Daily Forex News and Watchlist: AUD/CHF

AUD/CHF is consolidating after a big upswing and before Australia’s labor market data release!

Which way will the pair go in the next trading sessions?

Before moving on, ICYMI, yesterday’s watchlist checked out AUD/USD’s downtrend ahead of the U.S. inflation reports. Be sure to check out if it’s still a good play!

And now for the headlines that rocked the markets in the last trading sessions:

Fresh Market Headlines & Economic Data:

On Tuesday, the U.S. House of Representatives passed a temporary spending bill that would avert a government shutdown through mid-January

U.S. CPI for October: 0.0% m/m (0.1% m/m forecast; 0.4% m/m previous); Core CPI was 0.2% m/m (0.3% m/m forecast / previous); Annual headline rate fell to 3.2% y/y (3.3% y/y forecast; 3.7% y/y previous)

Bloomberg: China is planning to provide 1 trillion CNY ($137B) worth of low-cost financing to help the country’s property market

The PBOC kept its interest rates unchanged in November but injected 600 billion CNY worth of funds into the banking system – the largest since 2016 – through its medium-term lending facility

Japan’s preliminary Q3 GDP: -0.5% q/q (-0.1% q/q expected, 1.2% q/q previous); GDP price index rose by 5.1% y/y in Q3 (4.8% y/y expected, 3.5% y/y previous)

Australia’s quarterly wage price increases accelerated from 0.9% q/q to 1.3% q/q in Q3 as expected

China’s industrial production in October: 4.6% y/y (4.5% y/y forecast and previous)

China’s retail sales in October: 7.6% y/y (7.1% y/y forecast, 5.5% y/y previous)

China’s fixed asset investment in October: 2.9% ytd/y (3.1% ytd/y forecast and previous)

China’s unemployment rate remained at 5.0% for a second consecutive month in October

Japan’s industrial production revised lower from 0.2% m/m to 0.5% m/m in September

Germany’s wholesale price index dropped by 0.7% m/m in October (0.2% m/m forecast and previous); annual prices dipped by 4.2% for the month

U.K.’s annual CPI for October : 4.6% y/y (4.7% y/y forecast, 6.7% y/y previous); Core CPI was at 5.7% y/y (5.8% y/y forecast, 6.1% y/y previous)

U.K.’s producer input prices in October: 0.4% m/m (0.1% m/m forecast, 0.6% m/m previous); Producer output prices remained at 0.1% m/m (0.6% m/m previous)

Price Action News

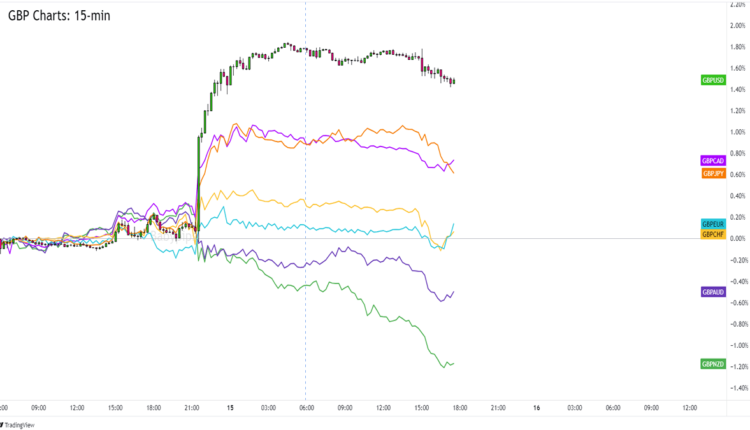

Overlay of GBP vs. Major Currencies Chart by TradingView

Asian session traders generally took cues from their U.S. counterparts and priced in a risk-friendly environment where we may have seen “peak rates” from the major central banks and maybe even interest rate cuts in less than a year.

The British pound missed the bus in the early European session, though, after the U.K. printed much slower inflation figures for October and accelerated rate cut bets for the Bank of England (BOE).

GBP is currently down against all of its major counterparts. GBP is weakest against NZD and USD and is seeing the least losses against EUR and CAD.

Upcoming Potential Catalysts on the Economic Calendar:

U.K. house price index at 9:30 am GMT

Eurozone’s industrial production at 10:00 am GMT

Eurozone’s trade balance at 10:00 am GMT

Canada’s manufacturing sales at 1:30 pm GMT

U.S. PPI reports at 1:30 pm GMT

U.S. retail sales at 1:30 pm GMT

EIA crude oil inventory at 3:30 pm GMT

Japan’s core machinery orders at 11:50 pm GMT

Japan’s trade balance at 11:50 pm GMT

Australia’s labor market data at 12:30 am GMT (Nov 16)

Use our new Currency Heat Map to quickly see a visual overview of the forex market’s price action! 🔥 🗺️

AUD/CHF 15-min Forex Chart by TradingView

Like other “risky” bets, the commodity-related Australian dollar benefited from a risk-friendly trading environment after Uncle Sam’s slower inflation release encouraged “peak rate” speculations in the markets.

AUD also got an extra boost from China releasing mostly better-than-expected growth markers earlier today.

In AUD/CHF case, today’s bullish vibes resulted in the pair maintaining its gains above the .5760 Pivot Point line in the 15-minute time frame.

The pair is currently testing the top of its consolidation, after finding support from the 100 SMA.

Let’s see if AUD/CHF can force an upside breakout.

In a few hours, we’ll see the U.S. PPI and retail sales data. If the releases support the end of further tightening from the Fed, then we could see more risk-taking that may take pairs like AUD/CHF higher.

AUD/CHF could attract enough demand to reach potential inflection points like the .5800 psychological handle or the R1 (.5810 Pivot Point).

But Australia will also be publishing its October labor market data. As Australia’s Employment Report Trading Guide suggests, we’re likely to see weaker labor market markers that may weigh on AUD against safe havens like JPY and CHF.

Don’t discount a possible downside consolidation breakout or a trip back to the .5750 if we do see dovish labor market numbers from Australia!

Comments are closed.