Crude Oil Prices Linger Ahead of Production Guidance

BRENT CRUDE OIL ANALYSIS & TALKING POINTS

- Russia finding it tough to cut production the rest of OPEC+ seeks higher prices.

- Light economic week ahead gives places more emphasis on OPEC+.

- Weekly Brent crude chart may point to higher prices.

Recommended by Warren Venketas

Get Your Free Oil Forecast

BRENT CRUDE OIL FUNDAMENTAL BACKDROP

For crude oil prices (WTI and Brent), the OPEC+ meeting on June 4th, 2023 will be a critical juncture for oil markets. Of recent, friction between two of the most influential nation within the cartel, Russia and Saudi Arabia; have been growing. The problem stems from OPEC+’s pledge to limit supply while Russia continues to flood the market with cheap Russian oil. In summary, Russia has been contradicting the efforts by Saudi Arabia to elevate the price of crude oil.

From a Russian perspective, demand for their oil by major nations such as India have been keeping the cash strapped Russia afloat in an environment where international sanctions have left Russia with no choice but to extend this important economic lifeline.

Foundational Trading Knowledge

Commodities Trading

Recommended by Warren Venketas

Another worrying sign for OPEC+ is the lack of optimism around the Chinese economy with last week’s NBS manufacturing PMI remaining in contractionary territory reaching yearly lows at 48.8. If this trend continues OPEC+ will likely further production cuts in future meetings. The uncertainty around today’s makes for a heightened sense of anticipation. Many are expecting another cut but OPEC+ may use this meeting to signal to markets that they have the capacity to disrupt supply/demand dynamics should they need to but adopt a wait and see approach. This may be the most likely scenario considering the U.S. dollar’s recent rally may be fading after dovish Fed speak alongside a higher unemployment rate and clarity around the US debt ceiling. Although the recent Non-Farm Payroll (NFP) headline figure exceeded estimates, a decline in average earnings may help support crude oil prices as upside pressure in inflation may be declining.

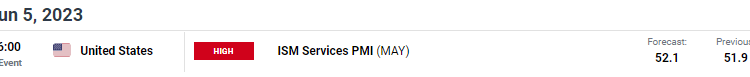

The economic calendar (see below) is rather light this week barring the OPEC+ meeting but both the weekly API and EIA crude oil stock change figures will be in focus as recent numbers have shown a growing crude inventory build.

U.S. ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

Introduction to Technical Analysis

Candlestick Patterns

Recommended by Warren Venketas

BRENT CRUDE OIL PRICE CHART (WEEKLY)

Chart prepared by Warren Venketas, IG

Weekly Brent crude oil price action shows rejection of the 200-day moving average (blue) with the recent candlestick forming a lower long wick. Traditionally, this points to impending upside to come but will ultimately be decided by OPEC+ guidance.

BRENT CRUDE OIL PRICE CHART (DAILY)

Chart prepared by Warren Venketas, IG

The short-term term daily chart above reflects the hesitancy in oil markets as the Relative Strength Index (RSI) hovers around the midpoint level indicating markets favoring neither bullish nor bearish momentum.

Key resistance levels:

- 80.00

- 50-day MA (yellow)

- 77.23

Key support levels:

IG CLIENT SENTIMENT: MIXED

IGCS shows retail traders are NET LONG on crude oil, with 81% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment however, due to recent changes in long and short positioning we arrive at a short-term cautious disposition.

Contact and followWarrenon Twitter:@WVenketas

Comments are closed.