Crude Oil Correction in Play; Natural Gas’ Rebound May Not be Over

CRUDE OIL, WTI, NATURAL GAS, NG – Outlook

- The downward correction in crude oil could still be in play.

- Natural gas is approaching major support area.

- What is the outlook for crude oil and natural gas and what are the key levels to watch?

If you're puzzled by trading losses, why not take a step in the right direction? Download our guide, “Traits of Successful Traders,” and gain valuable insights to steer clear of common pitfalls that can lead to costly errors.

Recommended by Manish Jaradi

Traits of Successful Traders

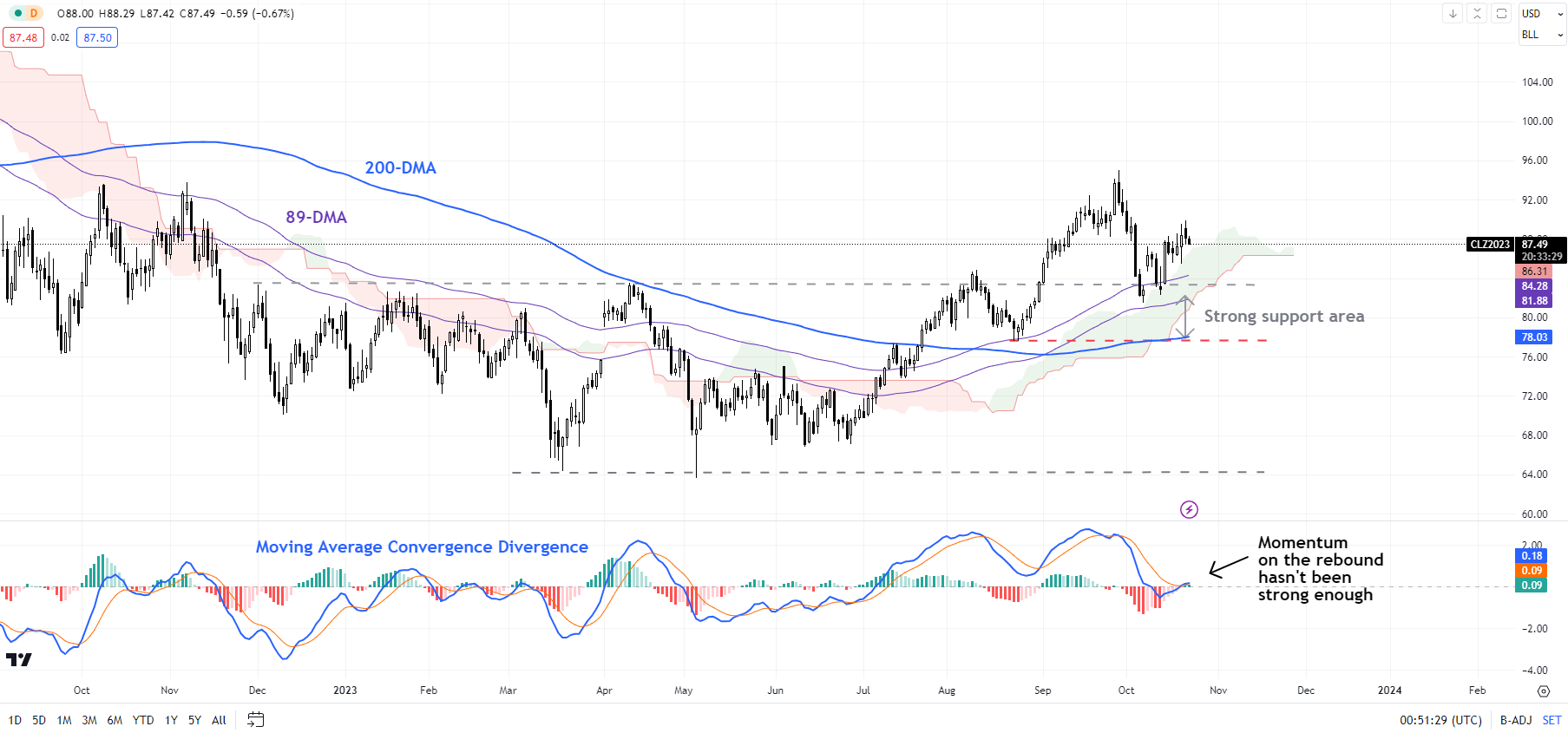

Crude Oil: Correction still in force

Momentum in the most recent rebound in crude oil isn’t looking strong enough to ensure a sustainable rally just yet. The implication is that the downward correction that started toward the end of September could still be in play. Oil has recovered from near quite strong converged support, including the 89-day moving average, slightly above the 200-day moving average, and the August low of 77.50.

