Daily Forex News and Watchlist: AUD/JPY

Aussie pairs got a strong boost from China’s stimulus announcement and yuan intervention earlier today.

Does this mean that the support levels on AUD/JPY are likely to hold?

Before moving on, ICYMI, yesterday’s watchlist looked at EUR/CHF’s triangle support test after downbeat eurozone PMIs were released. Be sure to check out if it’s still a good play!

And now for the headlines that rocked the markets in the last trading sessions:

Fresh Market Headlines & Economic Data:

U.S. flash manufacturing PMI jumped from 46.3 to 49.0 in July vs. 46.1 forecast, services PMI down from 54.4 to 52.4 to reflect slower growth vs. 54.0 consensus

BOJ core CPI ticked lower from 3.1% year-over-year to 3.0% in June as expected, indicating a dip in underlying price pressures

PBOC intervened in FX market to strengthen the yuan, setting USD/CNY at 7.1406 vs. 7.2044 expected

China promised more stimulus, including rate cuts, tax cuts, debt resolution, real estate policy tweaks and fee reductions, according to state-sponsored media

Price Action News

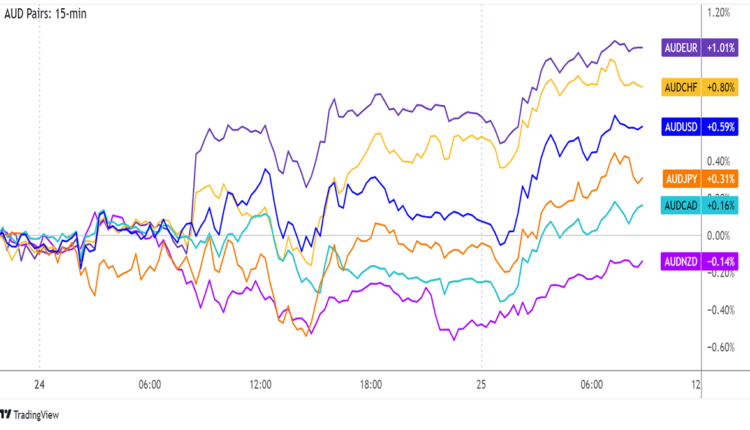

Overlay of AUD Pairs 15-min Charts

The Aussie and Kiwi were big winners during the Asian trading session, following rumors that the Chinese government was considering additional stimulus efforts. This included the possibility of more interest rate cuts, tax reductions, debt resolution, and real estate policy adjustments.

As a result, the country’s property sector shares staged a strong rally, lifting most Asian equity indices along the way. AUD chalked up its strongest gains versus the euro and franc.

U.S. CB consumer confidence index at 2:00 pm GMT

Australian quarterly CPI at 1:30 am GMT (July 26)

Use our new Currency Heat Map to quickly see a visual overview of the forex market’s price action! 🔥 🗺️

AUD/JPY 15-min Forex Chart by TV

Time for a pullback on this pair’s rally?

AUD/JPY has been on a tear for the most part of the day, but it looks like the ceiling around R2 (95.85) is forcing a correction to take place.

In that case, price could retreat to the nearby levels seen on the short-term time frame. So where are buyers looking to hop in?

The Fib tool shows that the 38.2% level is right around an area of interest near the 95.50 minor psychological mark while the 61.8% Fib coincides with a rising trend line and the pivot point (95.23).

If any of these are able to keep losses in check, AUD/JPY could resume the climb to the swing high or even until R3 (96.22).

A break below the trend line, on the other hand, could set off a drop to the next floor at S1 (94.97) near the 95.00 major psychological mark or lower.

China’s stimulus efforts are propping up the commodity currency at the moment, but don’t forget that Australia has its quarterly CPI lined up in the next Asian session!

Comments are closed.