Daily Forex News and Watchlist: AUD/JPY

Risk-off flows and downbeat Australian CPI are weighing down Aussie pairs today.

Does this mean another wave lower for AUD/JPY?

Before moving on, ICYMI, yesterday’s watchlist looked at AUD/USD’s short-term pullback ahead of the CPI release. Be sure to check out if it’s still a valid play!

And now for the headlines that rocked the markets in the last trading sessions:

Fresh Market Headlines & Economic Data:

Banking sector jitters return as First Republic bank considers sale of $100 billion in assets amid deposit run of $72 billion in Q1

U.S. Richmond manufacturing index slumped from -5 to -10 vs. estimate at -8, as shipments contracted while prices increased in April

U.S. CB consumer confidence index tumbled from 104.0 to 101.3 instead of improving to 104.1 consensus, as economic expectations component dropped

Australia’s Q1 CPI dipped from 1.9% quarter-over-quarter to 1.4%, bringing annual inflation figure down from 6.8% to 6.3% vs. 6.5% forecast

New Zealand credit card spending slowed from 25.5% year-over-year to 20.3% in March

German GfK consumer climate index improved from -29.3 to -25.7 vs. -28.0 forecast, as income expectations recovered significantly in April

Price Action News

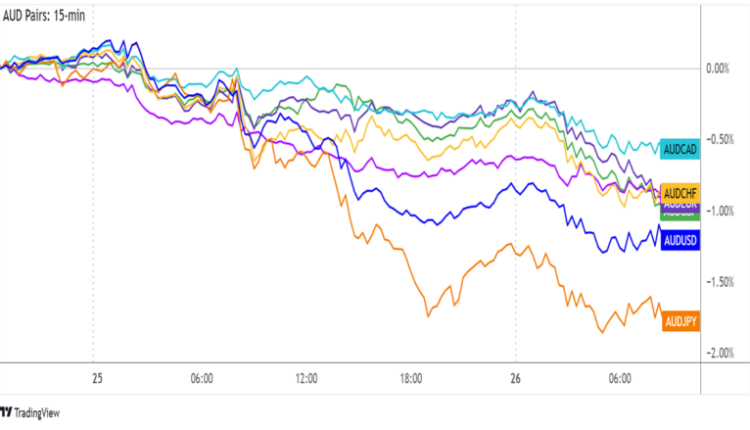

Overlay of AUD Pairs 15-min

The higher-yielding Aussie was already in selloff mode, along with other risk assets, as banking sector woes returned to the spotlight during the New York session.

As it turns out, First Republic bank is struggling to stay afloat after depositors withdrew roughly $72 billion from their vaults in the first quarter of the year.

This sparked a flight to safety that benefitted mostly the U.S. dollar, before profit-taking took place towards the end of the session.

However, the Asian market hours brought another wave lower for AUD pairs when Australia printed a downbeat CPI report, further dashing RBA tightening hopes.

Upcoming Potential Catalysts on the Economic Calendar:

U.S. headline and core durable goods orders at 12:30 pm GMT

EIA crude oil inventories at 2:30 pm GMT

Australian import prices at 12:30 am GMT (April 27)

Use our new Currency Heat Map to quickly see a visual overview of the forex market’s price action! 🔥 🗺️

AUD/JPY 15-min Forex Chart by TradingView

This forex pair has been selling off over the past few hours, but it looks like it’s finding a bit of support around the 88.20 area near the previous day lows.

If sellers need to take a quick breather right here, we might see a small pullback to nearby resistance levels.

I’ve got my eye on the 61.8% Fibonacci retracement level that’s near a short-term falling trend line and an area of interest.

But given how sharp the selloff has been and the possibility that risk-off flows surge once more, AUD/JPY might be in for either a shallow pullback or another sharp breakdown.

The former could offer a chance for more sellers to hop in at the 38.2% Fib that lines up with the pivot point (88.96) while the latter could trigger the formation of fresh lows all the way down to R2 (87.19).

Make sure you check out the average daily AUD/JPY volatility if you plan on trading this one!

Comments are closed.