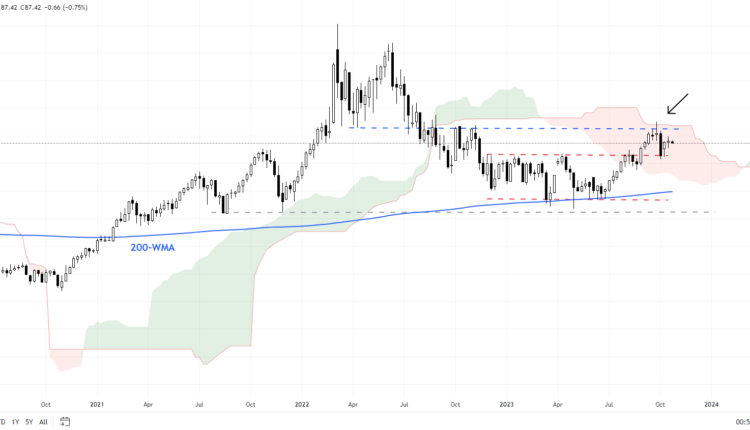

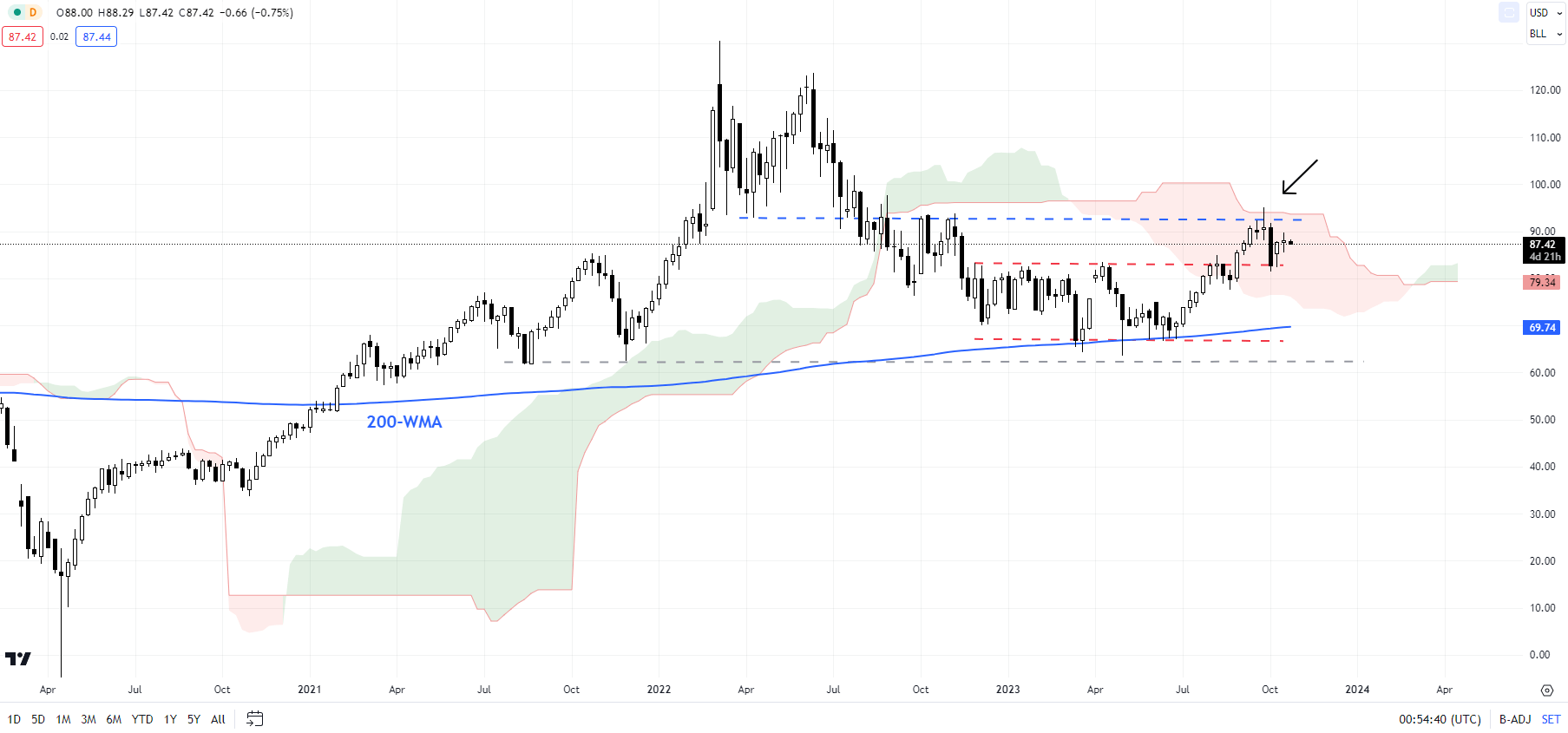

Earlier last month, oil pulled back from stiff converged barriers, including the Ichimoku cloud on the weekly charts and the October high of 93.00. This resistance remains crucial – a break above this barrier is needed to confirm that the rebound from June isn’t just a dead-cat bounce.

Crude Oil Weekly Chart

Chart Created by Manish Jaradi Using TradingView

Earlier in September, crude broke out from the multi-month sideways zone triggering a double bottom (the March and May lows), pointing to a potential rise toward 103. The 77.00-81.00 support area continues to offer a strong cushion which could limit the immediate downside, and while the support remains in place, oil could still attempt another leg higher.

Crude Oil Daily Chart

Chart Created by Manish Jaradi Using TradingView

Looking for actionable trading ideas? Download our top trading opportunities guide packed with insightful tips for the fourth quarter!

