Daily Forex News and Watchlist: AUD/JPY

Welcome to a brand new trading month, forex fellas!

This time I’m looking at AUD/JPY ahead of the RBA decision.

Before moving on, ICYMI, I’ve listed the potential economic catalysts that you need to watch out for this week. Check them out before you place your first trades today!

And now for the headlines that rocked the markets in the last trading sessions:

Fresh Market Headlines & Economic Data:

European markets closed in observance of Labor Day

Chinese official manufacturing PMI fell from 51.9 to 49.2 vs. 51.4 estimate in April to reflect return to industry contraction

Chinese official non-manufacturing PMI fell from 58.2 to 56.4 vs. 57.0 estimate in April to signal sharper contraction in the sector

Australia’s MI inflation gauge slowed from 0.3% month-over-month to 0.2% in April to reflect weaker price pressures

Australia’s ANZ job advertisements tumbled 0.3% month-over-month in April, following earlier 2.4% slump

Japanese consumer confidence index improved from 33.9 to 35.4 in April vs. estimated 34.7 figure, as overall livelihood, income growth, and employment ticked higher

Australian commodity prices slipped 19.2% year-over-year in April vs. earlier 6.9% drop due to lower coal, iron ore and LNG prices

Price Action News

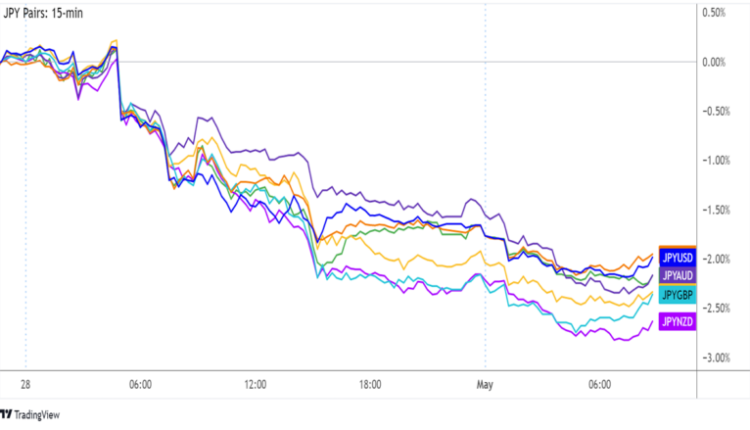

Overlay of JPY Pairs 15-min

The Japanese yen was off to a rocky start, as traders are still reacting to last Friday’s relatively dovish BOJ decision.

As expected, the central bank kept interest rates unchanged and signaled willingness to maintain easy monetary policy for much longer.

Outside of yen pairs, other forex crosses traded mostly sideways, as market players are likely holding out for bigger catalysts later in the week. Also, European markets are closed in observance of Labor Day.

Canada’s manufacturing PMI at 1:45 pm GMT

U.S. ISM manufacturing PMI at 2:00 pm GMT

RBA monetary policy decision at 4:30 am GMT (May 2)

Use our new Currency Heat Map to quickly see a visual overview of the forex market’s price action! 🔥 🗺️

AUD/JPY 1-hour Forex Chart by TradingView

Another round of yen selling drove AUD/JPY almost straight up to the top of its ascending channel.

Will sellers defend the ceiling?

Some profit-taking might happen here, as the channel resistance lines up with R1 (90.93) of the Standard Pivot Points.

If that’s the case, we could see the pair drop to the channel bottom at S1 (88.59) or at least until the middle near the pivot point (89.48).

However, if yen bears refuse to let up, AUD/JPY might be able to sustain its climb past the channel top and onto R2 (91.75).

Either way, just make sure you keep tabs on risk sentiment when trading this one!

Comments are closed.