Daily Forex News and Watchlist: AUD/NZD

Today’s RBA decision dragged AUD/NZD to a key short-term support!

Will the pair’s range pattern hold today? Or will AUD bears force a downside breakout?

Before moving on, ICYMI, yesterday’s watchlist looked at GBP/AUD’s downtrend pullback ahead of the RBA’s decision. Be sure to check out if it’s still a good play!

And now for the headlines that rocked the markets in the last trading sessions:

Fresh Market Headlines & Economic Data:

Canada Ivey PMI for October: 53.4 (52.1 forecast; 53.1 previous); Employment Index at 54.7 vs. 58.5 previous; Prices Index fell to 60.0 vs. 67.3 previous

In an online presentation, BOE MPC member Huw Pill suggested that expectations of an August 2024 rate cut “doesn’t seem totally unreasonable”

Japan’s nominal wages rose by 1.2% y/y in September (1.1% y/y expected, 0.8% previous)

Japan’s household spending fell by 2.8% y/y in September (-3.0% expected, -2.5% previous) – its seventh consecutive monthly decline – as consumers cut back on food and other spending; Nominal wages

BRC: U.K.’s consumer spending grew by 2.6% y/y in October (2.4% expected, 2.8% previous) as high mortgage and rental costs weighed on consumer confidence

China’s trade surplus narrowed from 559B CNY to 405B CNY ($77.B to $56.5B in USD terms) – the lowest grap since February – as exports (-3.1% y/y) dropped while imports (6.4%) grew in October

RBA raised its interest rates by 25bps to 4.35%; Further tightening “will depend upon the data and the evolving assessment of risks”

Switzerland’s unemployment rate remained at 2.1% as expected in October

Germany’s industrial production in September: -1.4% m/m (-0.1% expected, -0.1% previous)

U.K.’s Halifax house price index rose by 1.1% in October (0.2% expected, -0.3% previous)

Price Action News

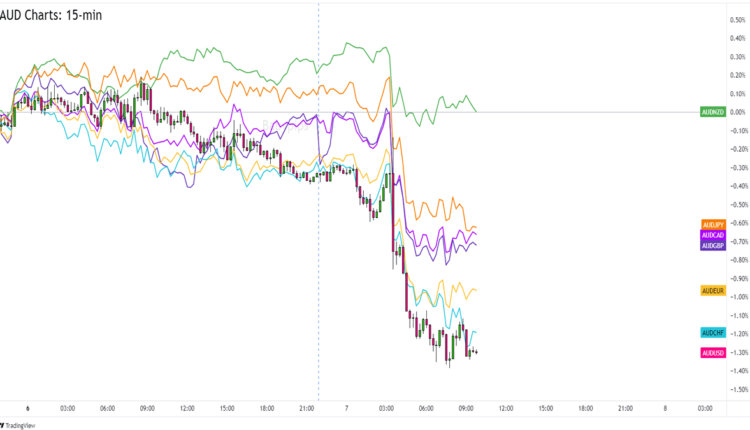

Overlay of AUD vs. Major Currencies Chart by TradingView

Thanks to the RBA, the Australian dollar was the biggest mover among the major currencies in the last couple of hours.

In case you missed it, the Reserve Bank of Australia (RBA) raised its interest rates by 25 basis points to 4.35%. But aside from the decision being expected, Governor Bullock and her team also said that “Whether further tightening of monetary policy is required to ensure that inflation returns to target in a reasonable timeframe will depend upon the data and the evolving assessment of risks.”

The markets read all that as “We’re done raising rates in the foreseeable future” and sold AUD across the board. It also didn’t help that traders turned a bit cautious today after taking risks in the last few days.

AUD is trading the lowest against USD and CHF and is seeing the least losses against NZD and GBP.

Upcoming Potential Catalysts on the Economic Calendar:

Eurozone PPI at 10:00 am GMT

FOMC member Kashkari to give a speech at 12:30 pm GMT

FOMC member Goolsbee to give a speech at 1:00 pm GMT

Canada’s trade balance at 1:30 pm GMT

U.S. trade balance at 1:30 pm GMT

NZ quarterly inflation expectations at 2:00 am GMT (Nov 8)

Use our new Currency Heat Map to quickly see a visual overview of the forex market’s price action! 🔥 🗺️

AUD/NZD 15-min Forex Chart by TradingView

As mentioned above, the RBA’s not-so-hawkish rate hike dragged the Australian dollar lower across the board.

AUD/NZD, in particular, dropped to the 1.0850 area after hitting the R1 (1.090) Pivot Point line and almost reaching the 1.0900 psychological handle.

Will the AUD selling stop at AUD/NZD’s current levels?

Take note that the 1.0850 minor psychological level lines up with today’s S1 (1.0850) Pivot Point and is an area of interest that’s been around since mid-October.

This time, 1.0850 also represents the bottom of a short-term range.

Let’s see if AUD bulls can sneak in pips against NZD traders in the next trading sessions.

New Zealand will publish a quarterly inflation expectations report that, if the speculations are true, will put less pressure on the Reserve Bank of New Zealand (RBNZ) to raise its cash rates some more.

An anti-NZD move could boost AUD/NZD from its current prices all the way to its pre-RBA levels near 1.0900.

Don’t discount a possible downside breakout, though.

If U.S. session traders jump on the anti-AUD intraday trend, or if New Zealand’s inflation survey comes in more hawkish than expected, then AUD/NZD may trade below its 1.0850 support.

Watch AUD/NZD closely to see which way the pair will trade in the next few hours!

Comments are closed.