Daily Forex News and Watchlist: AUD/JPY

AUD/JPY is retreating from its rally after Australia printed a weak jobs report.

Will near-term support levels still hold?

Before moving on, ICYMI, yesterday’s watchlist looked at AUD/USD trending lower ahead of Australia’s jobs release. Be sure to check out if it’s still a good play!

And now for the headlines that rocked the markets in the last trading sessions:

Fresh Market Headlines & Economic Data:

U.S. President Biden says he is confident on an agreement about the debt ceiling while House Speaker McCarthy noted they have a structure to reach a conclusion

New Zealand Q1 producer input prices posted 0.2% quarterly uptick versus estimated 0.5% gain, producer output prices rose 0.3% versus estimated 0.8% increase

Japanese trade deficit narrowed from 1.21 trillion JPY to 1.02 trillion JPY in April as exports rose 2.6% year-over-year while imports fell 2.3%

Australian April employment change showed surprise 4.3K in hiring losses versus estimated 24.8K gain, previous reading upgraded from 53K to 61.1K in employment gains, jobless rate up from 3.5% to 3.7%

New Zealand annual budget release revealed that Treasury is no longer projecting a recession for the country this year

Price Action News

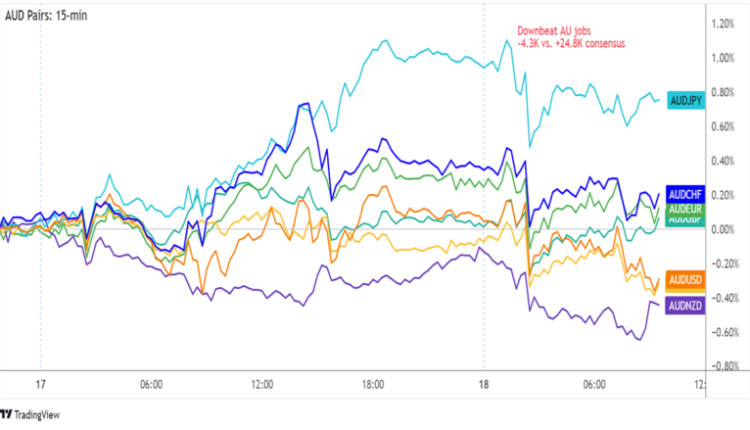

Overlay of AUD Pairs 15-min

Improved risk sentiment was actually lifting the higher-yielding Australian dollar higher during the U.S. market hours, before the commodity currency resumed its slump on account of weak jobs figures.

A few positive updates on the U.S. debt ceiling talks, along with green shoots in retailers earnings reports and housing market data, kept market players hungry for risk in the previous sessions.

Downgraded growth forecasts for China from the likes of Barclays and Nomura also added downside pressure on risk assets later on.

Upcoming Potential Catalysts on the Economic Calendar:

U.S. initial jobless claims at 12:30 pm GMT

U.S. Philly Fed manufacturing index at 12:30 pm GMT

U.S. existing home sales at 2:00 pm GMT

BOC Governor Macklem’s speech at 3:00 pm GMT

New Zealand trade balance at 10:45 pm GMT

Use our new Currency Heat Map to quickly see a visual overview of the forex market’s price action! 🔥 🗺️

AUD/JPY 15-min Forex Chart by TV

This forex pair is in the middle of a correction from its bullish trend after Australia’s jobs report fell short of estimates.

However, the short-term rising trend line remains intact, as AUD/JPY also found support at the area of interest near the 91.00 handle.

A return in risk-taking in the next forex trading sessions could allow the pair to resume its climb, possibly setting its sights on R1 (92.08) or even R2 (92.49).

On the other hand, sustained risk-off flows and bearish AUD vibes could spur a break below S1 (90.98) and trigger a move to the previous day lows or all the way down to S2 (90.26).

Be sure to keep tabs on U.S. debt ceiling developments, as signs of progress could be enough to put traders back in the mood for riskier currencies!

Comments are closed.