Recommended by Manish Jaradi

Get Your Free Top Trading Opportunities Forecast

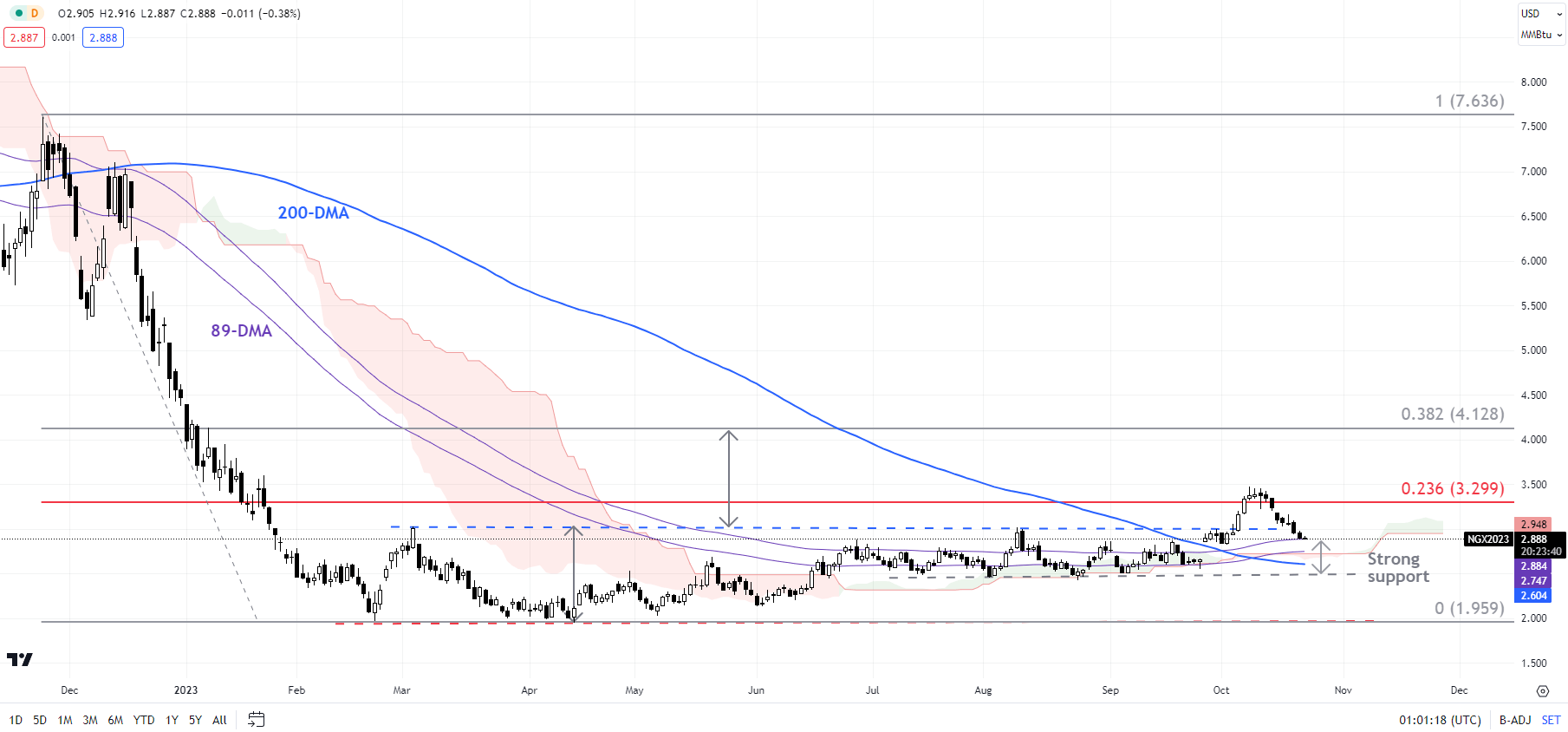

Natural gas: Approaches strong support

Natural gas has retreated from a stiff barrier around 3.25 (the 23.6% retracement of the November 2022-February 2023 fall). In the context of a slightly zoomed-out view, the retreat isn’t surprising given the steps forward one step back nature of recovery since early 2023. This follows a break higher from a multi-month sideway range is a further confirmation that the long road to recovery may have started, but the damage done in 2022 could take time to unwind.

Natural Gas Daily Chart

Chart Created by Manish Jaradi Using TradingView

The break earlier this month above crucial resistance at the March & August highs of 3.03 triggered a significant break out from an eight-month-long sideways range, pointing to a rise to around 4.00-4.10, based on the price objective of the pattern. Importantly, for the first time since the end of 2022 natural gas has risen above the 200-day moving average and a decisive break above the 89-day moving average, suggesting that the base building may have taken place. For more details see “Bullish Natural Gas: Base May Have Been Built,” published October 9.

Any break above 3.25 could open the door toward 4.20 (the 50% retracement). However, for the bullish view to remain intact, natural gas needs to stay above the August low of 2.40.

Elevate your trading skills and gain a competitive edge. Get your hands on the US Dollar Q4 outlook today for exclusive insights into key market catalysts that should be on every trader's radar.

Recommended by Manish Jaradi

Get Your Free USD Forecast

Comments are closed.