Crude Oil Price Surges on Easing Banking Woes and Supply Issues. Higher WTI?

Crude Oil, US Dollar, WTI, SVB, FDIC, Iraq, Kurdistan, Turkey, Volatility – Talking Points

- Crude oil roared back to life to start this week after FDIC action

- The banking sector appears to have steadied the ship for now, boosting sentiment

- Supply issues continue to linger for energy products. Where to for WTI?

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Crude oil streaked higher overnight as sentiment was given a boost by the rescue of SVB Financial announced by the Federal Deposit Insurance Corporation (FDIC). A sinking US Dollar and supply concerns also appear to have provided some impetus for the lift.

The sale of SVB to First–Citizens Bank & Trust Company has allayed concerns of contagion of banking problems for now. The statement from the FDIC highlighted mismanagement as the key cause for the demise of the tech industry focussed bank.

The FDIC had previously underpinned the troubled Signature Bank. Combined with the Swiss regulators backstopping Credit Suisse with a tie-up to UBS, markets seem to have taken a breath of relief.

Republic Bank shares have also rallied overnight on speculation that the FDIC may step in to assist there as well.

The US Dollar was softer against most major currencies despite Treasury yields resuming their march higher. The entire curve lifted in a bear-flattening (inversion) moves with the benchmark 2-year note back above 4.0% after touching 3.56% on Friday.

Recommended by Daniel McCarthy

How to Trade Oil

It is being reported that an international arbitration court ruled in favour of Iraq and it will mean that Turkey will no longer be able to access oil from Kurdistan via a pipeline.

It is estimated that the impact might be around 400k – 450k fewer barrels per day hitting the global market.

In and of itself, it is not a large amount in the change of supply, but it perhaps reflects the nervousness within the energy sector against the backdrop of the Ukraine war given the move in price.

The US session saw the WTI futures contract finish up over 5% for the day as it eclipsed USD 73. At the same time, oil volatility eased from the peak seen last week, which may indicate a degree of comfort with the rally.

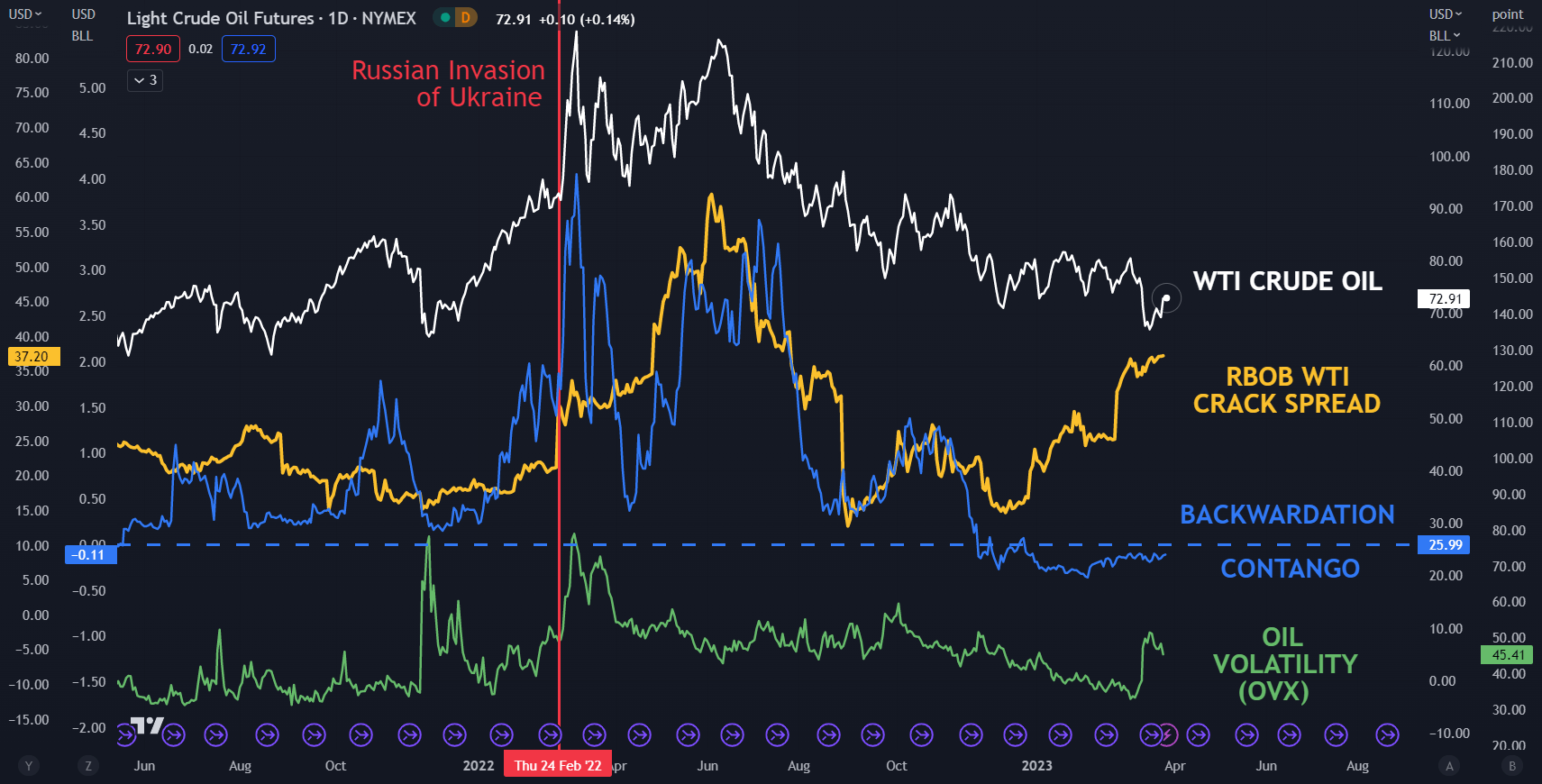

The crack spread between the WTI crude and RBOB gasoline futures contracts might also be supportive of the current price action. The crack spread bifurcates the difference in price between WTI crude oil and refined RBOB gasoline.

WTI CRUDE OIL, CRACK SPREAD, BACKWARDATION/CONTANGO, VOLATILITY (OVX)

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter

Comments are closed.