climb to the swing high that lines up with R3 (.6720).

Of course this might depend on how Australia’s May CPI report turns out, and analysts are projecting weaker inflationary pressures.

Don’t forget, however, that today’s PBOC easing announcement has revived risk-taking somewhat, so any upside CPI surprise could be enough to boost AUD/USD.

Comments are closed.